About

By 2030, nine out of ten people in the world without energy access will be in Africa.

Decentralized renewable energy is one of the most cost-effective ways of scaling electrification, but due in part to stagnating investments in the space, the rate of energy access is increasing at an anemic rate.

A significant barrier to scaling decentralized RE is the inability to properly assess customer repayment risk. This data gap limits distributors’ ability to raise capital, especially for small and mid-sized, local providers, who have strong distribution networks but cannot affordably access debt.

Donor capital is achieving limited success in its mission to leverage private finance. Concessional capital does not always enable distributors to reach last mile customers because without data on household ability to pay these funds are applied across a project instead of being targeted to those who need it most.

Data-Driven Energy Access for Africa uses artificial intelligence to standardize metrics related to customer repayment risk, improving access to capital for distributors and efficient intermediation of credit and grants to better serve customers.

INNOVATION

Data-Driven Energy Access for Africa offers a solution.

Powered by its Risk Analytics Engine, Nithio uses artificial intelligence and demographic, geospatial, and anonymized customer data to analyze customer repayment risk within distributors’ receivables portfolios. This enables better credit assessment of underlying portfolios of receivables and more effective intermediation of capital to serve those customers with the greatest financial need. By incorporating a detailed segmentation of forecasted customer repayment abilities, this approach scales investment efficiently and offers a step-change in making more rapid progress toward achieving SDG 7.

IMPACT

Proponents estimate that 700,000 households could achieve energy access by 2025 through this instrument, avoiding 90,000 metric tons of carbon emissions per year by 2025, based solely on kerosene replacement. Proponents estimate they will provide energy access to 5.4 million new customers by 2030.

By 2025, the proponents estimate that 80,000 systems will replace diesel generators, reducing carbon emissions and pollution-related illness as well as powering small- and medium-sized enterprises, health, education, and other civil services. Nithio can finance both solar products for the home and productive use, including solar water heaters and clean cooking, further reducing fuel-based emissions.

This would also create nearly 25,000 jobs, enabling end-users to earn USD 60 million in additional income and provide 1 billion extra hours of study time for young students, along with many other health, education, and resilience benefits.

The instrument would also create nearly 25,000 jobs, enabling end users to earn USD 60 million in additional income and provide 1 billion extra hours of study time for young students, along with other health, education, and resilience benefits

DESIGN

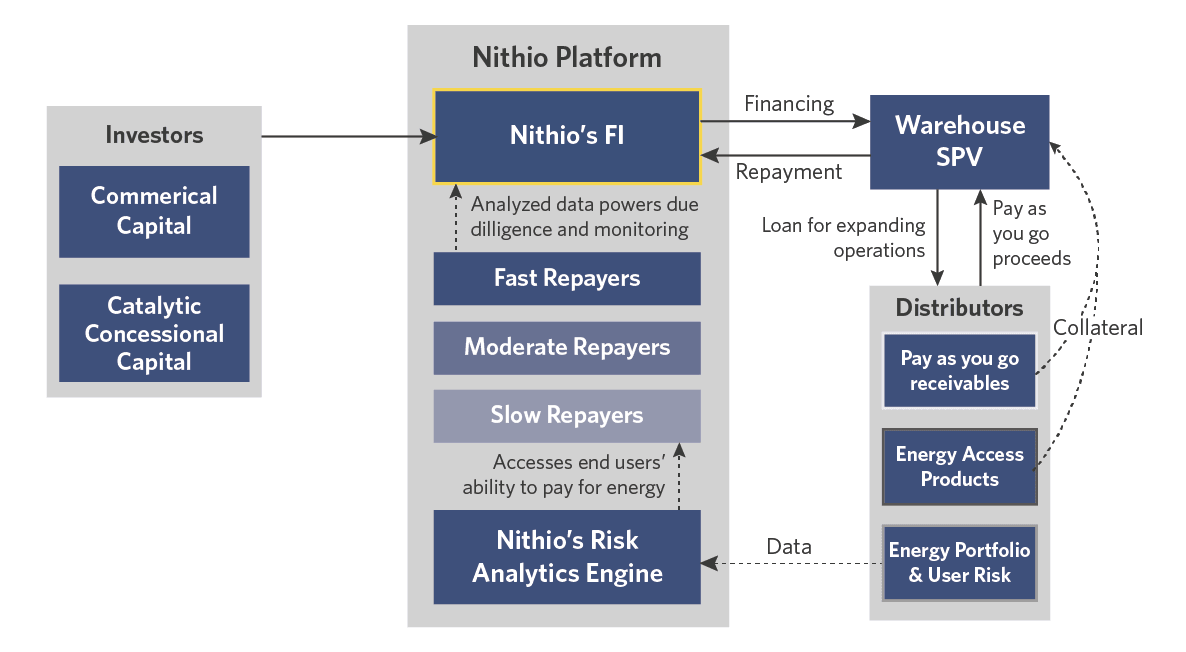

The instrument is enabled by a financial intermediary (FI) that provides loans to renewable energy distributors with advance rates based on the risk analysis of the distributors’ portfolios.

Nithio sources, analyses, and segments a distributor’s customer portfolio using its proprietary Risk Analytics Engine, applying and promoting standardized metrics. Combining anonymized customer repayment data from the distributors and geospatial and demographic data (including income, assets, geography, roofing quality, and many more inputs), it forecasts repayment rates for each customer aggregating these analytics for the relevant portfolio.

Customers are segmented based on estimated repayment speed and rates of default over various timelines. This enables standardized measurement of credit risk across a pool of receivables, as well as sustainable loan pricing. Receivables are not “cherry-picked:” the entire portfolio is financed with a blend of capital as suits the characteristics of the end-users in the portfolio.

Using this portfolio analysis, Nithio calculates appropriate financing terms for each distributor. Nithio can also intermediate grant capital such that those end users with limited ability to repay are still able to obtain relevant products, while distributors’ business models can remain viable.