Toolbox on Financing Nature-Based Solutions

Relatório – Ferramentas para Impulsionar o Financiamento de Soluções Baseadas na Natureza

Executive summary

To support the 2024 agenda of the G20 Sustainable Finance Working Group, this report presents case studies that have used blended finance to surpass barriers to investments in Nature-based Solutions (NbS).

The wide scope of NbS generates unique financing considerations. NbS is an overarching term for varied approaches spanning multiple sectors, such as fisheries, forestry, and agriculture. Nature—and the benefits of NbS—is considered a public good, which is often dispersed among a multitude of stakeholders and difficult to capture and monetize. As a result, financing NbS pose different considerations than other areas of climate action.

We can apply lessons from other sectors, but there is no one-size-fits-all financing approach for NbS. Blended finance has been used to mitigate various risks in mature sectors, such as renewable energy, with successful approaches being transferred from developed economies to emerging economies. While NbS-relevant sectors often face similar challenges—e.g., country, currency, and credit risks—markets for such interventions are at an early stage, requiring efforts to create and prove the viability of commercial investment at scale.

Private sector engagement in NbS is still far from mainstream, and an exclusive focus on this could divert attention from key actions required to help the market grow. Blended finance can use de-risking tools such as technical support, and concessional capital to drive private sector interest in NbS, but there are phases of implementation that should first be considered. While concessional capital providers often direct funds based on potential for private capital mobilization and capacity to achieve scale, a wider view NbS is needed.

Given their nascent stage of development, NbS require efforts on ecosystem building and fostering enabling conditions, which do not typically involve private capital. Support to build this ecosystem and thus de-risk investments is vital and can be provided through direct technical or financial assistance, with the most effectiveness coming from a combination of both approaches.

Investing in teams, educating investors, and piloting new approaches are essential to demonstrate NbS’ potential for profitability. The focus should be on proving the commercial viability of NbS investments and the capacity of certain approaches to achieve returns, even if this requires efforts at a smaller scale to later be replicated.

Given its limited availability, concessional capital must be used carefully to create the greatest impact across NbS-relevant sectors. Based on the analyzed cases, we derived the key findings below.

KEY FINDINGS

Guarantees can be the most catalytic instruments to drive private capital to NbS. While many NbS still need to prove their revenue-generation capacity, guarantees can de-risk investments, creating a safer environment for testing new solutions. This can draw in investors and familiarize them with new sectors. At the same time, capacity-building support can improve a project’s revenue-generation potential and decrease the likelihood of having to activate a guarantee. The same funds can be reused to fund guarantees for new projects in subsequent investment cycles. Case studies of the Galápagos Debt Swap, AGRI3 fund, Asia Climate-Smart Landscape Fund, Seychelles Blue Bond, and Food Securities Fund demonstrate how guarantees can drive investment to NbS in different geographies.

The public sector is crucial to supporting NbS’s scaling. In addition to direct concessional funding and technical support, it can also establish incentives for beneficiaries to engage with NbS, thus creating new revenue sources for NbS.

Governments can either enable or deter a sector’s development. Creating a constructive regulatory environment to support financial solutions and developing a long-term NbS strategy are examples of policy measures that can unlock NbS potential. The public sector can also create an enabling environment by incentivizing new agents to engage with NbS , supporting the creation of new revenue streams. With time, this new source of income can enable a transition, where the need for public funding decreases in line with the increase in sustainable revenue flows.

One way to build NbS cashflows is to determine the value of an intervention in monetary terms and then find stakeholders who will benefit. This can be done by incentivizing engagement from beneficiaries such as social and community enterprises, utility companies, and insurance agencies with providers of NbS as observed in the Qiandao Lake Water Fund , the Forest Resilience Bond, and RISCO respectively. Supporting and regulating new markets—e.g., blue and carbon markets—can also generate new revenue streams for nature.

Case Studies

The 12 cases were developed through analysis of each instrument’s de-risking strategies and their success in driving investments with their envisioned structures. Different combinations of tools were used to achieve these objectives, with certain strategies observed across different instruments including: the use of concessional capital, the development of technical assistance (TA), and engagement with local stakeholders.

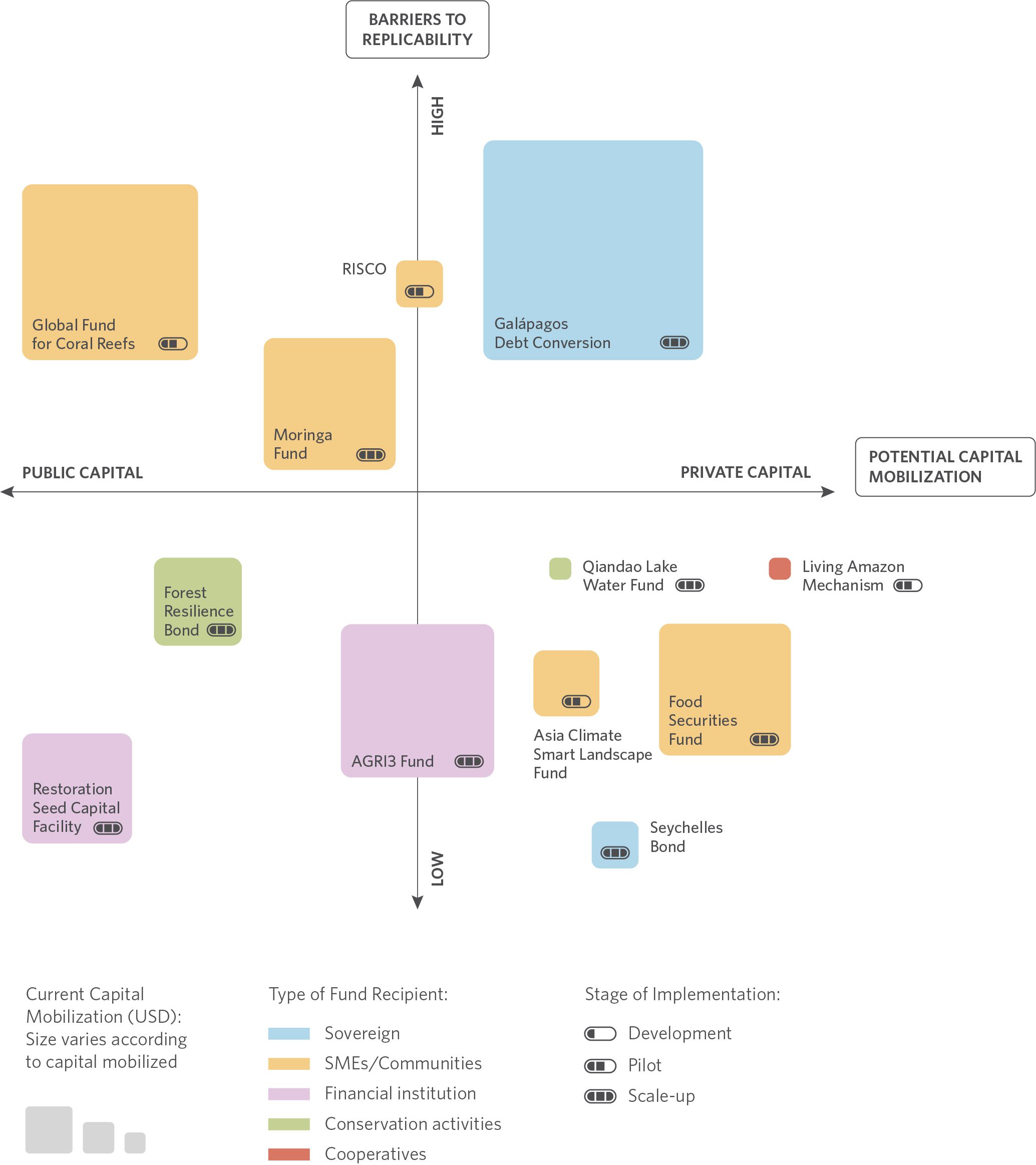

The case studies highlight each instrument’s innovative aspects and other characteristics, such as financial sustainability, potential for replication and scale, and the capacity to mobilize other (private and public) sources of capital. Figure 1 charts these instruments’ replicability and capital mobilization potential, with their size and color indicating their current capital mobilization and the type of entities they finance.

Summary of Case Study Analysis

Note: Stage of Implementation understood as outlined in the methodology, with pilot encompassing instruments that are still not operational at full form and scale-up classified as instruments deployed at near or full capacity. Suitability for Private / Public Capital based on analysis of current capital mobilized and envisioned scale-up version of instrument. Type of Fund Recipient classified according to majority of the instrument’s investment mandate focus.

Source: Climate Policy Initiative, 2024

Conclusion

Our 12 case studies showcase key tools for scaling investment in NbS: (i) ecosystem building (ii) engaging beneficiaries as a form of cash flow generation, and (iii) the use of guarantees as de-risking agents.

These can inform the action of public and private sector actors and point the way to many promising areas of further research for scaling NbS. G20 representatives are well-positioned to influence and streamline public support in this area, just as they have accelerated responses to many other financial challenges. Well-rounded public policies that support NbS by fostering targeted concessional capital as well as the enabling environment is key to replicating successful models across new geographies.

Initiatives that accelerate collaboration between stakeholders can spur NbS finance. Furthermore, for NbS to succeed as an investable thematic area, holistic financial and technical support must be offered for early-stage initiatives, as well as at the project and financial instrument level. Solutions are not yet sufficiently developed to scale through direct investment alone, and technical support will be instrumental, with the public sector uniquely positioned to provide it.

While this analysis has focused on the structure and deployment of financial instruments, there are additional themes that could be explored to support the development and implementation of NbS. These include:

How to define, value, measure, account for, and monetize nature. This is challenged by the way current economic models attribute value to goods and services, and the gap that arises when benefits related to nature cannot be privatized. Measuring—which is essential to valuing, accounting, and monetizing —faces barriers connected to data, disclosures, and process integrity. Initiatives that support these efforts could be analyzed to better understand the elements that contribute to this ecosystem, to enable a better coordination. Initiatives related to natural capital accounting that attempt to attribute and report on the value of nature could be further investigated, followed by initiatives that could monetize nature through tools such as carbon, blue carbon, biodiversity, and water markets.

Creating an enabling policy environment: Additional research could work to identify and promote policies that create favorable conditions for NbS finance. This could include mapping best practices for incentivizing corporations to: engage with NbS, avoid greenwashing, and track and disclose their impact on nature.

Exploring innovative NbS finance instruments: Research could further expand on the analysis of different types of instruments that leverage the local benefits of NbS, such as resilience and ecosystem services. Analyzing IPLC-led instruments and projects could help to understand the gaps between those solutions and others that have gained bigger scale. Investigating opportunities for broader financial market engagement, e.g. related to the relevance of the insurance industry and other nascent markets, could also help develop more systemic solutions for financing NbS.

Understanding conflicts between NbS and other net-zero solutions: Research could identify conflicts, such as those arising from high carbon reduction technologies that may harm ecosystems. Strategies are needed to harmonize NbS with technology-based net-zero approaches, ensuring climate mitigation efforts do not compromise ecosystems. This includes evaluating the environmental impact of new technologies and integrating them with NbS.

Aligning with other G20 Initiatives: It is important to identify best practices, share challenges, and seize opportunities for joint efforts to create a cohesive strategy that leverages the collective strengths of G20 member countries and other global initiatives. This can be done with the objective of better connecting initiatives working on this theme—within the G20 and more broadly—and ensuring that the sum of their parts is larger and better coordinated than each individual one.

This report was written to inform the G20s Sustainable Finance Working Group (SFWG) with a priority theme of Financing NbS.

This project was made possible by support from Instituto Clima e Sociedade.