Landscape of Climate Finance for Land Use in Brazil 2021–2023

Sections

In Brazil, activities related to land use play a central role in decarbonizing the economy, as agriculture and deforestation together account for three-quarters of the country’s greenhouse gas (GHG) emissions (SEEG 2023). At the same time, the sector has great potential to lead climate solutions, being largely responsible for removing GHGs from the atmosphere.

It is, therefore, necessary to mobilize resources and develop finance strategies that promote the transition to low-carbon, regenerative agriculture—through the adoption of practices such as integrated crop-livestock-forest systems, no-till farming, and crop rotation—combat deforestation and the degradation of native vegetation, support forest restoration and increase climate resilience.

With the aim of identifying climate finance for land use in Brazil, researchers from Climate Policy Initiative/Pontifical Catholic University of Rio de Janeiro (CPI/PUC-Rio) quantify the financial flows directed toward agriculture and forests between 2021 and 2023 that are aligned with climate objectives. The work identifies the origin and source of these resources, the disbursement channels and financial instruments used, which sectors are benefiting, and the climate use. Finally, the report identifies opportunities for climate finance for the land use sector in Brazil.

This document is the second edition of the report, the first having been published in 2023, covering the period from 2015 to 2020. The information in this study allows for the continuous monitoring of the status of climate finance for land use in Brazil, serving as a guide to direct efforts and available resources. From the detailed analysis of the data, it is possible to identify five trends over the period tracked (2021-2023):

WHAT IS CLIMATE FINANCE?

Climate finance refers to capital flows that have direct or indirect effects on GHG mitigation or generate adaptation to climate change. Flows can also be directed towards activities with dual benefits when they contribute to both mitigation and adaptation. According to the United Nations Framework Convention on Climate Change (UNFCCC), climate finance resources can originate locally, nationally, or transnationally and come from public, private, or alternative sources (UNFCCC nd).

WHAT IS LAND USE?

This work maps climate finance for land use, which includes:

Agriculture: Agricultural production, from the primary sector to activities in the secondary sector of this value chain, such as agro-industry. This category also includes infrastructure on rural properties, the purchase and production of inputs, rural extension activities, and financial services. It also covers measures for energy efficiency in agro-industry and the generation of renewable energy from sugar cane or agricultural waste, such as the production of biofuels. Finally, it includes policy planning and management, as well as research and development for agriculture.

Forests: Conservation, restoration, and reforestation activities, as well as economic exploitation, such as planted forests. This category also includes policies to combat deforestation, environmental and land regularization, territorial planning, and protection and support for indigenous peoples.

Multisectoral: Policies and projects aimed at reducing vulnerability to climate change, including monitoring and surveillance systems for meteorology, natural disaster alerts, and risk management for hydrological and geological events, among others. For more details, see the list of climate-aligned activities in Appendix I and the definition of sectors in Appendix III.

1

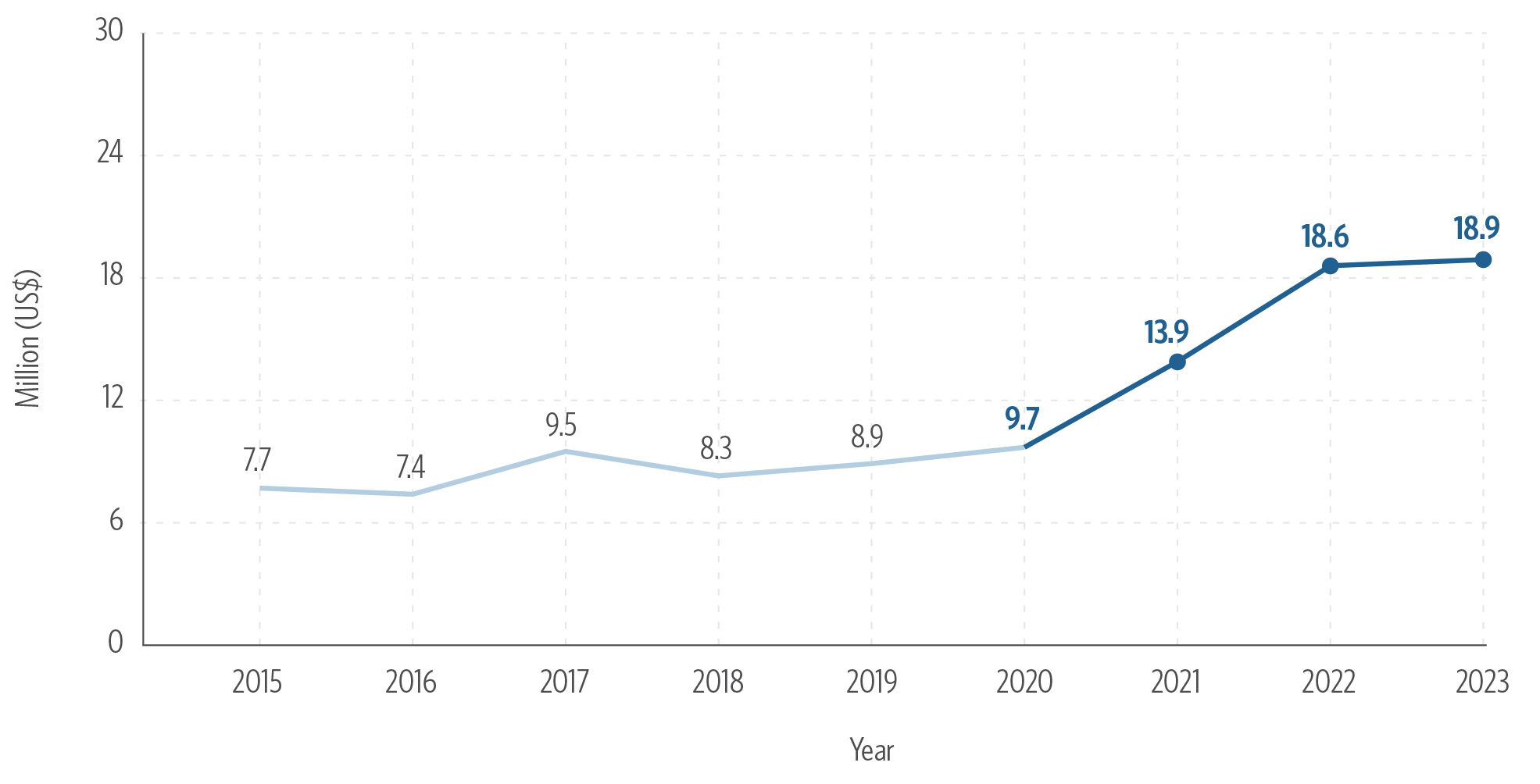

There has been a significant increase in climate finance for land use in the country, from an average of US$ 8.6 billion per year between 2015 and 2020 to an annual average of US$ 17.1 billion between 2021 and 2023. The report notes that part of this increase is due to the self-declared registration of sustainable practices, a requirement for obtaining better credit conditions. This indicates increasing recognition of the importance of the climate agenda in Brazil, particularly as a result of efforts to improve agricultural policy instruments, incorporate socio-environmental requirements, and monitor rural credit operations.

2

One trend that remains relevant is that domestic finance continues to be the driving force behind the climate agenda in the land use sector, accounting for 97% of tracked resources. This suggests that, despite the change of government and the adoption of a policy committed to the environment and climate, attracting significant volumes of international resources for climate finance in the land use sector in Brazil is no simple task and will require greater clarity and ambition regarding the guidelines and targets adopted.

3

A significant portion of climate finance comes from private resources directed by public policies, such as the Agricultural Plan (Plano Safra) and the National Policy for Biofuels (Política Nacional de Biocombustíveis – RENOVABIO). Capital market instruments also play an important role in channeling private resources, but they are mainly used to finance consolidated sectors in Brazil, such as biofuels, bioenergy, and planted forests. One point of note, however, is the move away from thematic bonds in the land use sector over the last three-year period tracked.

4

The native forest sector depends mostly on resources from the federal public budget, supplemented by flows from international sources. Government spending, which had been on a downward trend since 2016, picked up between 2021 and 2023, reaching pre-Bolsonaro government levels. On the other hand, the administrative budgets of key agencies for environmental preservation, combating deforestation and fires, and protecting indigenous peoples, such as the Brazilian Institute of Environment and Renewable Natural Resources (Instituto Brasileiro do Meio Ambiente e dos Recursos Naturais – IBAMA), the Chico Mendes Institute for Biodiversity Conservation (Instituto Chico Mendes de Conservação da Biodiversidade – ICMBIO), the Brazilian Indigenous Peoples Foundation (Fundação Nacional dos Povos Indígenas – FUNAI) and the direct administration of the Ministry of the Environment and Climate Change (Ministério do Meio Ambiente e Mudança do Clima – MMA), remained stagnant.

5

Loss and damage flows, which aim to address the impacts of adverse weather events, grew significantly between 2021 and 2023 due to compensation paid by the federal government via programs such as the Agricultural Activity Guarantee Program (Programa de Garantia da Atividade Agropecuária – PROAGRO) and the Crop Guarantee Fund (Fundo Garantia Safra). In a context in which rural producers are increasingly impacted by extreme weather events and agriculture losses are expected to worsen due to droughts, floods, and fires, it is essential that the Brazilian Agricultural Plan improves risk management policies in agriculture.

Main results

Landscape of Climate Finance for Land Use

Climate finance for land use in Brazil had an annual average of US$ 17.1 billion for the period between 2021 and 2023. Figure 1 shows that there has been a significant increase of 99% in the flows identified compared to the average of US$ 8.6 billion per year in the previous period analyzed. The growth in tracked climate finance represents both the greater mobilization of resources for the agenda and the reclassification of flows as sustainable. The introduction of more favorable credit conditions for practices aligned with climate objectives encouraged the declaration of sustainable practices, without this necessarily representing the adoption of new practices. This reclassification is partly responsible for the growth shown in Figure 1.

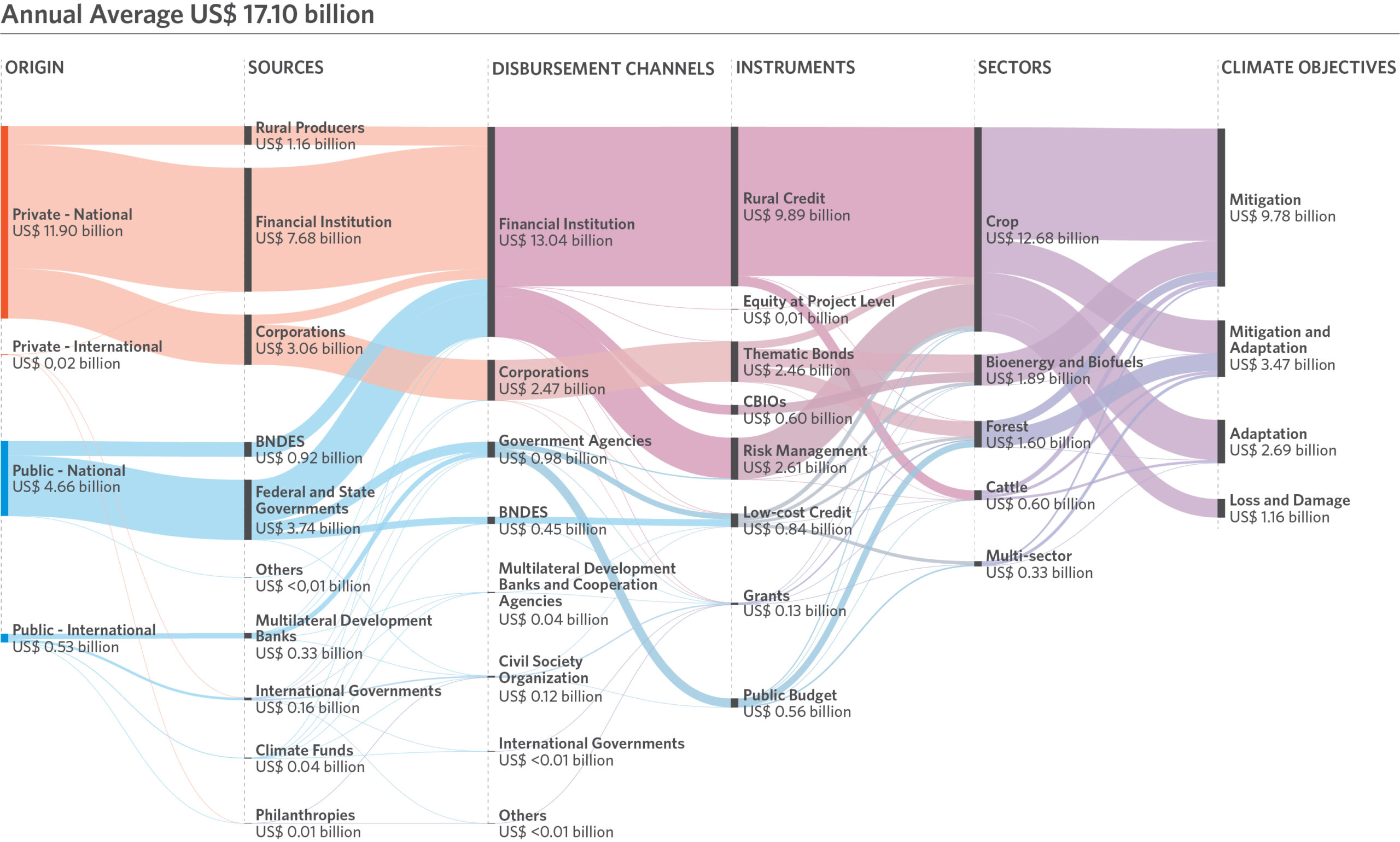

Figure 2 shows the Landscape of Climate Finance for Land Use in Brazil through a Sankey diagram, illustrating the flows of public/private and domestic/international resources, as well as their sources, disbursement channels, and financial instruments. It also shows the sectors benefiting from these flows, and the climate use.

Figure 1. Evolution of climate finance for land use, 2015–2023

Note: The figures refer to the annual average, adjusted based on the IPCA, with reference to December 2023.

Source: CPI/PUC-RIO with data from SICOR/BCB (2023), SIOP/MPO (2023), MAPA (2023), SES/SUSEP (2023), MMA (2023), BNDES (2023), MME (2023), B3 (2023), NINT (2023), OECD-DAC (2022), IDB (2023), IBRD (2023), KfW (2023), GEF (2023), NORAD (2023), German Federal Ministry for Economic Cooperation and Development (2023), 2024

Figure 2. Landscape of Climate Finance for Land Use in Brazil, 2021-2023

Note: The figures refer to the annual average, adjusted based on the IPCA, with reference to December 2023.

Source: CPI/PUC-Rio with data from SICOR/BCB (2023), SIOP/MPO (2023), MAPA (2023), SES/SUSEP (2023), MMA (2023), BNDES (2023), MME (2023), B3 (2023), NINT (2023), OCDE-DAC (2022), BID (2023), BIRD (2023), KfW (2023), GEF (2023), NORAD (2023), Ministério Federal de Cooperação e Desenvolvimento Econômico da Alemanha (2023), 2024

Resources for Land Use Climate Finance

Domestic sources contributed to the majority of the climate-aligned land use finance, accounting for US$ 16.6 billion per year, 97% of the total tracked. The private sector provided 72% of domestic finance (US$ 11.9 billion per year), largely thanks to public policies that mobilized private flows, such as rural credit and CBIOs, to land use investments. The main sources of domestic private resources were financial institutions (46%, or US$ 7.7billion per year), corporations (18%, or US$ 3.1 billion per year), and rural producers with (7%, US$ 1.2 billion per year). The main domestic public actors tracked were the federal government (23%, or US$ 3.7 billion per year) and the BNDES (6%, or US$ 0.9 billion per year).

International sources mobilized US$ 551 million per year, representing 3% of the flows tracked, with 96% of this, equivalent to US$ 530 million per year, coming from public sources. Multilateral development banks were the main financiers of the climate agenda in land use in Brazil for the period, with 60% of international flows (US$ 331 million per year), with the Inter-American Development Bank (IADB) accounting for 33% (US$ 183 million per year) and the World Bank for 27% (US$ 148 million per year). International governments accounted for 29% of these flows, with Germany standing out with 14% (US$ 74 million per year) and Norway with 8% (US$ 44 million per year), especially in the forestry sector.

Disbursement Channels

Disbursement channels are the institutions responsible for intermediating climate finance and allocating resources to different sectors. Financial institutions were responsible for 76% of total flows (US$ 13.0 billion per year), channeling both private national resources (72%, or US$ 9.4 billion per year) and public ones (28%, US$ 3.6 billion per year). Corporations channeled 14% of tracked resources (US$ 2.5 billion per year), coming almost exclusively from thematic bonds.

Government agencies channeled US$ 1.0 billion per year (6%), 64% of which came from the federal budget (US$ 625 million) and 36% from multilateral development banks, international governments and climate funds (US$ 351 million). The BNDES channeled US$ 451 million per year (3%) through direct and indirect finance from its portfolio.

Financial Instruments

Rural credit was the main instrument for financing activities aligned with climate objectives for land use in the country, accounting for US$ 9.9 billion per year between 2021 and 2023, which corresponds to 58% of the total tracked. Financial institutions were responsible for 78% of these resources, directed by the Agricultural Plan.

Agriculture risk management instruments mobilized US$ 2.6 billion (15%) through the PROAGRO, PSR, and Crop Guarantee Fund programs. These were mainly responsible for climate adaptation flows, with US$ 1.4 billion per year, 54% of the adaptation flows tracked in the period, and for all the spending on losses and damages tracked. The PSR accounted for the largest share of adaptation finance, with US$ 1.1 billion per year in climate flows.

Thematic bonds, capital market instruments aimed at obtaining resources to promote investments with social and environmental benefits, raised US$ 2.5 billion per year (14%) in climate finance for land use. These funds went mainly to bioenergy and biofuels (US$ 1.1 billion, or 44%), and forestry (US$ 0.9 billion, or 37%), concentrated in planted forests.

Low-cost credit, facilitated by development institutions and international agents, mobilized US$ 842 billion per year (5%). The main player in this agenda is the BNDES, providing US$ 426 billion per year, which in this three-year period concentrated its activities in the areas of bioenergy, biofuels, and forests. Among the international players, multilateral development banks mobilized US$ 328 million per year (39%), while international governments mobilized US$ 76 million per year (10%).

CBIOs, the main instrument implemented by the RENOVABIO, mobilized US$ 600 million per year (3%). Since 2019, the program has financed efforts that have avoided emissions of 109 million tonnes of CO2 equivalent.

The federal public budget has mobilized US$ 560 million per year, with growth of 48% between 2021 and 2023. The forestry sector is the main recipient of these resources, with US$ 400 million per year (71%), through the work of strategic bodies for the maintenance of Brazil’s native forests such as the MMA, IBAMA, ICMBIO, FUNAI, and the Brazilian Forest Service (Serviço Florestal Brasileiro – SFB).

Sectors

The sector that received the most climate finance resources was crops, totalling US$ 12.7 billion per year, or 74% of the total tracked. The prominence of rural credit and agriculture risk management accounts for the volume of resources directed to this sector. Bioenergy and biofuels received US$ 1.9 billion per year in climate finance (11%), leveraged by thematic bonds (58%) and CBIOs (32%).

The forestry sector received a total of US$ 1.6 billion per year, representing 9% of flows, half of the amount that was tracked between 2015 and 2020. The native forest sector received US$ 598 million per year, with 70% (US$ 420 million per year) channeled by the federal government through the public budget, and a further 15% (US$ 91 million) from international governments. Planted forests received US$ 1.0 billion per year, mobilized through thematic bonds (US$ 851 million) and low-cost credit from the BNDES (US$ 128 million).

Climate Use

Flows for climate mitigation accounted for most of the tracked resources, at US$ 9.8 billion per year (57%). Dual objective finance—going to projects that include both mitigation and adaptation objectives—totaled US$ 3.5 billion per year (20%). Resources earmarked exclusively for climate adaptation amounted to US$ 2.7 billion per year (16%), with the agriculture risk management sector accounting for 64% of these flows. Finally, spending on climate losses and damages totaled US$ 1.2 billion per year (7%), with growth of 386% between 2021 (US$ 0.2 billion) and 2023 (US$ 2.0 billion).