India needs to accelerate the growth of its rooftop solar sector. Of the 40 GW of rooftop solar installations targeted by 2022, the country has only achieved 2 GW to-date. This slow progress may hinder the country’s ability to reach its overall solar targets and meet its energy demand.

Presently in India, there are two dominant business models for rooftop solar: the capital expenditure (CAPEX) model, which has an approximate 75% of market share, and the renewable energy supply company (RESCO) model, which accounts for 22% of rooftop installations. These models work fine for larger commercial and industrial (C&I) players who have access to upfront capital, or can obtain commercial loans. However, rooftop solar remains constrained among smaller C&I players, micro, small and medium enterprises (MSME), and residential customers due to lack of financial resources and inability to access debt.

A CAPEX model with a commercial loan for the off-taker is a potential solution for these categories of customers. This model has proven effective with large scale implementation across Europe and the U.S.

This proposed model is similar to the existing the CAPEX model, where the customer makes the upfront payment to finance the solar assets. This payment is, however, financed by a mix of the customer’s own equity and a commercial loan taken directly by the customer.

In this report, we assess the viability of the CAPEX loan model with a focus on the MSME sector, identify barriers to uptake, and recommended policy solutions to these barriers.

Through secondary research and interviews, we draw the following conclusions:

- There are several factors that could lead to a significant demand for the CAPEX loan model. The barriers to the CAPEX cash (i.e., lack of capital) and the RESCO model, such as lack of equity with smaller developers and difficulty in raising debt for MSMEs, are some of the factors that can encourage the uptake of the CAPEX loan model.

On the demand side, the model is primarily driven by a cost imperative as the installation cost of solar energy has decreased significantly and has become cheaper than procuring from the grid in most of Indian states. While developers may find it difficult to raise funds for projects targeting MSMEs and unrated clients, the customers themselves can leverage their existing banking relationships to raise debt for solar installation. This is another major driver.

Customers can also take advantage of accelerated depreciation, offsetting their tax liabilities in the initial years. - However, there are barriers and challenges that need to be addressed to expand the possible use of the model. The biggest barrier that the model faces for MSME clients is perceived lack of creditworthiness due to lack of credit information/ratings. This barrier is further aggravated by the high transaction cost/time of MSME rooftop loans due to their small size, decreasing their attractiveness to lenders. Lack of awareness on the part of MSMEs and perceived performance risk of solar generation are other important barriers that can limit the expansion of the model’s use.

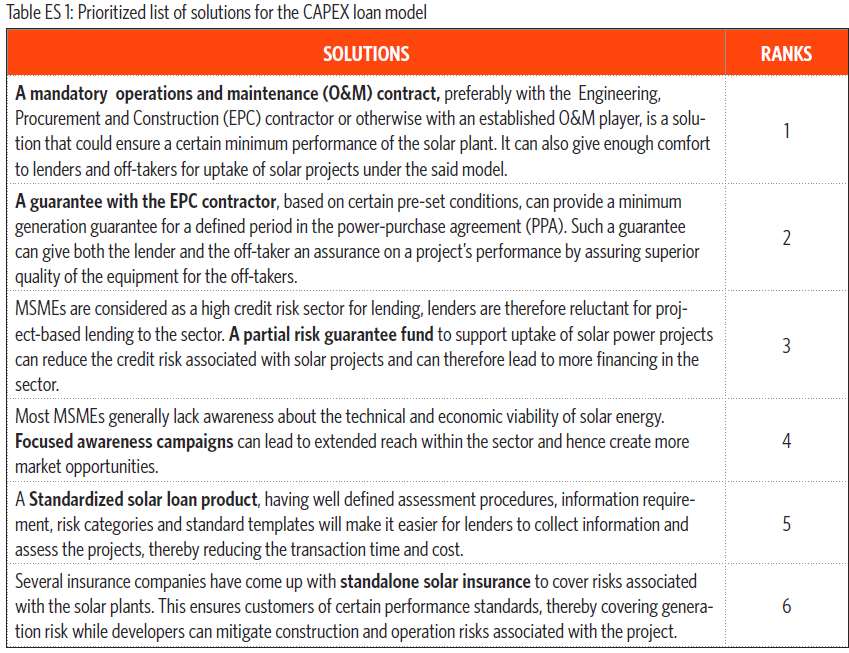

According to the lenders, MSMEs are often over-leveraged in terms of their borrowing, which makes it difficult for them to borrow for solar installations. MSMEs themselves may be unwilling to invest a sizeable portion of their capital (through equity or taking additional debt) in a non-core business activity that ties up capital for long periods of time. - Market solutions could help overcome these barriers. We identify and prioritize policy solutions for key barriers in Table ES1, based on factors of potential impact and implementation feasibility. These solutions cater specifically to the top two barriers identified in the study. The other barriers, although important, need further research and discourse. CPI, through its future work, intends to continue to work and delve deeper to find potential solutions to these barriers.

There are also certain other policy solutions, like increasing the limit for net-metered solar plants and devising clear timelines for benefits, that could help create a more favorable environment for rooftop solar. Coupled with the solutions discussed above, these solutions could open more opportunities for solar uptake in the MSME sector.

Prioritized list of solutions for the CAPEX loan model