India has ambitious renewable energy targets of 175GW by 2022.

In 2014, the Government of India embarked on an ambitious plan to increase the share of renewable energy in the country’s energy mix, setting targets to achieve 175 GW of installed renewable energy capacity by 2022. This includes 100 GW of solar power, 60 GW of wind power, 10 GW of waste-to-energy power and 5 GW of small hydropower by 2022. This is a significant increase from existing capacities of 3.5 GW, 23 GW, 4.4 GW and 4.2 GW, respectively (MNRE, November 2015).

In order to meet this target of 175 GW by 2022, the renewable energy sector in India will require $189 billion in additional investment.

The USD $189 billion requirement includes $57 billion in equity, and $132 billion in debt. We estimated this using capital expenditure forecasting for renewable energy projects (including solar power, onshore wind power, small hydropower, and waste-to-energy power) between 2016 and 2022.

The potential amount of investment in the renewable energy sector in India is more than double the investment required. However, the amount of investment expected falls short of the investment required, by 29% for equity and 27% for debt.

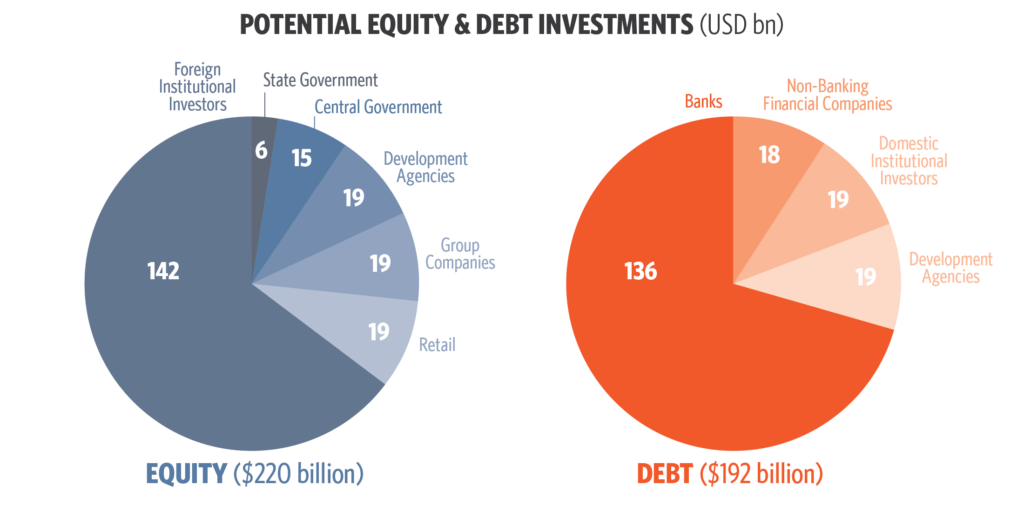

The potential for investment up to 2022 is $411 billion. The investment potential for equity is $220 billion – four times the equity investment required – and the investment potential for debt is $191 billion – 45% more than required. This indicates that more than sufficient investment potential is available for financing the renewable energy targets by 2022.

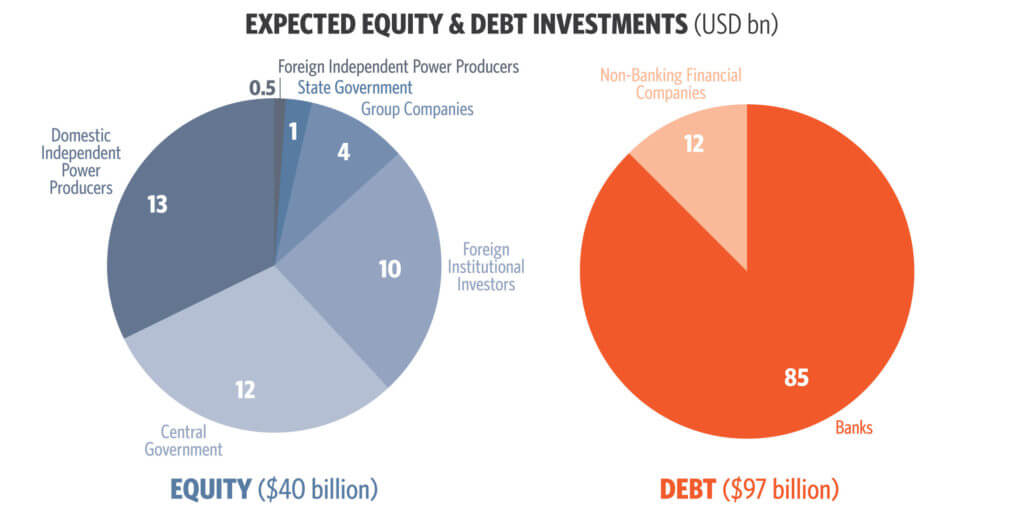

In a best case scenario, the amount of expected investment in debt financing is $126 billion, which falls short of the debt investment requirement by 5% (about $6 billion). On the equity side, the expected investment is $40 billion, which falls short of the equity investment requirement by 29% ($17 billion).

However, because banks are burdened with stressed loans (The Economic Times, 2016) and are overexposed to the infrastructure sector, their ability to finance renewable energy project debt may reduce to 64% in a realistic scenario. This will cause a shortfall of 27% ($36 billion) of the debt financing amount required.

Foreign and domestic institutional investors have the highest potential to bridge this financing gap between expected and required investments, for equity and debt financing, respectively.

Though the equity capital from foreign institutional investors comes at a slightly higher cost compared to the cost of capital from other sources, these investors have the highest unutilised potential for equity financing. In fact, these investors have the ability to meet 100% of the equity financing gap.

On the other hand, the cost of capital for domestic institutional investors is the most cost-effective amongst the investors providing the project debt for renewable energy projects in India. Domestic institutional investors have the ability to meet a large fraction – 54% – of the debt financing gap.

However, institutional investors have little exposure to the renewable energy sector in India, and because they are risk-averse, they have been reluctant to invest. There is a need to increase institutional investors’ understanding of and familiarity with the renewable energy sector in India as a viable investment option.

One potentially significant solution for this is to develop a business case which would demonstrate the benefits of institutional investment in renewable energy in India and would provide institutional investors with the information required to help them make informed investment decisions in renewable energy in India. The business case would include designing appropriate asset allocation models for institutional investors that indicate that investments in renewable energy in India are a good match with their preferred risk-return profiles. This is an area of future work for CPI.

Institutional investment in the renewable energy sector in India also remains seriously constrained by several specific policy and financial barriers.

Both foreign and domestic institutional investors are facing significant barriers to investment in renewable energy. The key risks facing foreign institutional investors are (in priority order): off-taker risk, lack of transmission evacuation infrastructure, currency risk, regulatory risks, and a mismatch in return expectations. The key risks for domestic institutional investors are (in priority order): a lack of intermediaries, lack of liquid instruments to invest in renewable energy, and low credit rating of operational assets; however, once these issues are resolved, land acquisition issues and regulatory risks are likely to become significant.

There are financial instruments and policy solutions which can address the barriers to institutional investment and drive more investment to fill the financing gap for meeting the targets.

The financial instrument solutions which have the highest potential to mitigate the above risks cost-effectively include a payment security mechanism to address off-taker risk, a foreign exchange hedging mechanism to address currency risk, and infrastructure debt funds and partial credit guarantees to enhance the credit rating of projects. Policy solutions include building adequate transmission capacity, creating consistent policy and regulatory provisions between central and state levels, and facilitating easier land acquisition, and helping create intermediaries to increase access to finance.