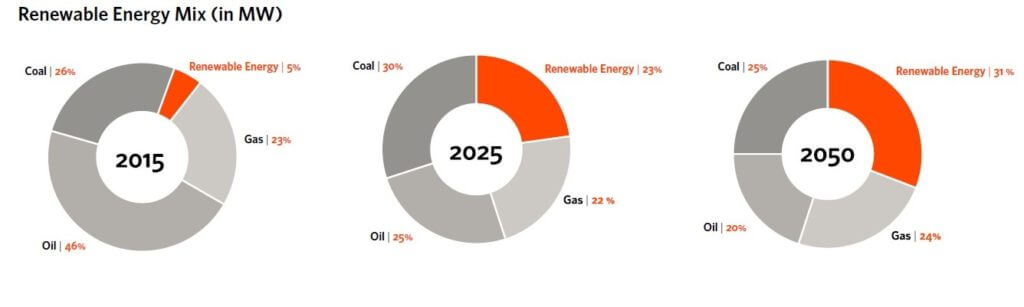

Mobilizing private capital is a requisite for Indonesia to meet its clean energy mix targets from the currently installed 5% to 23% by 2025.

Research (CPI Study, 2018) shows that investment requirements to meet Indonesia’s energy targets are estimated to reach USD 125 billion by 2025. And the private sector has a key role to play, yet private investments are far from sufficient. Public actors also need to play a larger, more crucial role to attract private investments, by de-risking investment opportunities more effectively.

A guarantee instrument is one of the many potential de-risking instruments to help accelerate renewable energy development in Indonesia. Though a guarantee is not the only solution to address the range of investment barriers renewable energy projects face, it can partially address some of these barriers:

- Security gap — In small projects a guarantee can address the security gap because of the tendency to attract small developers with insufficient balance sheets.

- Risk-return profile of a renewable energy project — A guarantee can improve the risk-return profile of a renewable energy project; in a situation where the guarantor assigns a lower risk profile to a project than the potential lender (and where the cost of guarantee is lower than the reduction of cost of debt).

- Access to long-term funding — A guarantee can increase access to long-term funding from local banks resulting from improved risk profile.

At present, there are ten organizations providing 13 guarantee products covering the Indonesian market, yet none provide specific coverage for the renewable energy sector. As resources are limited for deploying guarantees, they become less accessible. This is mainly due to competition from other sectors, not only in Indonesia but also in other countries.

As the perception of political risk and public sector performance in Indonesia has improved in recent years, the demand for guarantee instruments to cover these risks have gradually subsided among financial institutions. In addition, the Indonesia Infrastructure Guarantee Fund (IIGF) also partially covers these risks. The development of a credit guarantee for renewable energy in Indonesia offers the most potential to help rejuvenate the market while also catalyzing private investments. If developed by a local financial institution, it can also help increase the guarantee’s visibility and accessibility to local stakeholders. However, there are potential challenges to effectively implement a guarantee instrument in Indonesia, namely:

- Competition with shareholder/corporate guarantee, which tends to have a lower cost;

- “first demand” feature, often required by financial institutions;

- limited involvement in recovery proceedings in case of default; and

- limited awareness about a guarantee instrument among financial institutions.

This CPI study, produced in collaboration with PT Sarana Multi Infrastruktur (Persero) is part of a research program which explores the potential of developing a green investment bank model in Indonesia. The basic role of a green bank is to identify barriers to investment in green infrastructure and develop solutions to address these barriers. Green banks are typically capitalized with public money and engage in multiple activities, including concessional lending as well as risk mitigation instruments. The overall objective of the program is to help development financial institutions, policymakers, and donors to understand the opportunities and challenges of applying the green investment bank model in the country.

In this analysis, we specifically focus on the potential of developing a guarantee instrument to help catalyze renewable energy investments in Indonesia.