The CoolPact Capital India Fund will invest USD 100m in early-stage cooling solutions in India. The country’s first blended capital equity fund focused exclusively on cooling de-risks and scales innovative cooling technologies, addressing climate change and UN Sustainable Development Goals

ABOUT

As the world warms, heat waves are becoming more frequent, severe, and prolonged. In India, heat significantly impacts economic output, productivity, health, and food security while the use of cooling technologies is not widespread. However, the demand for cooling is projected to increase by eight times by 2038, coinciding with growing incomes, rising populations, and urbanization trends. This would increase energy consumption and emissions, posing a challenge for India’s 2070 Net Zero target. This represents an unprecedented opportunity to scale sustainable cooling in India, as current cooling solutions are inefficient or too expensive for households and businesses.

INNOVATION

Sustana’s Cooling India Fund tackles the significant barriers that hinder the scaling of energy-efficient cooling technologies in India by focusing on three key areas. First, it addresses the capital-intensive nature of cooling technology investments by providing the necessary patient equity capital and thereby bridges a gap in venture capital offerings. Second, it fosters innovation in business models by supporting early-stage growth for small and medium-sized enterprises (SMEs) and startups. Finally, the fund builds a collaborative ecosystem, bringing together stakeholders across the value chain to enhance the sustainability and effectiveness of cooling solutions.

“CoolPact Capital and Climake team members have collaborated with the Lab for several years as proponents and mentors. The CoolPact Capital India Fund represents a new climate finance initiative focused on adaptation benefits from cooling applications, alongside delivering strong mitigation results by promoting more efficient cooling technologies. The team sees CPI’s Lab support as crucial for refining the Cooling Fund’s strategy and testing its potential to meet the expectations of climate investors.”

Simmi Sareen, Co-founder at Climake.

IMPACT

The CoolPact Capital aims to raise USD 100 million to address India’s growing cooling needs while delivering significant returns to investors. Targeting sectors with high potential, the fund blends concessional equity to enhance returns for private investors, crowding in more private capital. With a robust pipeline of potential investees, the fund plans a first close at USD 50 million within the first year and a final close by the second year. Over a decade, Sustana’s investments are expected to abate approximately 7.5 million tons of CO2 equivalent over 10 years, demonstrating substantial environmental and financial impact. Sustana’s dual mitigation and adaptation focus will also support the development of resilient cooling solutions and ensure that businesses and communities can better cope with the changing climate and address extreme heat.

DESIGN

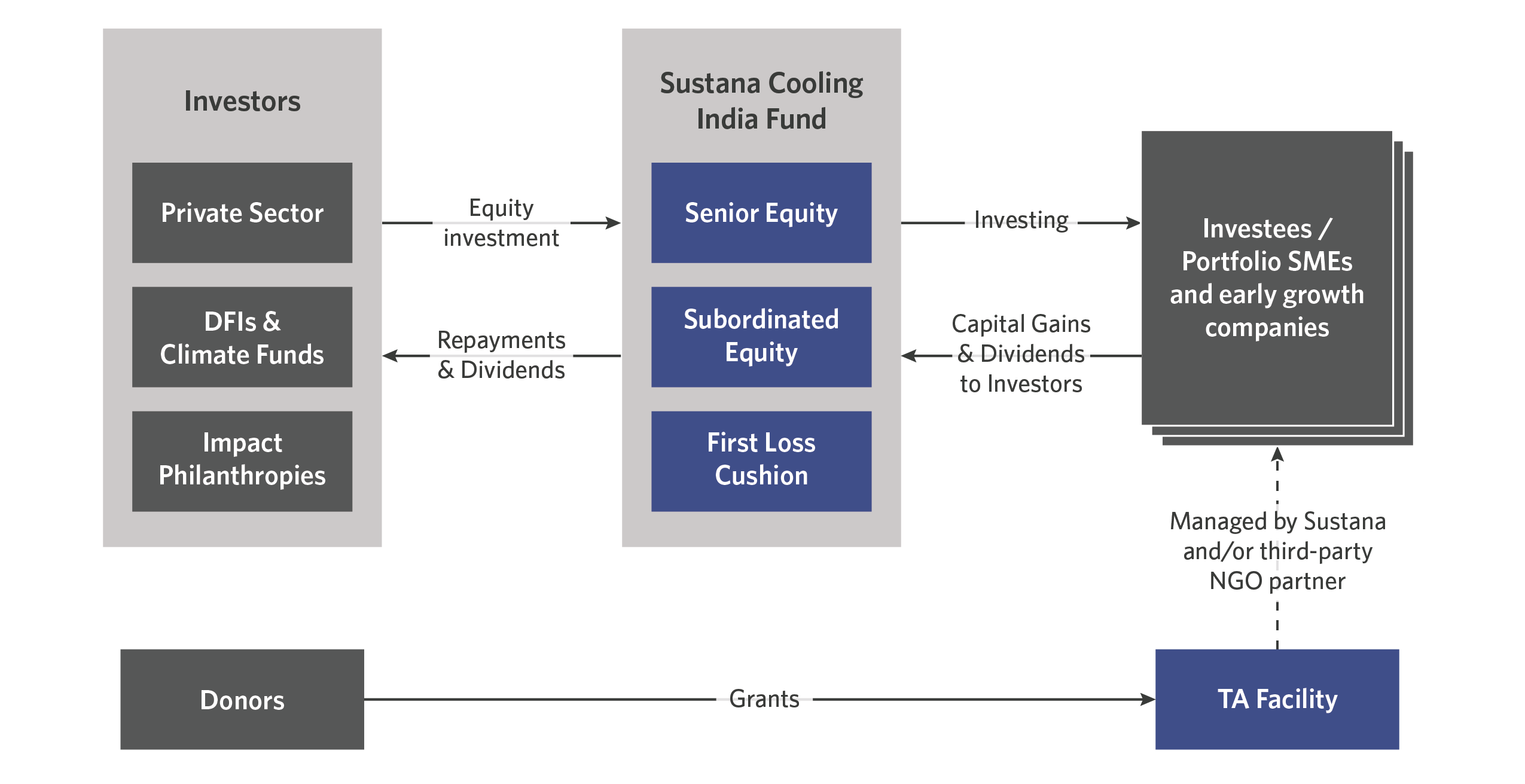

The CoolPact Capital is designed as a triple-tranche equity instrument, offering senior, subordinated, and “first loss” equity to attract a diverse investor base. The senior equity tranche, capitalized by private sector investors, offers higher returns. In contrast, the subordinated equity tranche, funded by development finance institutions (DFIs) and climate funds, offers market-linked returns which are in line with returns expectations of DFIs. A key feature is the provision of a first-loss equity provision, capitalized by philanthropies, which provides a cushion for the greater loss expectation which is more common for startups in this sector. This first-loss cushion will help crowd in more private sector investments into the fund.

The fund primarily benefits early-growth stage startups and SMEs in the cooling sector, which requires patient capital which is suited to the operational needs of the sector. The fund supports their development and market penetration by providing these companies with essential equity investments. In addition to financing, the fund offers technical advisory (TA) services through a third-party NGO partner, covering areas like business process improvement and staff training. This approach ensures the invested capital is used efficiently, driving economic growth and positive environmental impact.