The combined challenges of energy access and climate change present major needs for clean energy investment. The Paris Agreement and United Nations’ Sustainable Development Goals, negotiated in 2015, represented an inflection point for moving from talk to action in order to address two of the world’s most important challenges. The objective is clear: mobilize investment to meet the goal of limiting global warming to, at most, 2 degrees Celsius while also bringing electricity to the more than 1 billion people globally who do not yet have access to it.

Within developing economies, there are significant opportunities to increase investment in clean energy: by 2030, non-OECD countries are projected to increase demand for electricity by 63 percent from 2014 levels (OECD, 2017a). This nearly 7,000 terawatt hours (TWh) of additional demand represents 85% of the expected global demand increase for that same time period (IEA, 2016).

Many developing economies already offer strong environments for investment. Countries including Mexico, Chile, Thailand, Peru, Malaysia, and China, among others, offer strong institutions and favorable policy environments, which are reflected in high sovereign investment-grade ratings.

This report looks at what is needed to unlock investment opportunities in developing economies that are still catching up. We evaluated, by geography and clean energy sector, the most significant opportunities for impact on both climate change and energy access per dollar invested; the risks and barriers that prevent investment; and how blended finance could be deployed to address investor needs.

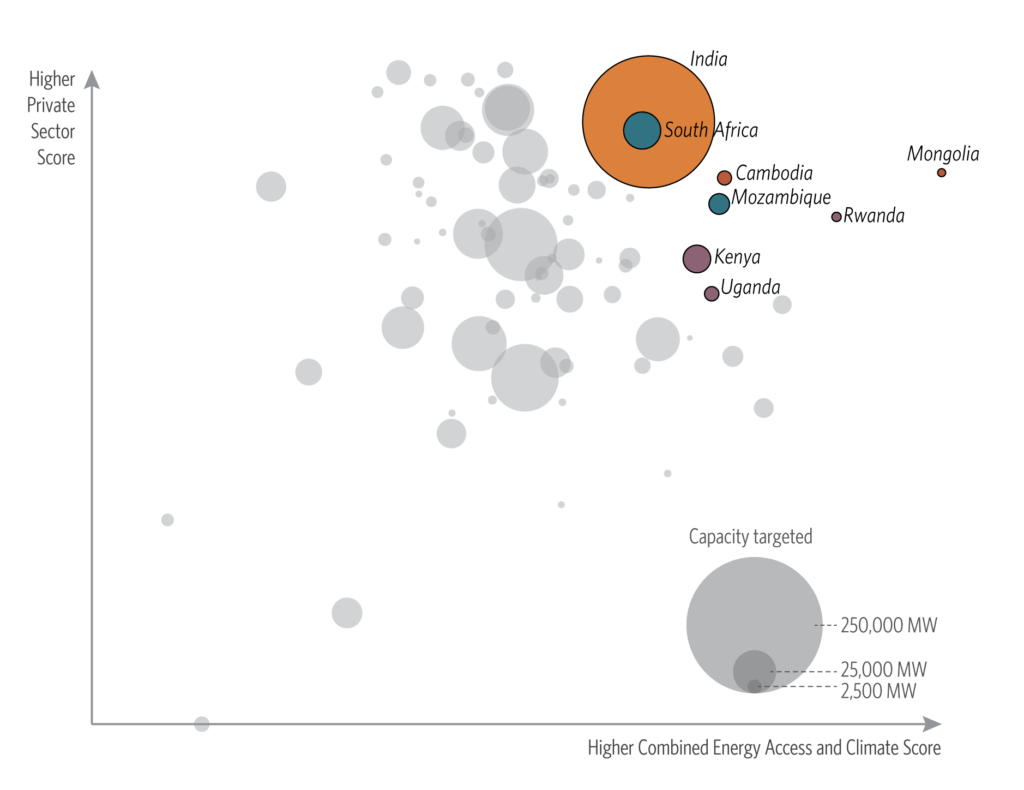

We find that the greatest opportunities for blended finance in clean energy are in Sub-Saharan Africa and South and East Asia, with a subset of eight countries alone offering more than USD 360bn in investment potential in clean energy by 2030 (see following bubble chart).

Private investors, in particular, should note the investment potential in the following:

- Large, relatively mature geographies, such as India and South Africa, which offer strong renewable energy policy environments and a wide variety of investment opportunities;

- Smaller countries in which grid-connected projects in hydro, wind, solar, and geothermal can be diversified via global and regional investment vehicles; and

- The nascent, yet quickly growing, distributed generation market, particularly in countries with large populations still without access to energy, through corporate finance and securitized assets.

Even though clean energy costs have come down significantly in recent years, risks and barriers remain in these countries and are preventing investment. The top risks identified in our research are off-taker risk, currency risk, policy risk, and liquidity and scale risks. In addition, many early stage projects and clean energy companies face barriers in accessing financing.

We looked at 75 blended finance initiatives in clean energy, diving in depth into a subset of them, to understand how barriers are currently being addressed and remaining gaps. We found, among others, that:

- The experience to date of blended finance in clean energy offers ample successes and room for improvement going forward;

- As clean energy closes the “viability gap” with fossil fuels, there is a gap between the investment risks and barriers addressed by earlier blended finance initiatives and those cited by investors as most important to address going forward, with liquidity, off-taker, and currency risks less frequently addressed to date;

- There is a gap between the types of instruments most needed and those offered: risk mitigation instruments, such as guarantees and insurance, are less frequently offered than direct investment; there are also major gaps in local currency financing, early stage risk financing, and vehicles that aggregate projects, especially small ones; and

- The limited scale of blended finance initiatives – both through direct investment vehicles as well as indirect blended finance via risk mitigation – likely limits the participation of many investors.

Blended finance is essential to increase private investment in critical markets, but changes to how it is deployed would increase its success in supporting global goals and mobilizing private investment. In particular, we recommend to blended finance practitioners that:

- Blended finance efforts focus on the highest impact opportunities. Our analysis identifies markets in Southeast Asia, Sub-Saharan Africa, and South Asia that have high relevance for climate change mitigation and energy access and broadly conducive environments for private sector investment, yet ongoing needs for blended finance;

- Developers of blended finance initiatives target the most commonly cited risks to private investors; and

- Achieving scale will require, among others: supporting initiatives that are ripe for expansion, as risks can remain even after a successful pilot; building sustainability through technical advisory services and supporting networks that generate new ideas and partnerships; and improving efficiency by streamlining approval processes.

Many innovators are already taking these lessons and building the next generation of blended finance initiatives. Promising approaches are highlighted throughout the report.

Read lead author Bella Tonkonogy’s blog post highlighting the report’s findings, here.

This working paper was commissioned by the Blended Finance Taskforce and contributes to its consultation paper “Better Finance, Better World”. The Taskforce was launched as an initiative of the Business & Sustainable Development Commission in 2017 to look at blended finance from a private sector perspective and to see how blended finance can make the SDGs more “investable” for commercial players. The Taskforce is developing an action plan to rapidly scale the blended finance market in order to mobilise more private capital for the SDGs, particularly for sustainable infrastructure in emerging markets and would welcome your feedback.

The Taskforce commissioned a series of working papers on blended finance (including this one) to contribute to this action plan. “Mobilising Institutional Capital at Scale for the Global Goals Through Blended Finance” was prepared by Convergence (and Tideline in advising role) and catalogues investment motivations, requirements, and constraints of institutional investors in taking advantage of blended finance mechanisms. “Blended Finance in Clean Energy” was prepared by the Climate Policy Initiative and analyses opportunities where blended finance can mobilise large scale private capital for clean energy. “Financing Sustainable Land Use” was prepared byKOIS Invest and explores how to unlock business opportunities in sustainable land use with blended finance.

All reports available at www.businesscommission.org