India has set an ambitious renewable energy target of 175 GW by 2022, including 100GW of solar power. Of that, the government aims for 60 GW to be utility-scale solar, and the rest to be rooftop solar. Though India has made significant progress on the 60 GW utility-scale solar target, getting to the 40 GW rooftop solar target will be a significant undertaking. As of December 2016, installed capacity of rooftop solar was only ~1.25 GW, which means that ~6 GW would need to be installed every year to reach the 40 GW target by 2022. Filling this gap between the current installment and the 40 GW goal will require an estimated USD 39 billion (INR 3 trillion).

This paper—produced in collaboration between Climate Policy Initiative (CPI), Stockholm Environment Institute (SEI), and Indian Council for Research on International Economic Relations (ICRIER), and funded by the Swedish Energy Agency as part of its support for the New Climate Economy project—proposes the use of municipal bonds to support the scale-up of rooftop solar in India, and details how such bonds could be designed and implemented.

The adoption of rooftop solar is primarily driven by expected savings in electricity costs, the need for an alternative source of electricity, and the desire to mitigate climate change risk. However, three key barriers hinder the growth of this technology in India: high upfront capital expenditure, perceived performance risk, and limited access to debt capital. To address the first two issues, CPI has previously advocated for a third-party financing model.

However, the third-party financing model has had limited success due to inadequate availability of debt capital for project developers. This lack of availability is driven by various factors, including: limited avenues of raising debt capital, already stressed commercial banks in India, concerns on the credit quality of the developer, limited long-term capital opportunities for Indian financial institutions with regard to rooftop solar, and small ticket size of investments leading to high transaction costs.

Municipal financing, via issuance of municipal bonds, has the potential to increase debt availability for rooftop solar project developers and lower rooftop solar costs up to 12%.

In the proposed model, which we are calling “solar municipal bond model” (SMB), a municipal entity would play the role of a finance aggregator for renewable energy project developers. Funds available through a municipal bond would be disbursed to project developers via a Public Private Partnership (PPP) approach, similar to the Design-Build-Finance and Operate (DBFO) model with the financing activity taken care by municipal corporation or corporate municipal entity (CME). By aggregating projects, this model would allow a project developer to access the debt capital markets otherwise difficult to access.

Municipalities have several market advantages in their potential role as finance aggregators for rooftop solar:

-

Institutional goals and mandates. Municipalities have target-based responsibilities to increase renewable energy deployment under the Solar City Program, so they have a built-in incentive to increase rooftop solar.

-

Access to debt capital markets. Compared to rooftop solar developers, municipalities are in a better position to access the debt capital market due to their larger balance sheets.

-

Superior credit profiles. More than half of the rated municipalities – 94 in total – are investment grade (i.e. BBB- or above); whereas almost all rooftop developers are below investment grade. The better credit profile of municipalities compared with project developers can help in raising debt capital at lower costs.

-

Access to public guarantees. Compared to private project developers, municipalities (as public entities) have relatively better access to public guarantees that are typically required to achieve the risk-reduction necessary to attract institutional investment.

-

Diverse revenue sources. Municipalities have multiple sources of revenues (e.g. property taxes), which can provide additional security to investors.

-

Good consumer engagement. Given municipalities’ relatively good proximity with the consumers, the government can quickly facilitate rooftop solar project aggregation.

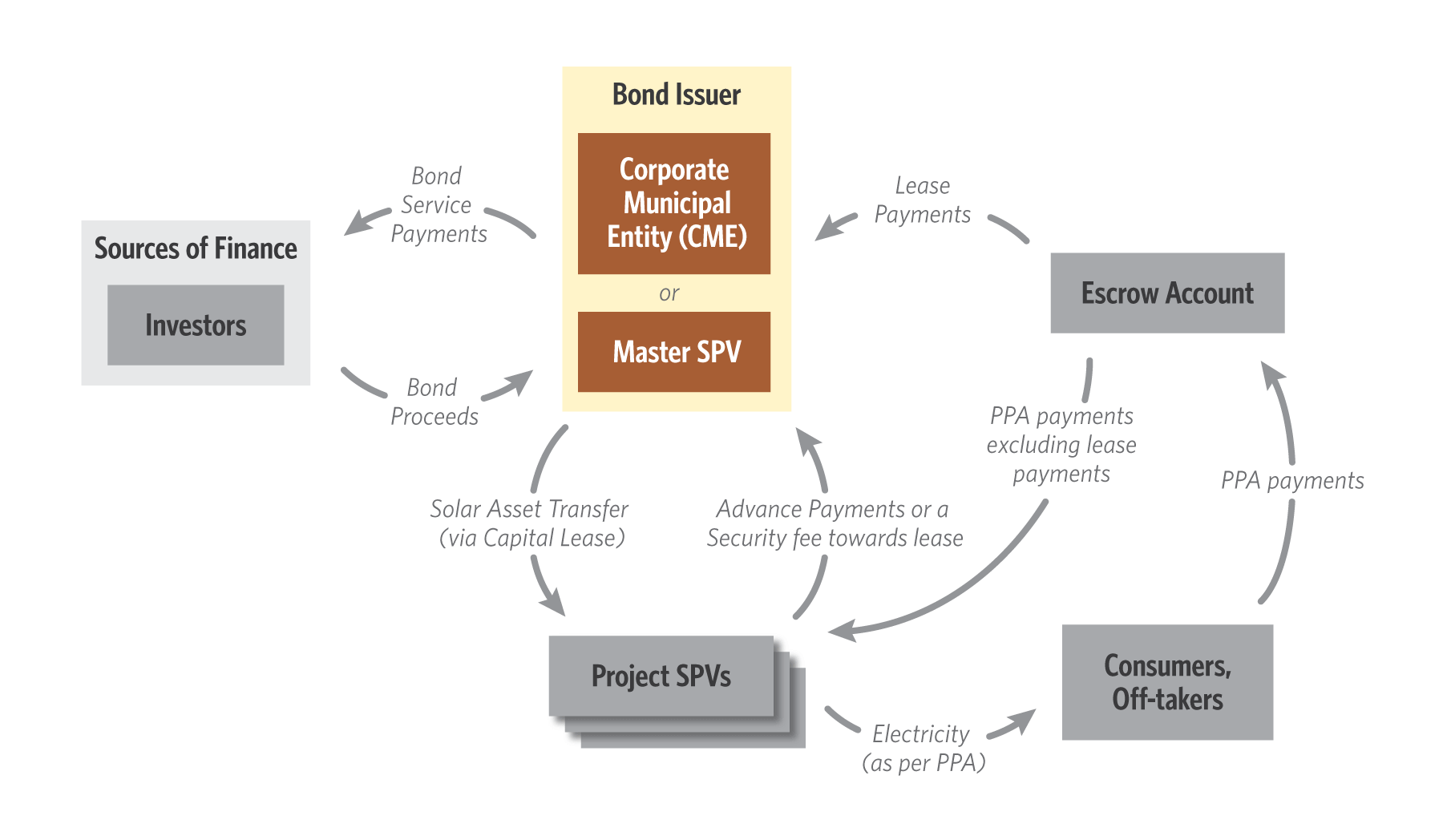

Innovative transaction structures would be required to facilitate the role of municipalities as finance aggregators. A particularly attractive structure (Figure ES-1) is where a municipality-owned master special purpose vehicle (SPV) or a corporate municipal entity (CME) would raise the bonds and disburse the proceeds of these bonds to SPVs owned by project developers via capital lease arrangements. In our paper, we also provide a detailed roadmap for municipalities to deploy the proposed model.

Transaction Structure to raise Municipal Bond for Rooftop Solar Financing

The SMB model shows considerable promise based on its application to Surat and New Delhi. For Surat and New Delhi, rooftop solar potential is 727 MW with a capital requirement of INR 38.5 billion and 110 MW with a capital requirement of INR 6 billion respectively. By reducing the cost of rooftop solar by up to 12%, a municipal bond would not only make rooftop solar competitive with existing tariffs, but also provide the much needed additional debt capital.

Apart from reduction in the cost of financing, a solar municipal bond also has the potential to mobilize the significant untapped investment into the rooftop solar sector, for example, from domestic institutional investors, which, according to a previous CPI study has an untapped investment potential of USD 56 billion in debt for renewable energy. Issuing municipal bond for solar will also help in building municipalities’ capacity to access the debt capital markets, and utilize an innovative transaction structure for other projects.

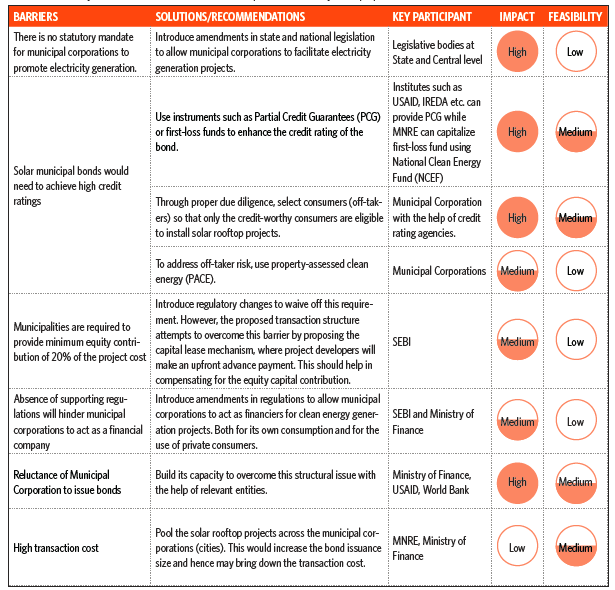

Despite its promise, implementation barriers remain, which are described below in the order of how critical they are:

-

There is no statutory mandate for municipal corporations to promote electricity generation: The municipal functions listed under the 12th Schedule of the 74th Constitutional Amendment do not include power generation. Though Municipal Corporations would play limited roles as financiers in the proposed model, this may prove to be the most significant barrier.

-

Solar municipal bonds would need to achieve high credit ratings: India’s debt capital market is relatively shallow, as it fails to attract enough investors if the credit rating of the bond is below AA or A+. Hence, high credit ratings of the municipal bonds would be critical to the success of the model.

-

Municipalities are required to provide minimum equity contribution of 20% of the project cost: According to Section 12 (5) of SEBI’s Regulations, municipalities would need to provide 20% of project costs as equity. Since most municipalities are struggling to meet the investment demand for basic infrastructure services, this regulation will be hard to meet.

-

Absence of supporting regulations will hinder municipal corporations to act as a financial company: In the proposed transaction structure, proceeds of the bond would be disbursed to projects via capital lease arrangements. Since capital leases are mostly executed by financial entities, in the absence of any specific regulation, municipalities might be reluctant to act as the finance aggregators.

-

Reluctance of Municipal Corporation to issue bonds: Successful issuance of municipal bond warrants transparency and due diligence in project management and accounting practices of municipal corporations. Many municipal corporations have serious shortcomings on these fronts and have to revamp their current practices before bond issuances.

-

High transaction cost: One potential downside of the proposed model is that transaction costs could be higher than either self-ownership or third party financing models, mainly due to the novelty of the approach.

This paper, therefore, recommends several focused interventions to address these barriers. Table ES-2 focuses on solutions/recommendations for the most critical barriers, as well as their potential impact and feasibility. Impact is the ability of the proposed recommendation to address the challenge, and feasibility is the likelihood of implementation for the recommendation.

Summary of Barriers and Potential Solutions to improve the feasibility of the proposed model

The proposed SMB model, though radical and futuristic, could be crucial if India wants to achieve its rooftop solar target by 2022. If we are able to successfully address the barriers highlighted in the above table, it will not only help rooftop solar to scale up its growth, but also help municipal corporations to use the similar structure for other priority infrastructure projects.

Next steps include further analysis in future work, particularly on an appropriate incentive mechanism to involve municipal corporations to act as financiers for private projects, which this study does not cover.