India, under the Intended Nationally Determined Contribution (INDC), has set an ambitious target to achieve installed capacity of 175GW of renewable energy by 2022, including 100GW of solar power. Of that, the government aims for 60 GW to be utility-scale solar, and the rest to be rooftop solar. Though India has made significant progress on the 60 GW utility-scale solar target, getting to the 40 GW rooftop solar target will be a significant undertaking. As of March 2018, installed capacity of rooftop solar was only ~2.53 GW, which means in the next four years India needs to achieve more than 15 times the current capacity. Filling this gap between the current installation and the 40 GW goal will require significant efforts from policy makers, lenders, and other stakeholders in this area, quickly.

One area of opportunity to fill this gap lies with small and medium businesses. Currently, the majority of rooftop solar installations are in the Commercial and Industrial (C&I) segment, primarily due to a business case for rooftop solar tariffs against the prevailing electricity tariffs. Market expansion under the C&I segment, however, has been limited to large corporates and high credit rated entities, for both the developers and off-takers, and does not extend to Micro, Small and Medium (MSME) entities. While these entities offer a huge potential for rooftop solar installations, they typically do not have high enough credit ratings to access finance under the two prevailing rooftop solar business models, the Capital Expenditure model and the Power Purchase Agreement model.

Lack of access to debt is the key barrier to expansion of rooftop solar to the low rated/ unrated MSME and general enterprises. This results from lack of credit benchmarks and credit history of such entities. For the market to move forward, it is essential to find a solution to address this barrier.

Our preliminary analysis shows that developers are hesitant to offer Power Purchase Agreement-based terms to a large section of prospective clients in the MSME segment. This is mainly due to the lack of historical financial performance record and uncertainty around the creditworthiness of off-takers. Further, lack of collateral makes banks reluctant to provide long-term financing to these projects. Thus, there exists a strong need for credit support mechanisms that can help address the key barriers to access to debt financing, i.e. payment delay and/or payment default, for expansion of rooftop solar to MSMEs.

This instrument design case study for the U.S.-India Catalytic Solar Finance Program (USICSF) proposes the use of a Credit Guarantee Mechanism to overcome these barriers to further scale-up rooftop solar for MSMEs.

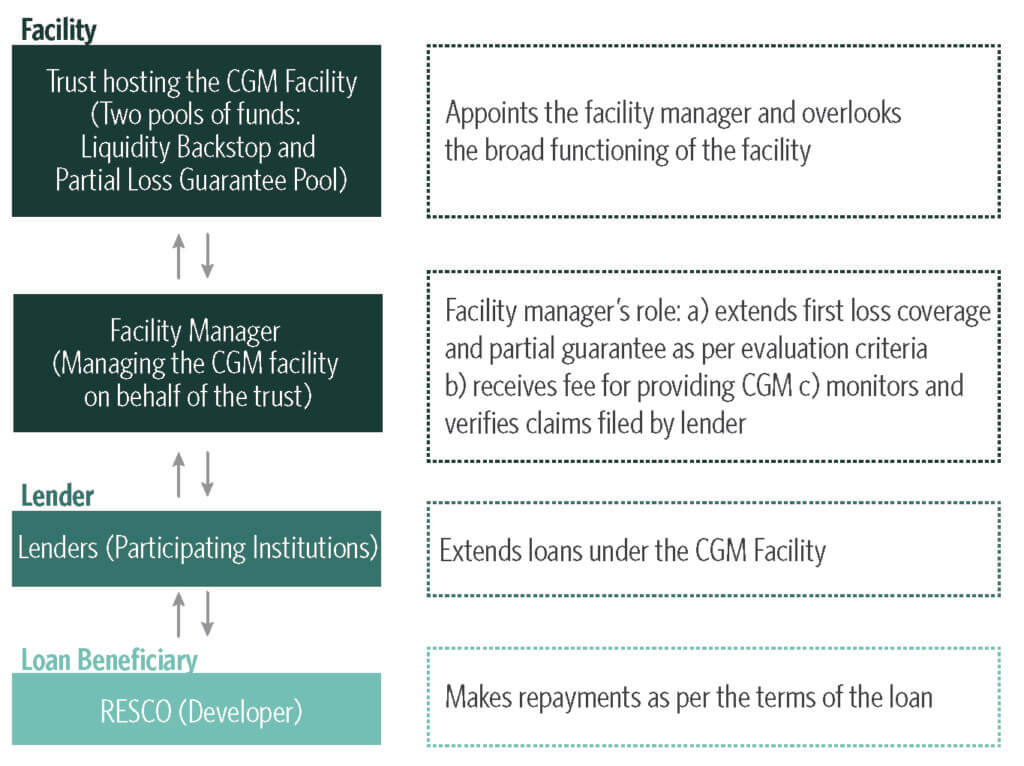

The proposed Credit Guarantee Mechanism (CGM) works as a bilateral loss-sharing agreement between a CGM Trust Fund and Lending Institutions (Banks/ FIs) as illustrated in Figure ES1. In this structure, a Facility Manager, under the guidance of the Trustees of the CGM Trust Fund, extends credit guarantees to participating lending institutions. Based on these credit guarantees, lending institutions then extend debt financing to renewable energy service companies (RESCOs), who enter into off-take agreements with MSMEs to install rooftop solar.

The Facility Manager, as per the agreement within the credit guarantee, commits to support lending institutions in case of delay in debt servicing and also reimburses the lending institutions for a portion of the losses incurred due to payment default by the RESCO.

Structure of Credit Guarantee Mechanism

Such a mechanism could be launched as a funded public intervention by the Ministry of New and Renewable Energy (MNRE) through suitable host financial institutions who could manage and administer the CGM Facility.

Overall, a CGM is effective because it takes lenders’ requirement for credit support in the event of payment delay or payment default into consideration. A CGM has an additional benefit of lowering the collateral required against the loan raised by the RESCO.

We find that under Credit Guarantee Mechanism, one million dollars of donor grant capital invested in the facility enables US$14 million of capital mobilization, and a capacity installation of 18 MW in the rooftop solar sector.

The proposed Credit Guarantee Mechanism addresses the most important barriers to scaling rooftop solar in the MSME sector; and could be crucial if India wants to achieve its rooftop solar target by 2022. Thus, we recommend the use of a Credit Guarantee Mechanism to scale-up rooftop solar in the low rated/unrated MSME/ general enterprises segment.