High-quality adaptation finance tracking identifies gaps and barriers in financing adaptation and resilience solutions globally, drives leaders and stakeholders to invest in adaptation or support increases in finance flows, and supports government agencies in developing policy guidance. Despite the critical importance of adaptation finance tracking, significant data and reporting challenges limit CPI’s ability to capture global adaptation finance flows in the Global Landscape of Climate Finance (the Landscape). Adaptation investment is difficult to track due to challenges associated with context dependency, the uncertain causality of investments made, a lack of impact metrics, and confidentiality and reporting requirements. The Landscape currently does not track any private sector adaptation finance and tracking of public domestic adaptation finance is limited.

In this brief, we set out potential methods to fill data gaps in adaptation tracking in the Landscape and propose methods to measure progress. The technical approaches we propose to identify flows in imperfect datasets are intended as a starting point for future iterations of adaptation finance tracking and can serve to identify information that should be tracked and reported by local governments and companies. Ideally, applying the proposed framework will improve our understanding of adaptation finance and feed into larger tracking efforts.

Through our analysis, we find that:

1. Investment flows that are specific to adaptation and resilience must be understood in the context of the total investment that receives a resilience benefit from the incremental adaptation investment. Adaptation and resilience-focused flows should be measured against total investment by sector to understand progress made to achieve resilience against a benchmark.

2. Technical approaches, such as keyword searches and investment matching against national adaptation goals and geographic climate risk, can help identify adaptation flows in datasets that do not label them as such. These approaches are not sufficient for adaptation finance tracking alone, but can enable manual review of a shorter list of investments.

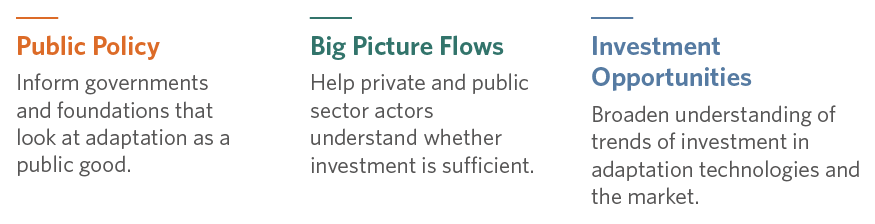

Figure: Three Use Cases for Adaptation Finance Tracking