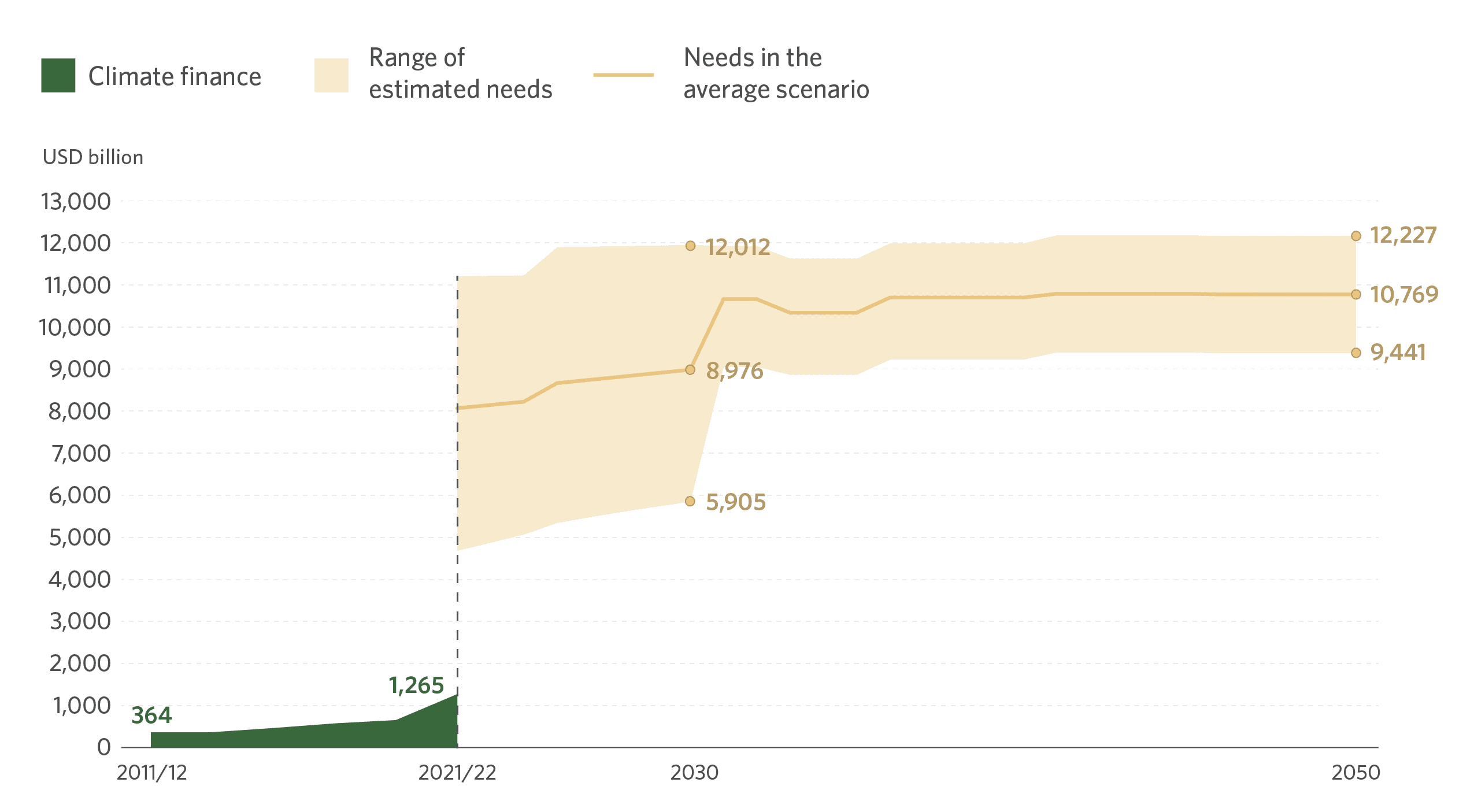

While global climate finance has steadily increased over the past decade, reaching an all-time high of nearly USD 1.3 trillion per year in 2021/2022, much more is needed to keep global temperature rises within 1.5°C by the end of this century and avoid the worst impacts of climate change.

CPI collects and standardizes data on climate finance needs from a wide variety of scenarios developed by various institutions to provide a comprehensive and unique understanding of the scale of the climate finance gaps in different sectors. Our aim is to inform decision-makers and capital allocators on how to effectively increase speed, scale, and quality of climate finance.

How much (more) is needed?

Our compilation of top-down needs assessments shows that, in an average scenario, annual climate finance flows must increase by at least sixfold compared to current levels, reaching USD 8.5 trillion per year between now and 2030, and over USD 10 trillion per year from 2031 to 2050.

Global tracked climate finance and estimated annual needs through 2050

| Top-down needs are estimations of the climate finance required by different sectors to keep global temperature rises within 1.5°C. These are typically derived using predictive models for different sectors. Climate-compatible scenarios developed by different institutions can differ widely in the data, assumptions, model used, and (geographic or sectoral) scope. |

CPI used calculations from a total of 17 sources to compile its top-down needs data.

| SECTOR | SOURCES USED IN CPI NEEDS ESTIMATIONS |

| Buildings & Infrastructure | IEA (2023b), IRENA (2023b), LSE (2021), McKinsey (2022) |

| AFOLU | FOLU (2019), LSE (2021), McKinsey (2022), Paulson Institute (2020), Thornton et al. (2023), UNEP (2022) |

| Transport | BNEF (2022a), IEA WEI (2023), IRENA (2023b), McKinsey (2022) |

| Industry | BNEF (2022A), IEA (2021, 2023b), IRENA (2023b) , McKinsey (2022) |

| Energy | BNEF (2022a, 2022b), IEA (2021, 2023b), IPCC (2022), IRENA (2023b), LSE (2021), McKinsey (2022) |

| Adaptation | Bhattacharya et al. (2022), Chapagain et al. (2020), LSE (2021), Songwe et al. (2022), UNEP (2023) |

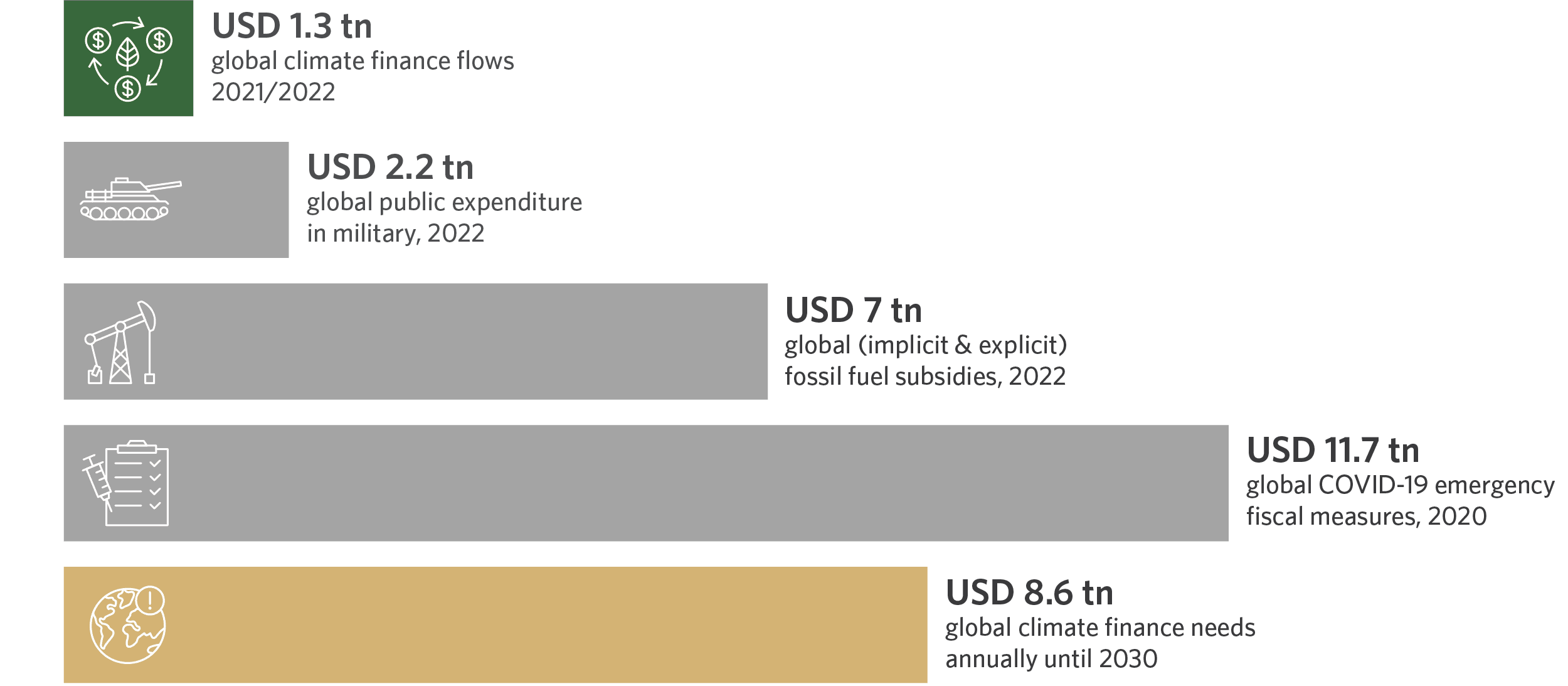

Can we rise to the challenge?

Faced with a daunting challenge, the good news is that the capital required is already available globally to reach the scale of global climate finance needed. It will, however, need to be redistributed or reallocated to uses consistent with global climate goals. Taking a broader perspective on current global spending reveals the feasibility of closing the climate funding gap, already in this decade: for example, global military expenditure in 2022 was estimated at USD 2.2 trillion, while global fossil fuel subsidies in the same year reached USD 7 trillion. The International Monetary Fund estimated that USD 11.7 trillion in emergency fiscal measures were announced globally in 2020 in response to the COVID-19 pandemic. There is, undoubtedly, enough liquidity in capital markets, with approximately USD 114 trillion in assets under management globally by the end of 2022.

Climate finance flows and needs in context

How much climate finance will keep us under 1.5°C?

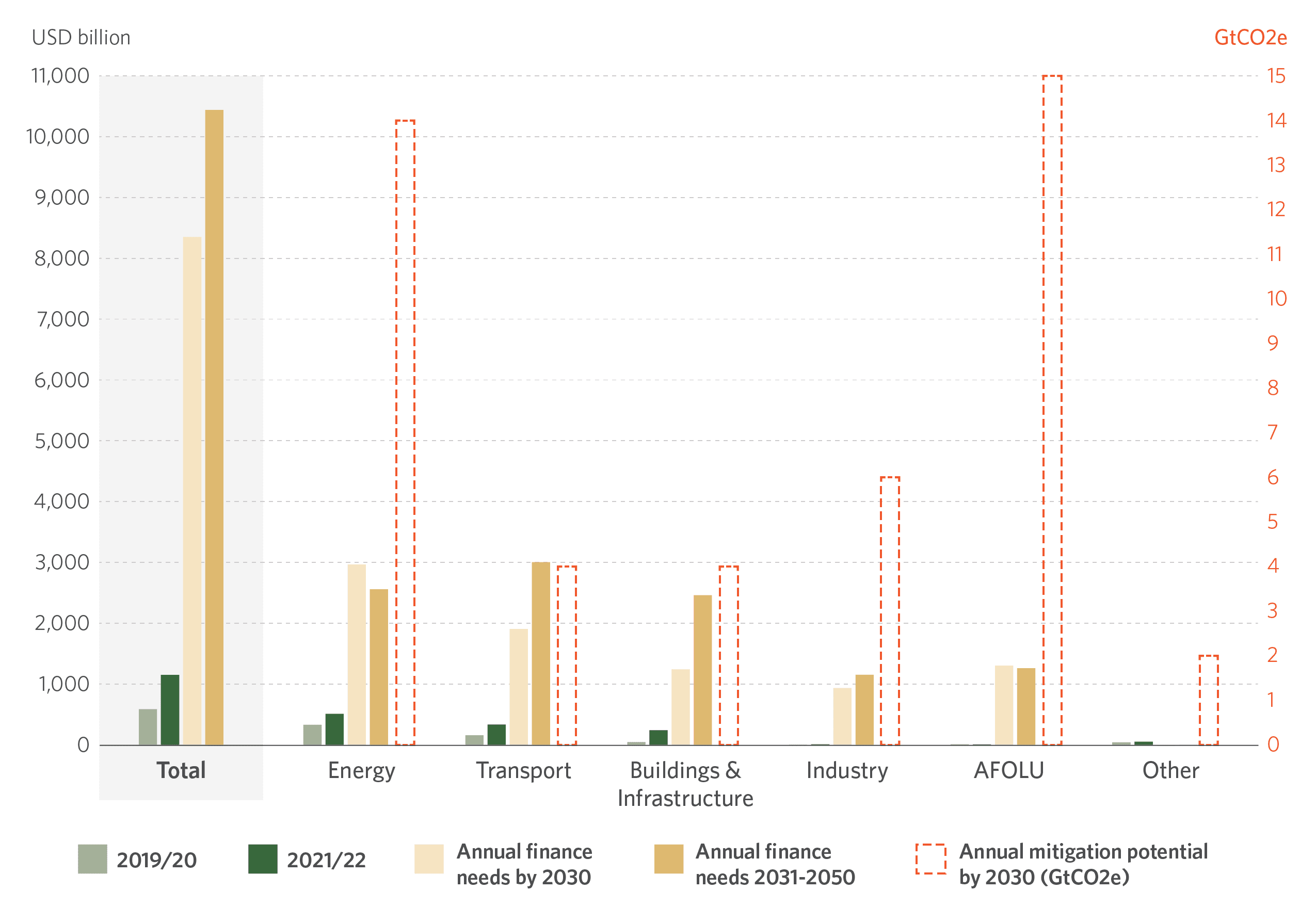

A rapid increase in mitigation finance is critical to keep global temperature rises within 1.5°C by the end of this century. Globally, annual mitigation finance needs to grow from USD 1.2 trillion in 2021/2022 to over USD 8.4 trillion between now and 2030, and USD 10.4 trillion in the following two decades.

In absolute terms, the largest investment gaps are observed in the transport and energy sectors, where an additional USD 2.4 trillion and USD 2.2 trillion per year will be required, respectively, between now and 2050. In relative terms, the largest gaps are observed in agriculture, forestry, and other land use (AFOLU) and industry, where funding needs to grow by over 180 times and 136 times, respectively, compared to 2021/2022 levels. Increasing funding for AFOLU could be especially impactful, as the sector is estimated to have the largest mitigation potential, at an average of 14.5 GtCO2e by 2030.

Global climate finance flows in key mitigation sectors, finance needs, and mitigation potential

How much do we need to adapt to climate change and build resilient economies?

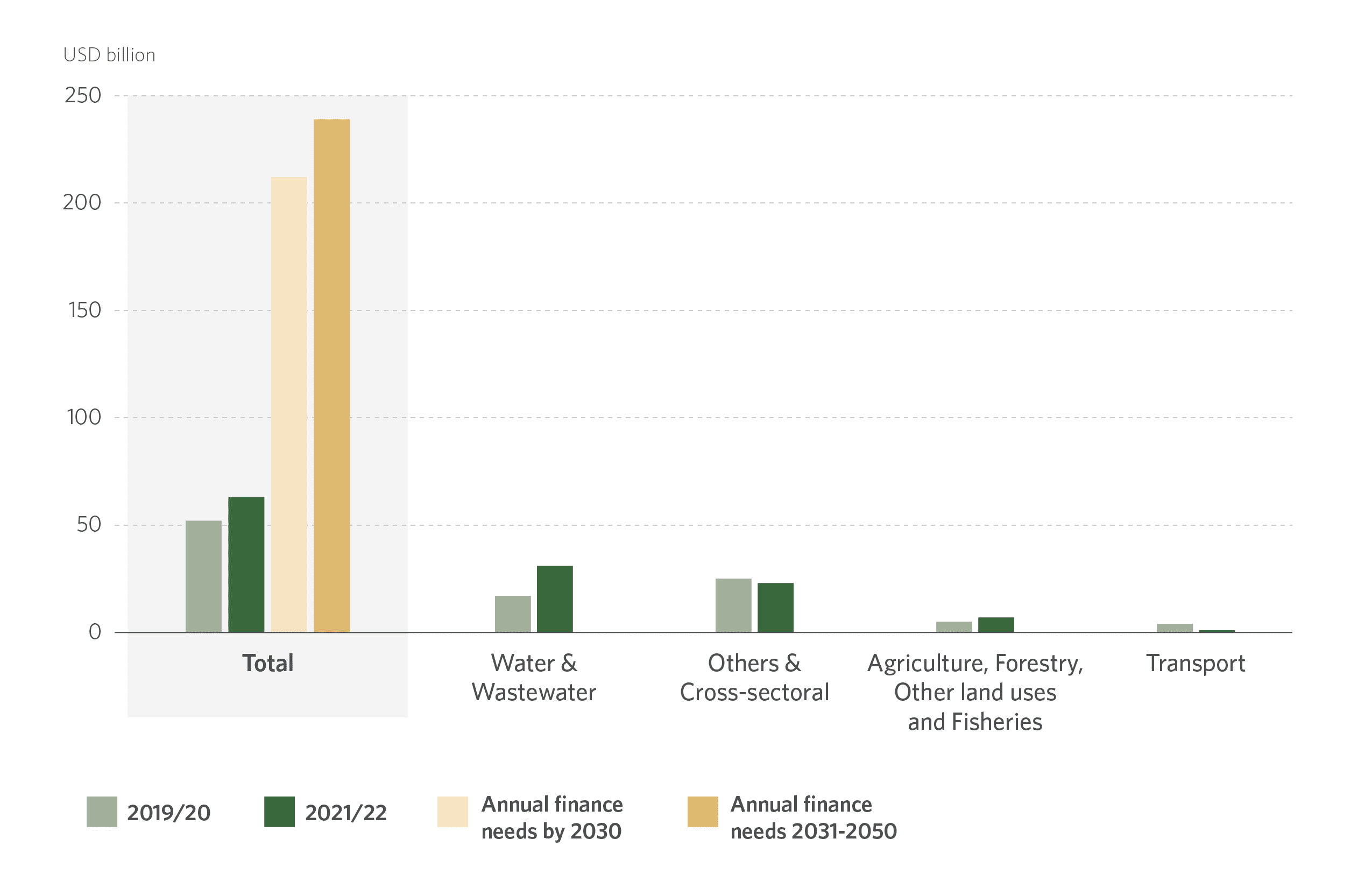

As the world is currently not on track to keep the average temperature rise within 1.5°C by 2030, losses and damages due to climate change impacts are likely to increase. In this context, adaptation finance will be essential to ensure climate-resilient development and address the growing costs of climate change, especially in emerging markets and developing economies (EMDEs).

In 2021/2022 adaptation finance reached USD 63 billion, a 29% increase on 2019/2020. Nevertheless, the global adaptation funding gap is widening: CPI analysis indicates that in EMDEs alone, annual adaptation finance will need reach USD 212 billion by 2030, and USD 239 billion between 2031 and 2050.

Adaptation finance flows by sector vs. finance needs in EMDEs

What is the cost of delaying action?

The longer we delay climate investment, the higher the costs of avoiding and adapting to the impacts of climate change will be. Continued inaction will make staying within the 1.5°C temperature threshold ever more costly and, eventually, out of reach.

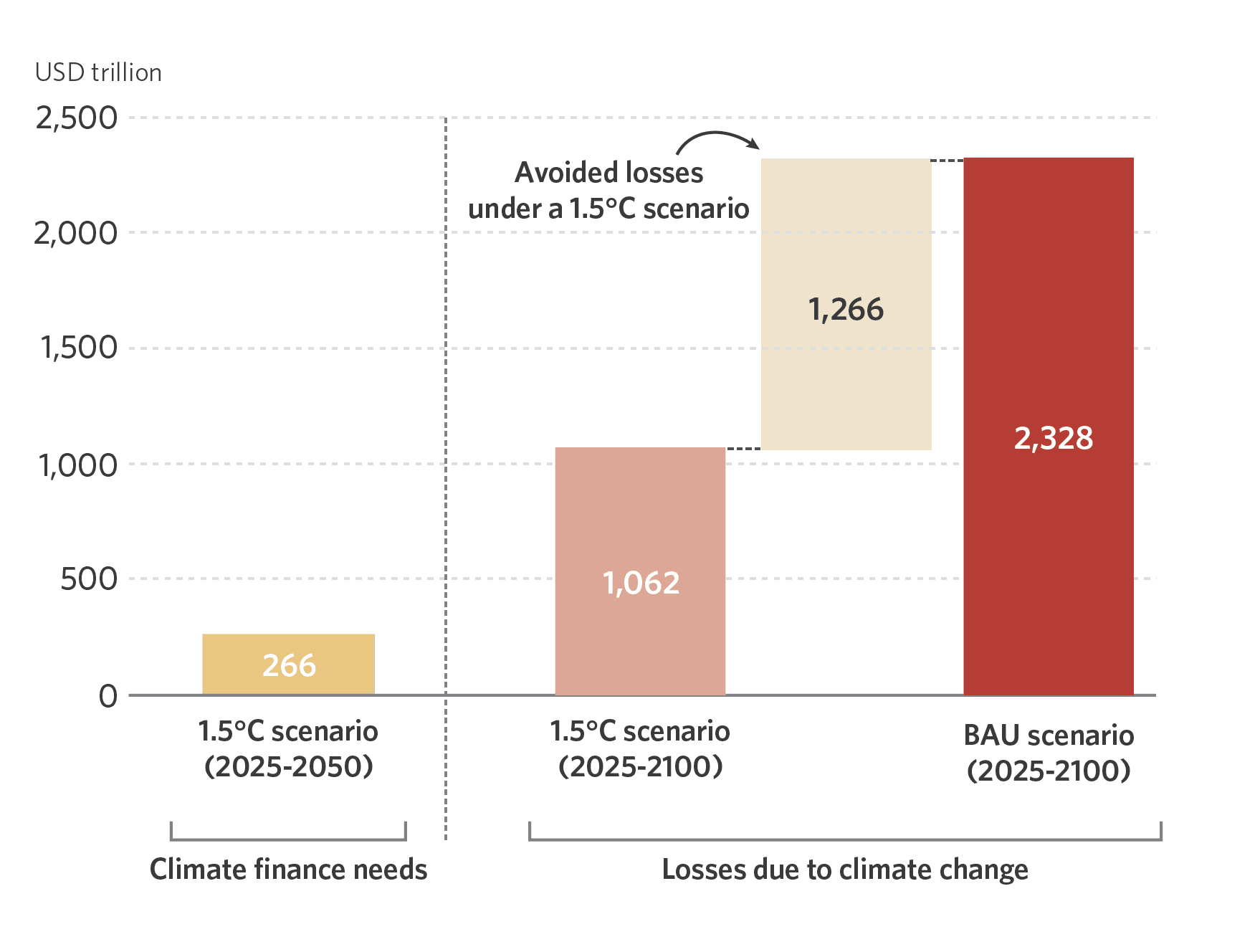

While investment needs are already large, social and economic losses under a business-as-usual (BAU) scenario will be twice the estimated finance needed under the 1.5°C scenario. Cumulatively, USD 266 trillion in climate finance is needed between now and 2050 to avoid at least USD 1,266 trillion in economic and social losses likely to be incurred in a BAU scenario by the end of this century.

Moreover, these estimated losses are likely to be a dramatic underestimate as they do not capture capital losses caused by stranded assets, losses to nature and biodiversity, or those from increased conflict and human migration that cannot yet be reasonably costed. This highlights the economic imperative to invest in climate mitigation and adaptation solutions now, and also an enormous opportunity for businesses, financial institutions, and governments to redirect action and investments toward low-carbon and climate-resilient pathways.

Cumulative climate finance needs vs. losses under 1.5°C and BAU scenarios

For more details on cost of inaction estimates, visit https://www.climatepolicyinitiative.org/the-cost-of-inaction/