While for decades the Berau district of East Kalimantan has relied on mining as an economic driver, the government has indicated that its future depends on the cultivation, not extraction, of natural resources. Palm oil holds strong potential in this regard. During the past six years, the total planted area of palm oil in Berau has increased significantly, from 40,000 to 120,000 hectares (ha), and the crop currently dominates more than 70% of agricultural land in Berau. Additionally, palm oil is a strong employer, and has grown from employing 3,000 people in 2012, to 21,000 people in 2014 (Disbun Berau 2016).

It is no surprise, therefore, that the Berau government sees oil palm development as an important. However, Berau wants to do more than just build an agricultural economy, they aspire to do so in a way that preserves natural resources for generations to come, meaning that careful considerations will need to be taken.

This study is the first in a series on low-emissions palm oil as part of a program led by The Nature Conservancy, funded by the German Ministry of Environment and Nuclear Energy (BMUB), and implemented jointly with GIZ and CPI. This CPI analysis contributes to the goals of the Berau government by providing an overview of the palm oil supply chain in Berau. In regards to both upstream and downstream, we examine the land use efficiency of palm oil as indicated by yield per hectare, absorption of raw material into processing factories, and the accessibility between plantations and mills. We also highlight opportunities to improve productivity and efficiency, while ensuring the sustainability of natural assets in Berau.

Our findings include:

1. Berau can reach optimal production levels and fulfill mill capacity needs with minimal land expansion

Berau produces 11% of East Kalimantan’s Fresh Fruit Bunches (FFB), which is equivalent to 1.2 million tons, and is grown on more than 120,000 ha of land (Disbun Kaltim 2017, BPS 2016). Plantation companies operated 74% of total planted area, and produced 88% of FFB in 2016. The majority of these companies are consolidated into four main plantation holding companies.

There are seven palm oil mills in Berau, which are owned by the four plantation holding groups. Mills in Berau have a combined total processing capacity of 2.8 milllion tons of FFB per year, but are currently only operating at 44% capacity.

Berau is producing oil palm at below its potential levels due to several reasons, including:

• most plants are between four to nine years old, whereas peak productivity starts after seven years;

• only approximately 41% of the total licensed area owned by company plantations have been planted on.

Based on our estimates, if Berau relied solely on crops reaching peak age and all concession areas becoming productive, Berau would reach a production level that is sufficient to fulfill mill capacity to 2.8 million tons by 2023. However, Berau only has 33,000 ha of low conservation value palm oil concession areas left still unplanted.

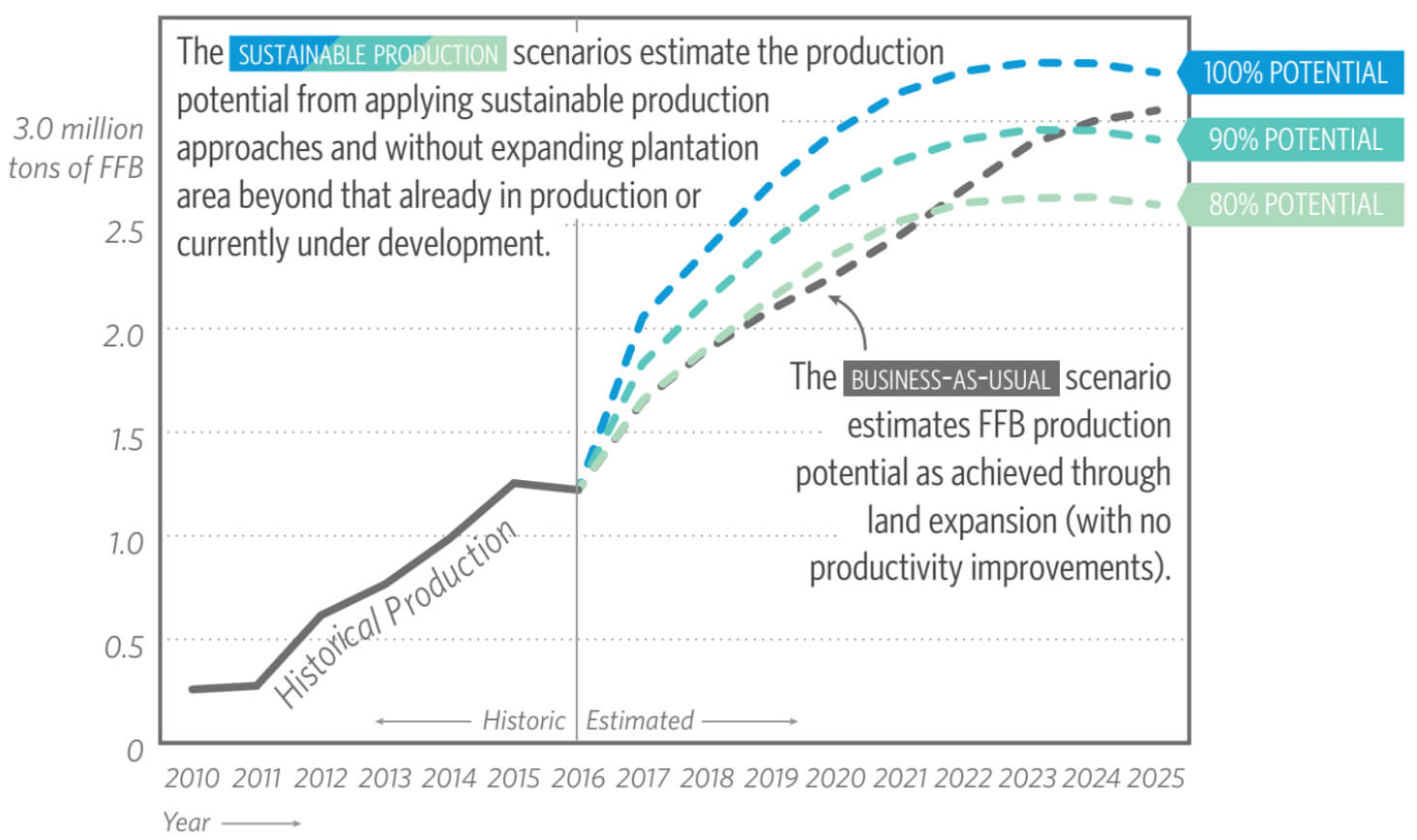

Figure I. Estimate of avoided deforestation through productivity improvement.

This does not provide a lot of room for land expansion, and if not supported by a viable strategy to intensify crops, the push to maintain oil palm growth will strain the existing limitations on land use.

In this study, we estimate the FFB production potential of currently producing trees in Berau under two scenarios: the sustainable production scenario and the business-as-usual scenario.

The business-as-usual scenario estimates FFB production potential as achieved through land expansion. The sustainable production scenario measures the oil palm trees’ optimal production potential by applying the sustainable production approach (IFC, 2013), without expanding the plantation area beyond what has already entered into production age and currently under development.

Our calculations estimate that, with better agricultural practices focused on improving yield, at just 90% optimum productivity Berau could be producing more than 2.8 million tons of FFB per year by 2021. On the other hand, under the business-as-usual scenario, production would still fall short of 100% optimum levels over the projected years. This implies that there is no need for further plantation expansion, as the existing concessions are sufficient to fulfill Berau’s production needs.

2. Palm oil plantations and mills are spread out evenly across East Kalimantan, but most crude palm oil leaves the region raw and unrefined

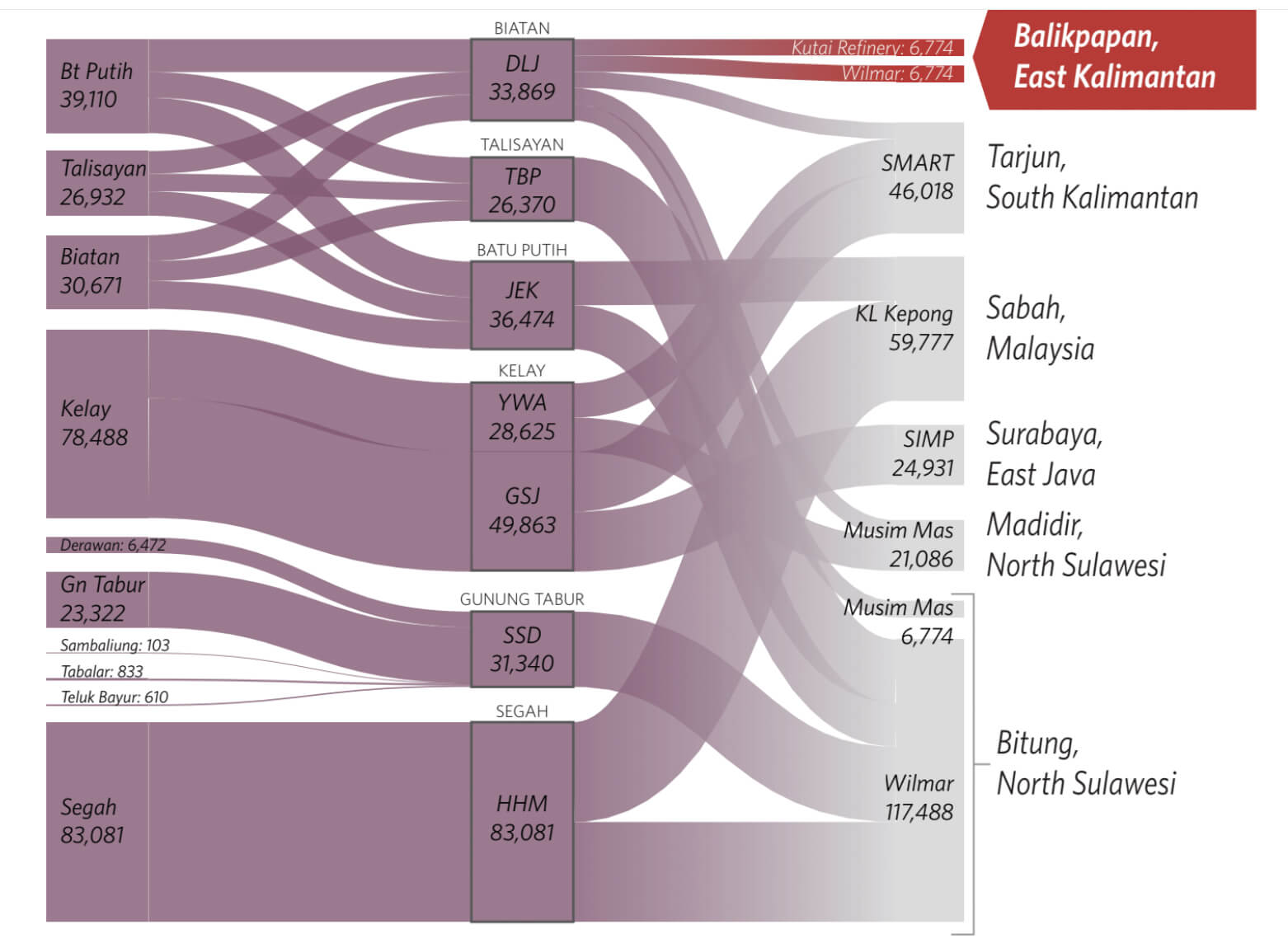

This study maps, for the first time, the flow of palm oil products in Berau, from the plantation to the refinery. Of the 12 sub-districts in Berau,

Figure II. Flow of palm oil products from the plantations in Berau’s sub-districts to the refineries. (*Units are in tons of CPO, or CPO equivalent.)

10 have planted palm oil, with the largest supply of FFB coming from Kelay and Segah, comprising 56% of total production in the north west of Berau.

There are eight mills in Berau, seven of which are operational as of 2017. Plantations owned by private companies in Berau are typically integrated into their own mills, built in a location close to the plantation. These company-run plantations have efficiently arranged their supply contracts to connect to the closest available buyer.

There are no crude palm oil (CPO) refineries in Berau, however, so CPO from Berau mills are sent to eight refineries across Indonesia and Malaysia, the closest

of which are located in Balikpapan, within the East Kalimantan province. Despite the existence of three refineries in East Kalimantan, Berau only supplies an

insignificant amount CPO to two of them, PT Kutai Refinery Nusantara and PT Wilmar Nabati. As a result, most of the CPO from Berau is sent to North Sulawesi and Sabah, Malaysia.

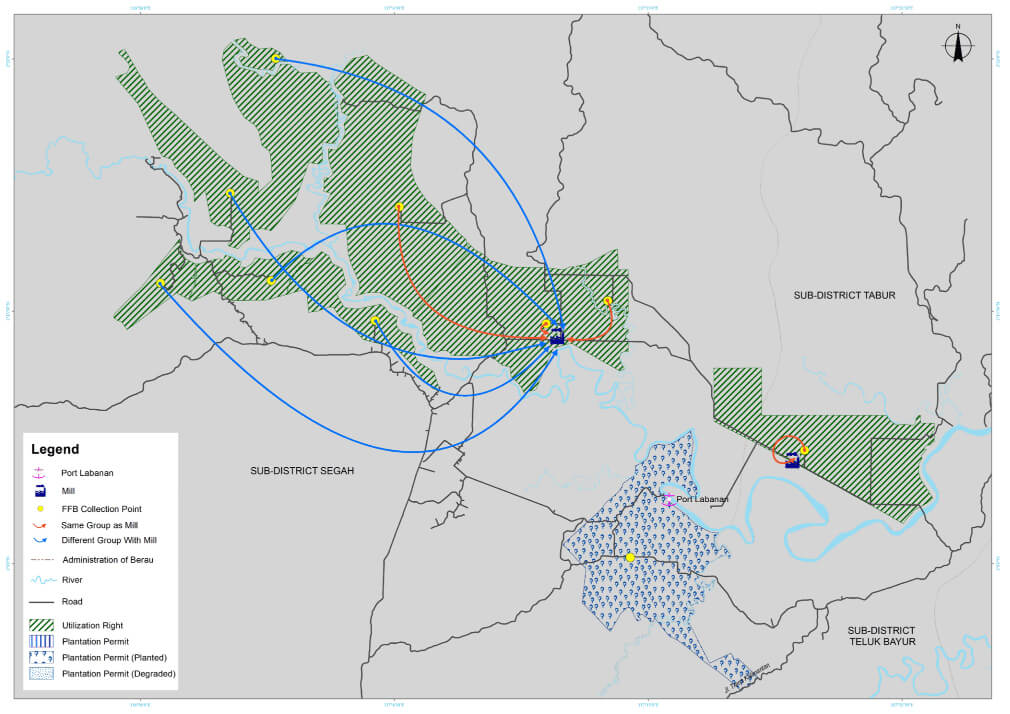

Figure III. Flow of company-produced FFB to mills. (The blue lines represent the transport of FFB from company plantations that are not group-affiliated to the destination mill.)

3. Company plantations are situated efficiently along the supply chain, but smallholders face additional challenges

Transportation is efficient from company plantations to mills. From our field research, we found that company plantations in Berau are typically integrated into mills they operate themselves, built in close proximity to the plantation. The map suggests that company-run plantations have efficiently arranged their supply contracts to connect to the closest available buyer.

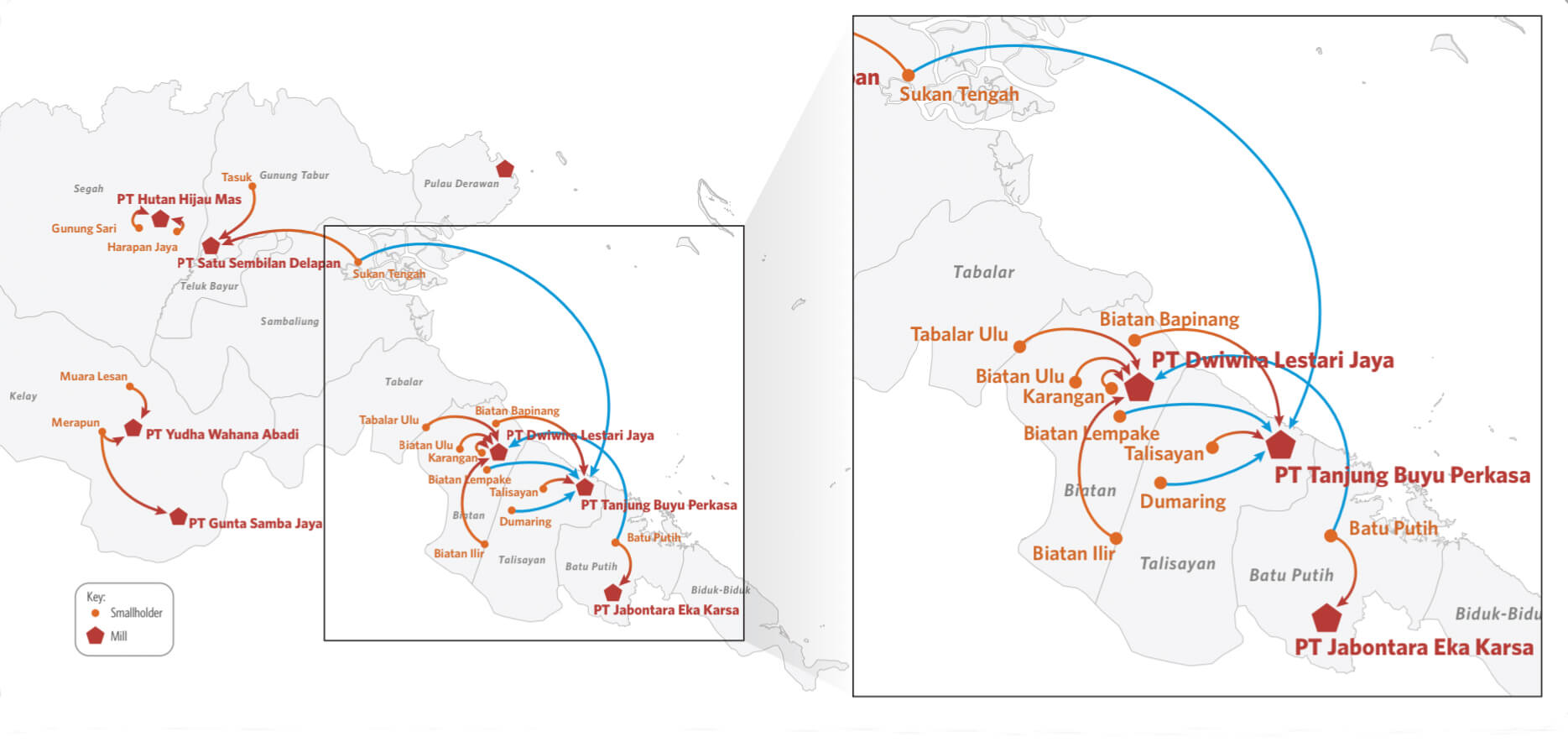

When comparing the supply chain routes that company plantations use to the smallholder routes, it is evident that several independent smallholders are not supplying FFB to their closest available mill, as they cannot meet certain standards imposed by that mill. There are at least three villages in the south-eastern part of Berau that supply FFB only to mills further away from them (greater than the average distance of 30km), despite there being a closer mill available. The three villages, Biatan Bapinang, Biatan Lempake, and Dumaring, only supply to PT Tanjung Buyu Perkasa which is between 40-70 km away from the villages, instead of PT Dwiwira Lestari Jaya, which is between 8-20 km distance range from the mill.

Additionally, there are two villages that supply FFB both to the closest mill and to mills further away, Batu Putih and Sukan Tengah. Batu Putih smallholders supply to the nearest mill of PT. Jabontara Eka Karsa, which is located within the sub-district, and to PT. Dwiwira Lestari Jaya mill, which is two sub-districts away, with an approximate distance of 75 km. Sukan Tengah has the longest FFB supply route we encountered in Berau, supplying to PT. Dwiwira Lestari Jaya, which is three sub-districts away and an approximate distance of 137 km.

In some cases, the cooperative has an agreement with the mill further away, but does not have an agreement with the closest mill. In the villages of Biatan Lempake and Dumaring, the cooperative in their respective villages has an agreement with PT Tanjung Buyung Perkasa mill, but does not have an agreement with PT Dwiwira Lestari Jaya mill, which is actually closer.

Figure IV. Flow of smallholder-produced FFB to mills. (The blue lines represent the transport of FFB from smallholders to a mill that is further than the closest one.)

Transportation distance is a significant factor in smallholder productivity and earnings, because FFB quality deterioriates within two days after harvesting, and transportation costs will also increase as the transportation distance increases.

The supply route of several smallholders is inefficient. Under optimal market conditions, business actors would opt for the most efficient and cost-effective method of selling to a buyer. These findings indicate that there are challenges preventing the smallholders from acting efficiently.

4. Recommendations and follow up

Based on the findings in this study, the research team recommends future studies or projects that focus on:

1. Identifying strategies for Berau to reach optimal levels of production within the existing productive concessions.

2. Supporting a region-wide effort to map smallholders, in order to create functional cooperatives and Village Owned Enterprises (BUMDes) in strategic locations throughout the district, and to provide alternative financing so that smallholders can access operational capital.

3. Mapping other potential agricultural plants, apart from palm oil, at the village level, to provide smallholders with alternative sources of income and to strengthen villages with a diversified economy.

4. Analyzing the need and business case for refineries in Berau, and the challenges that presents.

In the next phase of this study, CPI will take a deep dive into two selected villages, to map and survey smallholders in more detail, and to obtain smallholder financial profiles. This will then be developed into a model to provide smallholders with access to finance.