Landscape of Climate Finance for Land Use in Brazil

Climate finance is crucial for the transition to a low-carbon economy, as it allows financial flows to be geared towards mitigating greenhouse gas (GHG) emissions and adapting to the impacts of climate change. However, climate finance faces significant challenges, such as mobilizing sufficient resources to meet agreed-upon climate targets, prioritizing resource allocation, and effectively and transparently distributing funds.

In Brazil, activities related to land use play a central role in decarbonizing the economy, as agriculture and deforestation together account for almost three quarters of the country’s GHG emissions (SEEG 2021). As such, finance strategies must be developed to promote a transition to low-carbon agriculture and forest protection, increase climate resilience, reduce socio-economic vulnerabilities, and support activities compatible with the preservation of forests and their inhabitants.

To understand climate finance for land use in Brazil, researchers from the Climate Policy Initiative/Pontifical Catholic University of Rio de Janeiro (CPI/PUC-Rio) conducted an unprecedented tracking exercise to quantify the financial flows directed towards agriculture and forest in alignment with climate goals. This work identifies the amounts allocated from public and private sources of finance, both domestic and international. It also specifies the disbursement channels and financial instruments used, the sectors financed, and climate objectives. As such, this report provides a baseline for characterizing financial flows that contribute to land-use-related climate mitigation and adaptation for the period 2015 to 2020.

In addition to a quantitative overview of climate flows, another relevant contribution of this work is the development of a methodology to characterize climate finance in Brazil and identify land use practices, technologies, sectors, and activities aligned with mitigation and adaptation objectives. This approach is based on CPI’s international experience in tracking climate finance flows globally since 2011, by means of the Global Landscape of Climate Finance (Buchner et al. 2021). This methodology has been adapted to the specificities of the Brazilian context and can be replicated by other researchers, extended to other sectors, and used in the classification and disclosure of investments.

Information constraints posed a challenge when tracking financial flows. Finding relevant characteristics for the classification of financial flows proved impossible in some of the available databases. The private financial flows included in the map are also likely to be underestimated due to a lack of consistent and standardized data.

In this context, the careful characterization of climate finance flows for land use presented in this report aims to increase transparency and enable the monitoring of the evolution of finance, making it possible to assess whether they are growing in a way that is compatible with climate challenges. This work also helps with identifying finance gaps, designing investment and disinvestment strategies, and holding stakeholders accountable.

WHAT IS CLIMATE FINANCE?

Climate finance refers to capital flows that have direct or indirect effects on the mitigation of GHG emissions or which contribute to climate change adaptation. Flows can also be geared towards dual benefit activities, should they contribute to both mitigation and adaptation. According to the United Nations Framework Convention on Climate Change (UNFCCC), funds for climate finance may originate locally, nationally, or transnationally, from public, private, or alternative sources.

WHAT IS LAND USE?

This report tracks climate finance for land use, which includes:

Agriculture: crop and cattle production, all the way from the primary sector to activities in the secondary sector of the value chain, such as agroindustry. It includes infrastructure on rural properties, the purchase and production of inputs, rural extension activities, and financial services. It also spans measures for energy efficiency in agroindustry and renewable energy generation from sugarcane or crop residue, such as biofuel production. Finally, it covers policy management and planning, as well as research and development (R&D) for agriculture.

Forest: conservation, restoration, and reforestation activities, as well as use for economic purposes, as in the case of planted forests. This includes policies to combat deforestation, and on environmental and land tenure regularization and territorial planning.

Multi-sector: policies and projects aimed at reducing vulnerability to climate change, including meteorological monitoring and surveillance systems, natural disaster alerts, and risk management for hydrological and geological events, among others. For more detail, see the list of climate-aligned activities in Appendix I and the definition of sectors in Appendix III.

Main results

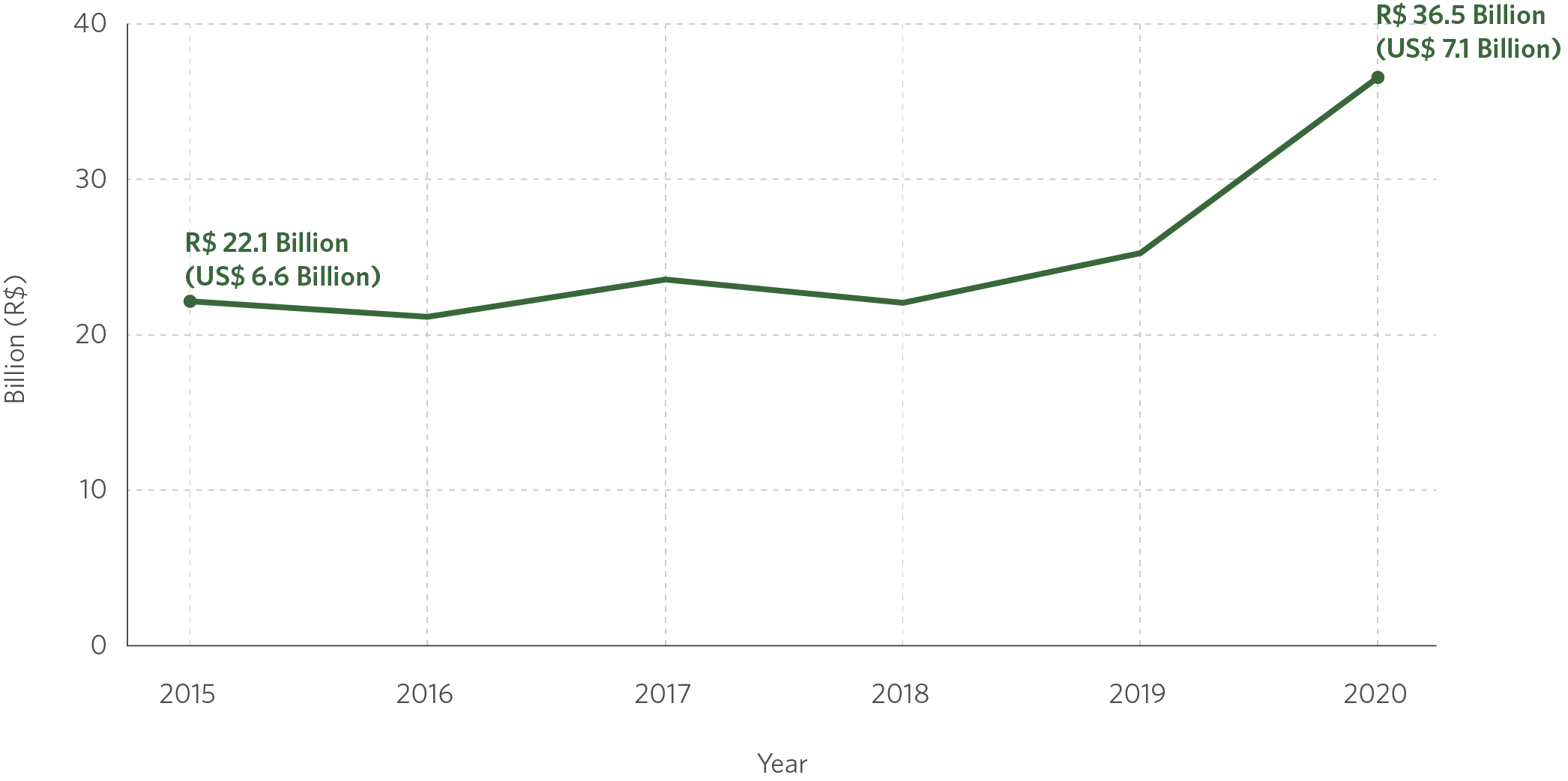

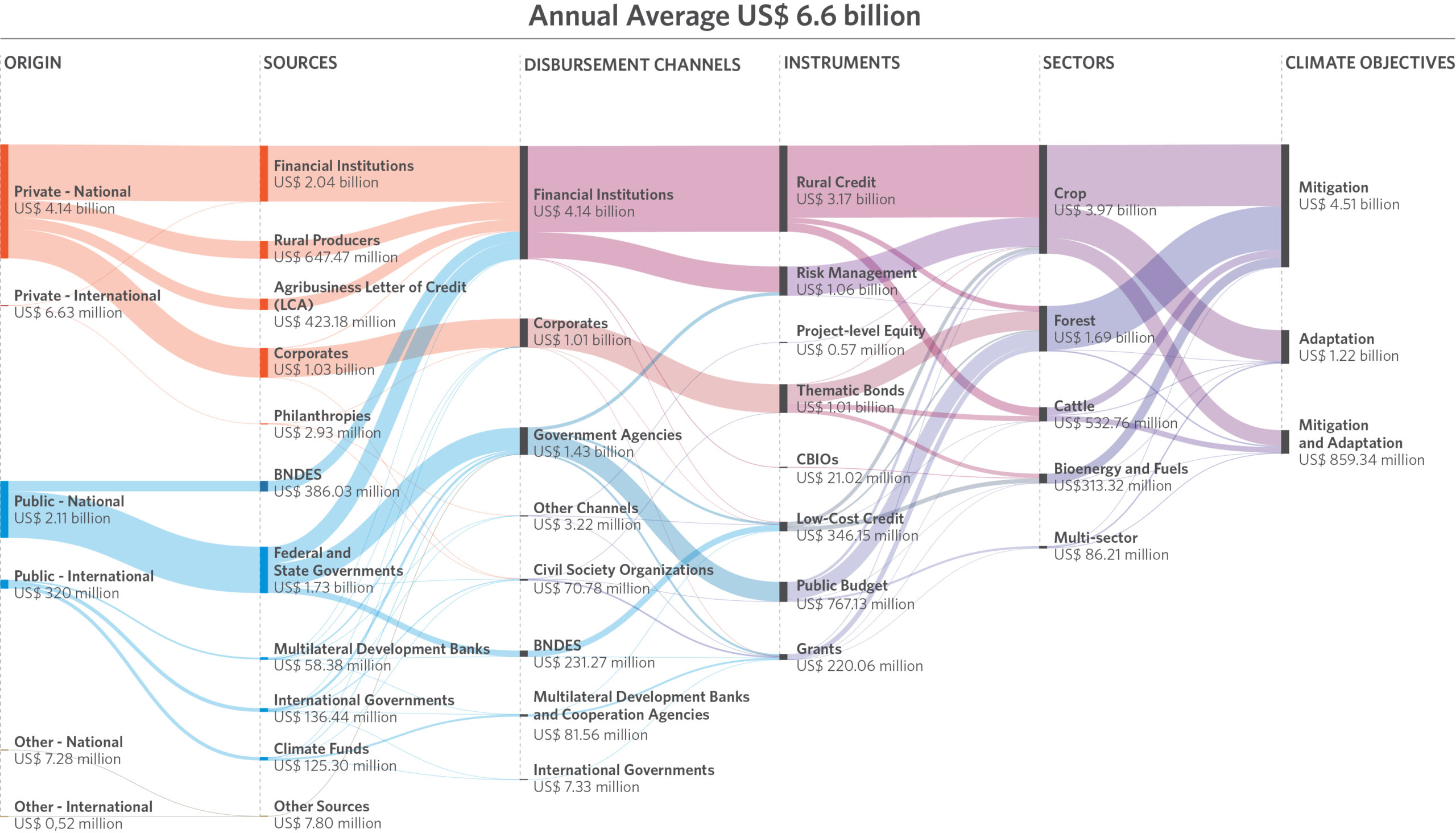

• Climate finance for land use in Brazil amounted to an average of US$ 6.6 billion/year[1] between 2015 and 2020. During this time, financial flows increased from US$ 6.6 billion in 2015 to US$ 7.1 billion in 2020, this represents a growth of 65% in Brazilian reais.

• Most of the finance aligned with climate objectives came from domestic sources, which channeled US$ 6.3 billion/year (95%).

• Two-thirds of domestic finance (US$ 4.1 billion/year) came in the way of private finance, which is largely explained by the fact that financial institutions are obligated to allocate finance to rural credit. As such, a relevant portion of climate finance for land use in Brazil comes from private finance directed by public policies.

• International finance accounted for 5% (US$ 327 million/year) of climate finance flows. International finance originated mostly from public sources: foreign governments (US$ 136 million/year), climate funds (US$ 125 million/year) and multilateral development banks (US$ 58 million/year), channeled mainly via grants (US$ 216 million/year).

• The Amazon Fund is the main climate fund channeling international finance for land use in Brazil. Despite this, the Amazon Fund approved an average of US$ 53 million/year in finance, which is equivalent to 0.7% of the total tracked for climate finance for land use in the country between 2015 and 2020.

• Rural credit is the main instrument to finance activities aligned with climate objectives for land use, as it channeled almost half of the flows tracked between 2015 and 2020 (US$ 3.2 billion/year). However, climate-aligned flows account for only 8% of the total volume of rural credit in Brazil, whose annual average was US$ 42.2 billion/year in the period under analysis.

• Agricultural risk management instruments, which constitute the main tool for climate adaptation, accounted for US$ 1.1 billion/year in finance aligned with climate objectives. Rural insurance was the most relevant of these instruments, with a channeled total of US$ 625 million/year. Of this amount, US$ 500 million/year came from private funds used to take out insurance policies.

• Thematic bonds, which obtain resources to finance projects with social and environmental impact, raised, on average, US$ 1 billion/year (16%) in climate finance for land use, obtained mostly via issuances by Brazilian companies abroad. Although the volume of funds raised via thematic bonds has almost quadrupled in the period under analysis– from US$ 685 million in 2015 to US$ 1.6 billion in 2020– it still represents only a small portion of fixed-income capital market finance.

• The public budget channeled US$ 767 million/year (11%) of finance aligned with climate objectives and was the main instrument for the implementation of policies for the forest sector (US$ 572 million/year). In that same period, finance from international public sources amounted to US$ 320 million/year geared towards projects in this sector. There was a drop, however, in the amount of finance from the public budget, from US$ 993 million in 2015 to US$ 394 million in 2020.

• The crop sector was the main recipient of climate finance, receiving an average of US$ 3.9 billion/year, which corresponds to 60% of flows in the tracked period. The forest sector received US$ 1.7 billion/year (25%), cattle received US$ 532 million/year (8%), bioenergy and fuels received US$ 311 million/year (5%) and multi-sector received US$ 86 million/year (1%).

• Finance geared towards mitigating climate change amounted to US$ 4.5 billion/year, or 68% of the finance tracked. Finance for climate adaptation totaled US$ 1.2 billion/year (19%), while flows with both mitigation and adaptation objectives stood at US$ 859 million/year (13%).

Landscape of Climate Finance for Land Use

Climate finance for land use in Brazil amounted to an annual average of US$ 6.6 billion for the period between 2015 and 2020. Figure 2 shows that the total finance amount increased from US$ 6.6 billion in 2015 to US$ 7.1 billion in 2020.[2] Given the evolution of the exchange rates, during the analyzed timeframe, this represents a growth of 65% in Brazilian reais. This trend is mainly related to the increase in issuances of thematic bonds – which almost quadrupled in the period, reaching US$ 1.6 billion in 2020 – and rural credit, which channeled US$ 3.2 billion aligned with climate goals in that same year.[3] Furthermore, the establishment of new financial instruments, such as Decarbonization Credit (Crédito de Descarbonização – CBIO), has contributed to Brazil’s efforts to promote climate finance.

Figure 1. Evolution of Climate Finance for Land Use, 2015-2020

Note: The values refer to the average amount of financial flows in Brazilian Real (R$) during the analyzed period, deflated by the IPCA using December 2020 as reference. The values were converted into United States Dollar (US$), according to the average exchange rate for the corresponding year, as provided by the Central Bank of Brazil (Banco Central do Brasil – BCB).

Source: CPI/PUC-RIO with data from SICOR/BCB, SIOP/MPO, MAPA, SES/SUSEP, MMA, BNDES, MME, B3, NINT, OECD-DAC, and IDB, 2023

Figure 2 shows the Landscape of climate finance for land use in Brazil by means of a sankey diagram, which tracks public/private and domestic/international finance flows, sources of finance, disbursement channels, financial instruments, beneficiary sectors, and climate objectives.

Figure 2. Landscape of Climate Finance for Land Use in Brazil, 2015–2020

Note: The values refer to the average amount of financial flows in Brazilian Real (R$) during the analyzed period, deflated by the IPCA using December 2020 as reference. The values were converted into United States Dollar (US$), according to the average exchange rate for the corresponding year, as provided by the Central Bank of Brazil (Banco Central do Brasil – BCB).

Source: CPI/PUC-RIO with data from SICOR/BCB, SIOP/MPO, MAPA, SES/SUSEP, MMA, BNDES, MME, B3, NINT, OECD-DAC, and IDB, 2023

Funding for Climate Finance

Most of the finance aligned with climate objectives came from domestic sources, which channeled US$ 6.3 billion/year (95%) between 2015 and 2020. Two-thirds of domestic finance US$ 4.1 billion/year came from private finance, which is largely explained by the fact that financial institutions in Brazil are obligated to allocate funds to rural credit.[4] Domestic private funding originated primarily from financial institutions (31%), corporations (16%), and rural producers (10%). The main sources of domestic public finance were the federal and state governments (26%) and the Brazilian Development Bank (Banco Nacional de Desenvolvimento Econômico e Social – BNDES) (6%).

International funds accounted for 5% (US$ 327 million/year) of climate finance flows. This international funding originated mostly from public sources: international governments (US$ 136 million/year), climate funds (US$ 125 million/year), and multilateral development banks (US$ 58 million/year). The main sources were the government of Germany (US$ 79 million/year), the Amazon Fund (US$ 53 million/year), the World Bank (US$ 39 million/year), the Green Climate Fund (GCF) (US$ 33 million/year), the Global Environment Facility (GEF) (US$ 32 million/year), and the government of Norway (US$ 20 million/year) – which, together, accounted for approximately 80% of climate-aligned international public funding. To avoid the double counting of financial flows, the source of finance called “international governments” does not include grants from the governments of Germany and Norway to the Amazon Fund.

The Amazon Fund is the main climate fund that channels international funding for land use in Brazil and, as such, is quite relevant in the promotion of conservation and sustainable land use in the country. Despite this, the Amazon Fund approved an average of US$ 53 million/year in project finance, which is equivalent to 0.7% of the total climate finance for land use in the country between 2015 and 2020.

Disbursement Channels

Disbursement channels intermediate climate finance for land use in Brazil and allocate finance to various sectors. Financial institutions were responsible for channeling almost two-thirds (US$ 4.1 billion/year) of finance tracked from 2015 to 2020, most of which came from private sources (US$ 3.1 billion/year), mainly originating from the institutions themselves (US$ 2.0 billion/year). Financial institutions also intermediate finance from public sources, such as federal and state governments (US$ 608 million/year) and BNDES (US$ 386 million/year). Climate finance channeled from corporations accounted for 16% (US$ 1.0 billion/year) and originated mostly from the corporations’ own funds, obtained by means of thematic bonds (US$ 1.0 billion/year).

Disbursements channeled via government agencies amounted to (US$ 1.0 billion/year) (15%) of climate finance, with (US$ 872 million/year) (84%) coming from federal and state government funds. Government agencies also channeled international finance (US$ 162 million/year) from international governments US$ 85 million/year, multilateral development banks (US$ 45 million/year), and climate funds (US$ 31 million/year).

Financial Instruments

Rural credit is the main financial instrument with climate-aligned finance for land use in Brazil, having channeled US$ 3.2 billion/year between 2015 and 2020, equivalent to 48% of all flows tracked in the same period. Approximately two-thirds (US$ 2 billion/year) of finance were sourced from the financial institutions that operate them. However, the total volume of rural credit in the country in the period under analysis was US$ 42.2 billion/year, meaning that the portion of rural credit aligned with climate objectives corresponded to only 8% of the total volume, in accordance with the criteria established in this work.[5]

Agricultural risk management instruments, which constitute the main tool for climate adaptation, accounted for US$ 1.0 billion/year in finance aligned with climate objectives between 2015 and 2020. The most relevant of these instruments was rural insurance, which directed US$ 625 million/year in climate finance for agricultural risk management. Rural insurance relied on private finance expressed in the amount paid by producers to take out the insurance policies (US$ 500 million/year and), in the case of subsidized premiums, it also relied on public finance from the Rural Insurance Premium Subsidy Program (Programa de Subvenção ao Prêmio de Seguro Rural – PSR), in the amount of US$ 124 million/year.

Thematic bonds, which obtain resources to finance projects that have social and environmental impact, captured US$ 1.0 billion/year (16%) in climate finance for land use, corresponding to only a small portion of traditional capital market finance. These securities were issued following voluntary guidelines and standards, such as the Green Bond Principles (GBP), and include global notes (US$ 686 million/year), bonds (US$ 100 million/year), Eurobonds (US$ 114 million/year), Agribusiness Receivables Certificates (Certificado de Recebíveis do Agronegócio – CRA) (US$ 85 million/year), debentures (US$ 22 million/year), and promissory notes (US$ 0.4 million/year).

The public budget channeled US$ 767 million/year (11%) in climate-aligned finance and constituted the main financial instrument for the implementation of policies aimed at the forest sector (US$ 572 million/year). Among the activities financed for this sector, the public budget disbursed US$ 22 million/year for actions to prevent and control deforestation and fires, and US$ 16 million/year for environmental and land regularization policies and territorial planning.

Public international finance (US$ 320 million/year) were mainly channeled via grants (US$ 216 million/year) and were mostly earmarked for the forest sector (US$ 221 million/year).

Sectors

The crop sector received, on average, US$ 3.9 billion/year in climate finance, which corresponds to 60% of the flows tracked from 2015 to 2020. This is explained by the prevalence of rural credit as the main financial instrument for climate-aligned finance. The forest sector received US$ 1.7 billion/year (25%); the cattle sector received US$ 532 million/year (8%); bioenergy and fuels received US$ 311 million/year (5%); and multi-sector received US$ 86 million/year (1%).

Climate Objectives

Finance aimed towards mitigation activities amounted to US$ 4.5 billion/year, i.e., 68% of climate finance for land use in the period from 2015 to 2020. Adaptation activities amounted to US$ 1.2 billion/year (19%). Furthermore, flows targeting both mitigation and adaptation accounted for US$ 859 million/year (13%). The high share of finance directed towards mitigation is in line with the GHG reduction commitments set in Brazil’s NDC, given that most of the country’s emissions come from changes in land use and agriculture.

In some rural credit lines and development and international cooperation projects, it is possible to identify the beneficiaries of the finance and ascertain whether they are small, medium or large rural producers, producer cooperatives, corporations, indigenous peoples, quilombolas, or other traditional communities. But this is not possible for most climate finance tracked in this report. Furthermore, a portion of the flows accounts for the provision of a public good, having been allocated to activities such as forest conservation. However, for climate finance to support the transition more effectively to low-carbon land use in Brazil, the design and information about finance will need to be improved in order to increase transparency about who the beneficiaries are and their locations.

Methodology

This report develops a methodology to quantify and compare financial flows for land use and their use for climate mitigation and adaptation objectives. The approach is based on CPI’s international experience for over a decade in tracking climate finance globally, as well as in specific countries and sectors, within the Global Landscape of Climate Finance (Buchner et al. 2021).

This work adapts the Global Landscape’s methodological criteria to reflect Brazil’s climate context– including, for example, finance for the protection of the rights of indigenous and traditional peoples, land use policies such as combating deforestation and land tenure regularization, production management, and infrastructure on rural properties and agroindustry activities. This work draws on four main sources of information to incorporate criteria relevant to land use in Brazil:

1. CPI Global – Activities pertaining to agriculture and forest aligned with climate goals (Rosenberg et al. 2018; Chiriac, Naran and Falconer 2020; Buchner et al. 2021).

2. Public Consultation No. 82 of 2021 by the Central Bank of Brazil (Banco Central do Brasil – BCB) – Sustainability criteria applicable to the granting of rural credit (BCB 2021).[6]

3. CPI/PUC-Rio – Institutional analysis of government policies and actions for the conservation and restoration of forest and for the development of sustainable agriculture that contribute to achieving the climate targets in Brazil’s Nationally Determined Contribution (NDC) (Antonaccio et al. 2018).

4. Rio Markers for Climate Change of the Development Assistance Committee – Organization for Economic Co-operation and Development (DAC/OECD) – Finance flows aligned with UNFCCC objectives (OECD 2018).

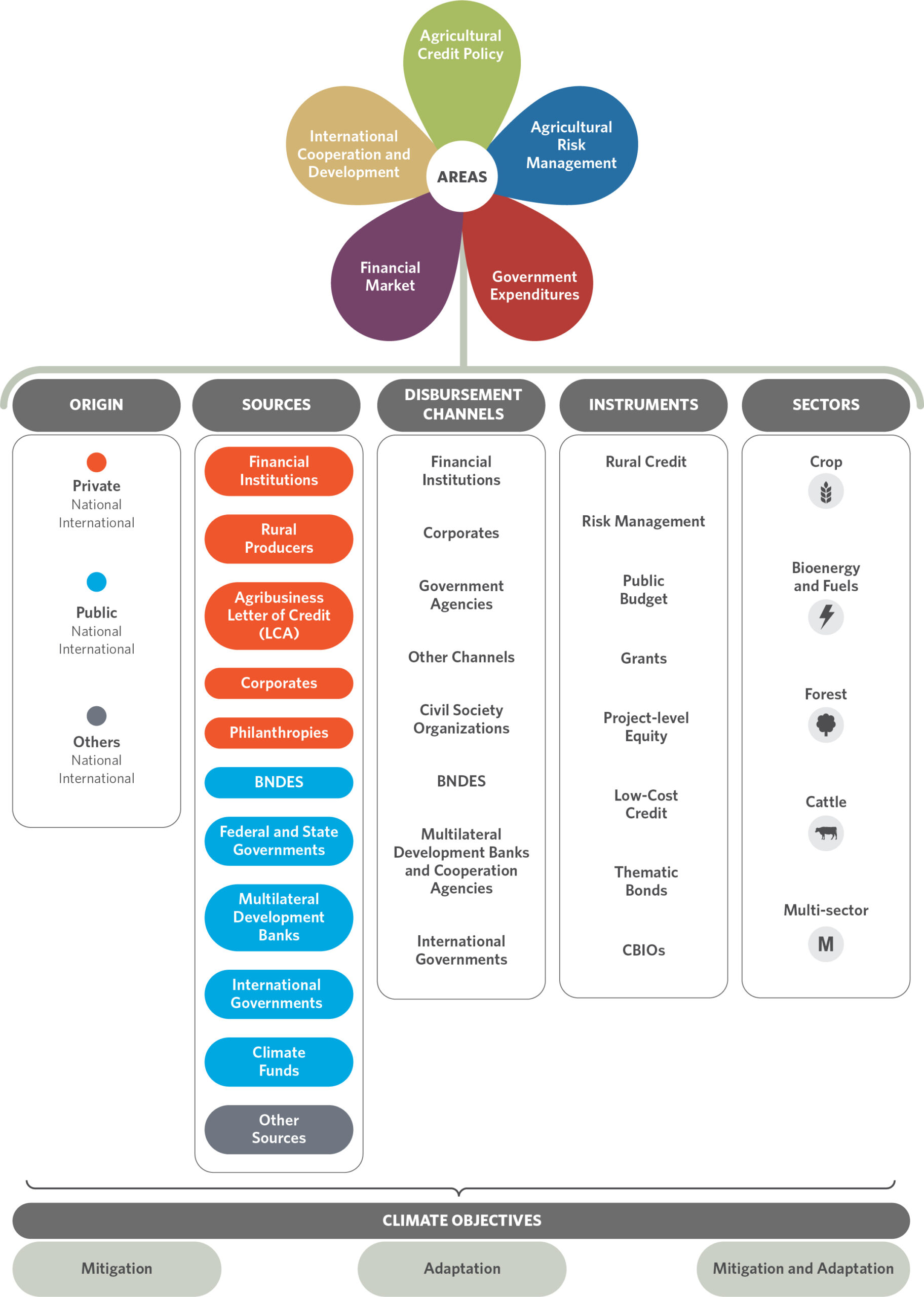

Appendix I shows a detailed list of the criteria used to define which financial flows are aligned with climate objectives. The criteria are divided by:

Climate objective: (i) mitigation; (ii) adaptation; (iii) mitigation and adaptation.

Area: (i) Agricultural credit policy; (ii) Agricultural risk management; (iii) Government expenditures; (iv) Financial market; (v) International cooperation and development.

Sectors: (i) crop; (ii) forest; (iii) cattle; (iv) bioenergy and fuels; (v) multi-sector.

Appendix II describes the five areas relevant for climate finance in Brazil; it also specifies the databases used for each of them. An important methodological measures were to avoid double counting financial flows.

Public and private finance sources, both domestic and international, were tracked for the period of 2015 to 2020. Financial flows were updated via indexation to the Extended National Consumer Price Index (Índice Nacional de Preços ao Consumidor Amplo – IPCA) using December 2020 as a reference. For finance originally granted in foreign currencies –such as US dollar or Euro – the amounts were converted into Brazilian Real (R$) according to the average exchange rate for the year corresponding to the flow in question, as provided by the Central Bank of Brazil, and then subsequently updated via indexation to the IPCA.

This report provides a broad view of climate-aligned finance for land use activities. However, the list of climate finance flows is not exhaustive. Indeed, the methodology for measuring climate finance and its composition are constantly evolving (Meattle et al. 2022).

Transparency about the use of climate-aligned public and private finance needs to be improved. This issue is particularly critical for private finance that is not guided by public policy. In the context of strengthening the Environmental, Social and Governance (ESG) agenda, improving disclosure requirements is necessary to better understand project implementation and operation. Clearer disclosure regulations and standards will allow for more accurate estimates of private finance aligned with climate objectives.

Figure 3 presents the Climate Finance Ecosystem for the land use sector in Brazil, which organizes financial flows into five areas: agricultural credit policy; agricultural risk management; government expenditures; financial markets; and international cooperation and development (described in Appendix II). The Ecosystem structures the relationship between the various types of actors involved and characterizes climate-aligned financial flows. Analysis of the databases related to the five areas of climate finance made it possible to extract information to characterize the flows in terms of: origin of finance, sources of finance, disbursement channels, instruments, sectors, and climate objectives. The definitions of each of the categories and subcategories in this figure can be found in Appendix III.

Figure 3. Climate Finance Ecosystem for Land Use in Brazil

Source: CPI/PUC-Rio, 2023

The authors would like to thank Juliano Assunção, Luiza Antonaccio and Mariana Stussi for their comments and suggestions, Natalie Hoover El Rashidi, Giovanna de Miranda, Camila Calado, Rogério Reis de Mello Filho and Letícia Miranda for the editing and revision of the text and Meyrele Nascimento for formatting and graphic design.

[1] The values refer to the average amount of financial flows in Brazilian Real (R$) during the analyzed period, deflated by the IPCA using December 2020 as reference. The values were converted into United States Dollar (US$), according to the average exchange rate for the corresponding year, as provided by the Central Bank of Brazil (Banco Central do Brasil – BCB).

[2] The total amount tracked in Brazilian reais corresponded to 22.1 billion in 2015 and 36.5 billion in 2020.

[3] Detailed definitions of thematic bonds, rural credit, and other financial instruments can be found in Appendix III.

[4] Public policy in Brazil directs finance from financial institutions to rural credit. Financial institutions are required to allocate the equivalent of 30% of all bank deposits in checking accounts to rural credit operations through Compulsory Resources. Additionally, 65% of rural savings accounts (Poupança Rural, a form of savings account in certain public banks and cooperatives) funds must be directed to rural credit.

[5] The trade purpose was excluded from the calculation of the total value of total rural credit granted in the period. This purpose was not considered because it can be used to finance the purchase of products by means of the Minimum Price Guarantee Policy (Política de Garantia de Preços Mínimos – PGPM) or for refinance, as in the cases of Rural Duplicate (Duplicata Rural – DR) and Rural Promissory Note (Nota Promissória Rural – NPR) discounts. The annual average of rural credit granted for all purposes – funding, investment, industrialization and trade – was US$ 49.4 billion in 2020 prices.

[6] Although not listed in BCB Public Consultation No. 82, all lines in the following initiatives were deemed to be climate-aligned: the National Program for Low-carbon emissions in Agriculture (Programa para Redução da Emissão de Gases de Efeito Estufa na Agricultura – ABC+ Program), the National Plan for Family Farming under the ABC (Programa Nacional de Fortalecimento da Agricultura Familiar no âmbito do ABC – Pronaf ABC+) and the Constitutional Financing Fund of the North under the ABC (Fundo Constitucional de Financiamento do Norte – FNO-ABC).