In recent years, deforestation in the Amazon has raised concerns among researchers and policymakers in Brazil and around the world. By 2022, the Brazilian Amazon had lost around 21% of its original forest. Portions of the remaining forest have also been degraded by illegal logging and forest fires. All these factors are driving the forest dangerously close to a tipping point. If the Amazon reaches this critical point, the consequences to climate stability and biodiversity protection would be catastrophic. In response to this threat, governments and large corporations around the world are willing to purchase forest carbon credits, especially via capture (forest restoration), to neutralize their emissions.

Despite growing interest in carbon credits, the actual pricing of this mechanism is yet to be fully understood. In the Brazilian Amazon, where cattle ranching is a leading driver of deforestation, understanding this dynamic is paramount. What carbon price would make the government and rural producers switch from cattle ranching to large-scale forest restoration in the Amazon?

Answering this question requires an integrated approach that considers the incentives for deforestation, agricultural suitability, and the capacity for forest regeneration in each portion of the Amazon. Quantitative references must also be established to guide the design of carbon mechanisms and public policies.

This publication[1] shows that carbon prices exceeding US$ 20 per ton of CO2 captured by the natural regeneration of deforested areas in the Amazon would be truly transformative for the region’s landscape. Offsets for captured carbon would ensure forest integrity, inducing extensive forest restoration and the capture of 16 Gt CO2 over the next 30 years. Under this scenario, the Amazon would no longer be a net carbon emitter and, as a region, would have an enormous capacity to capture CO2 on a large scale.

With this amount, it would be more economically advantageous to turn most of the areas currently devoted to cattle ranching into areas destined for forest restoration via natural regeneration. The revenue from carbon (US$ 320 billion over 30 years) would compensate for the loss of revenue in cattle activities. This analysis considers not only the uncertainty about fluctuations in cattle prices, but also the uncertainty inherent to the measurements used to calibrate the modelling parameters.

This study presents an exercise of economic rationality, in which the carbon cycle, agricultural dynamics, conservation of standing forests, and forest restoration are all addressed together. The analysis also includes maps of priorities for forest conservation and the evolution of cattle activities over time.

Highlights

- A carbon price point of US$ 20 per ton of net carbon captured by the Amazon biome would make forest restoration via natural regeneration more profitable than cattle ranching in nearly the entire region. This amount would curb deforestation and help with forest restoration, ultimately preserving the integrity of the forest.

- The carbon associated with this mechanism refers to forest restoration, which consists of net carbon capture much like the mechanisms traded in regulated carbon markets. In the first half of 2023, the average price on the European market revolved around US$ 90 per ton of CO2. On the other hand, mechanisms associated with payments for reducing deforestation tend to command lower carbon prices. In this sense, US$ 20 per ton of CO2 is quite a low amount.

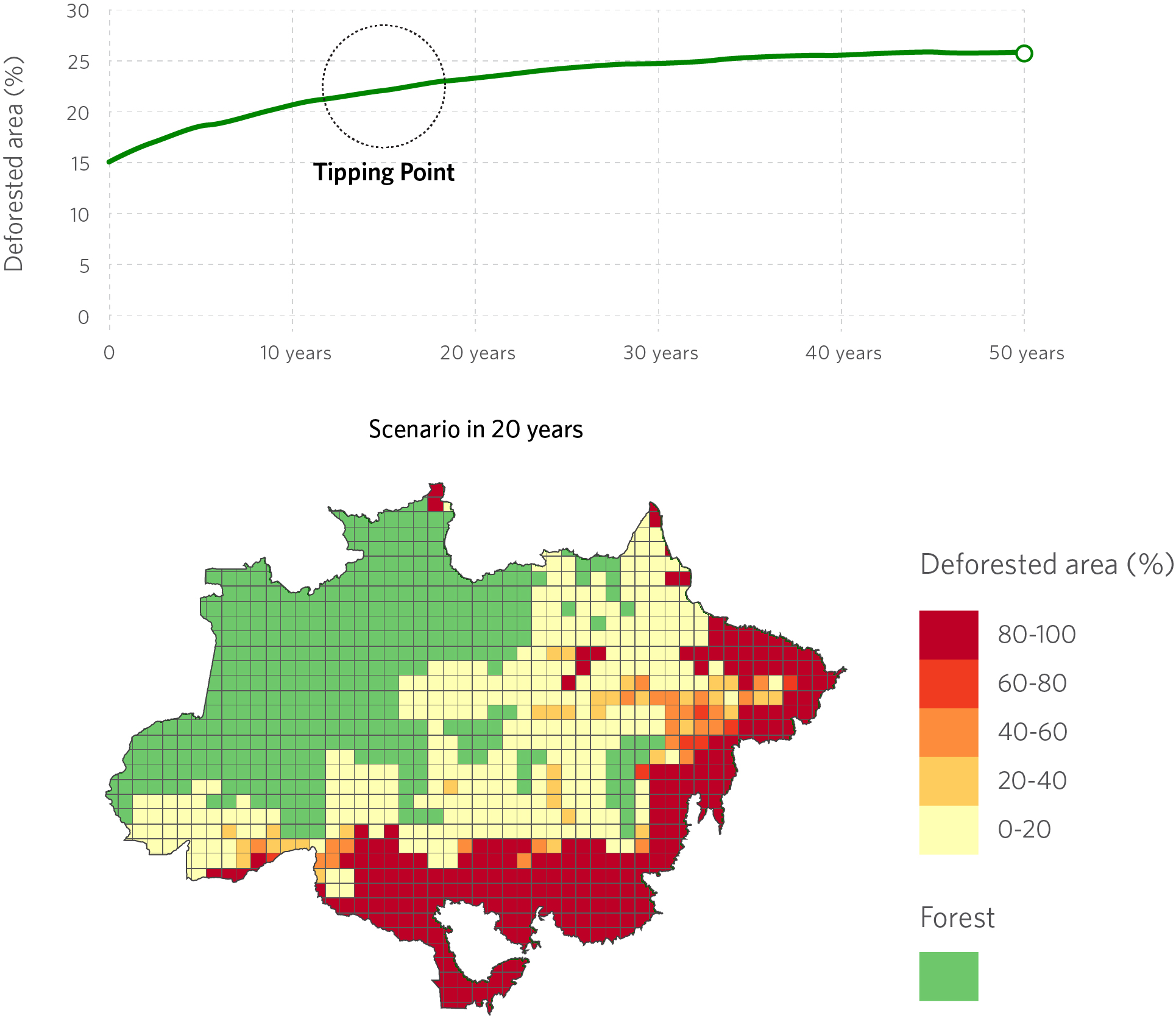

- In the absence of a robust payment mechanism for forest carbon, the analysis shows that, even with current efforts to combat deforestation, there would still be incentives for deforestation to increase via the expansion of cattle ranching. Deforestation in the Amazon tends to increase and is expected to reach a tipping point in under two decades, emitting approximately 32 billion tons of CO2 over the next 30 years.

- Even when considering only the carbon captured via natural regeneration, US$ 20 per ton in compensation would encourage measures to control deforestation – as deforestation, in this case, would carry a high opportunity cost for Brazil. In fact, because the mechanism under analysis considers net carbon capture, the carbon emissions from deforestation will be deducted from the amount captured by forest restoration. Along with enabling the recovery of forested areas, such payments would also put the brakes on deforestation activities.

- The combined effect of carbon captured by large-scale forest restoration and by avoided deforestation (i.e., avoided emissions) will be approximately 48 billion tons of CO2 over the next 30 years – 16 Gt CO2 from forest restoration and an additional 32 Gt CO2 from avoided deforestation.

The current state of the Amazon and the carbon market

An initial assessment of the Amazon shows that economic activity is very much out of line with carbon emissions. At the national level, the Brazilian Amazon represents just under 9% of the country’s GDP, but accounts for approximately 50% of all greenhouse gas emissions.[2] From an international standpoint, Figure 1 shows that, if the Brazilian Amazon were a country, it would be rather atypical, as it would generate exceedingly high carbon emissions per capita and feature a very low per capita GDP. This evidence suggests that there are ways to reduce emissions that carry low opportunity costs in economic terms when compared to other regions of the planet.

Figure 1. Relationship between Greenhouse Gas Emissions and per Capita GDP, 2018

![]() Interactive graphic

Interactive graphic

Source: CPI/PUC-Rio and Amazônia 2030

Carbon emissions from the Amazon are, to a large extent, associated with deforestation. Figure 2 shows that, after deforestation peaked in 2004, a series of public policy measures were put in place that reduced deforestation by 80% by 2012. The agricultural GDP increased substantially in that period, which also points to a dissociation between deforestation and economic activity.[3] While deforestation has grown steadily since 2012, it still remains far from what it used to be in 2004.

Figure 2. Deforestation in the Amazon, 2000-2022

![]() Interactive graphic

Interactive graphic

Source: CPI/PUC-Rio and Amazônia 2030

Analysis of deforested areas shows that degraded areas have been significantly recovered via natural regeneration. Figure 3 shows around 10 million hectares of natural regeneration in the Amazon Biome. An additional 7.2 million hectares have been undergoing an advanced regeneration process for more than six years,[4] which attests to the good forest restoration capacity of abandoned deforested areas.

Figure 3. Natural Regeneration in the Amazon Biome, 1987-2021

![]() Interactive graphic

Interactive graphic

Source: Mapbiomas, collection 7.1

THE APPROACH

The relationship between carbon and agricultural activity requires a detailed assessment of land use changes. Considering that almost 90% of the deforested area in the Amazon biome was used for cattle ranching, the analysis focuses on this particular activity.[5] Deforestation results in carbon emissions associated with biomass loss, and cattle activities that replace it generate income flows from production that are, in turn, tied to agricultural prices. There is also a flow of emissions from cattle activities themselves. On the other hand, areas devoted to cattle ranching can be abandoned and placed in a natural regeneration process. This brings about a loss of future income and gives rise to a carbon capture process.

Assessing the impact of different carbon capture compensation scenarios in the Brazilian Amazon involves methodological challenges that go beyond the main approaches available for dynamic problems subject to uncertainty in economics.

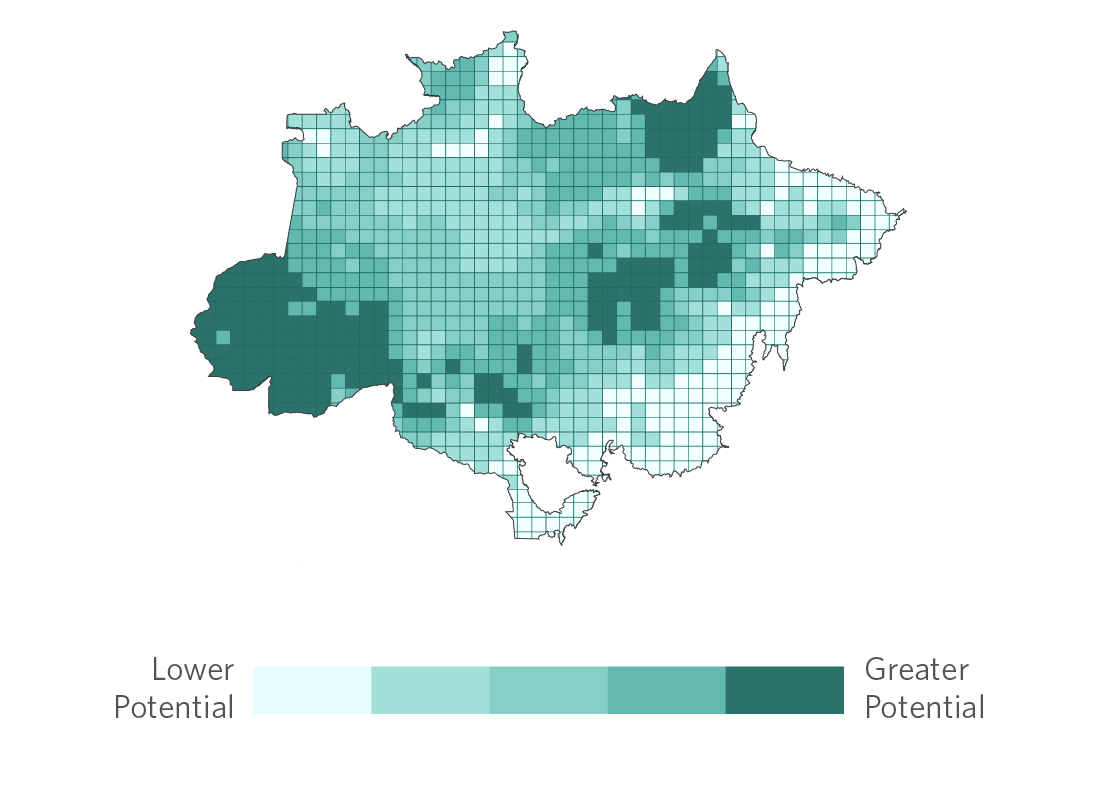

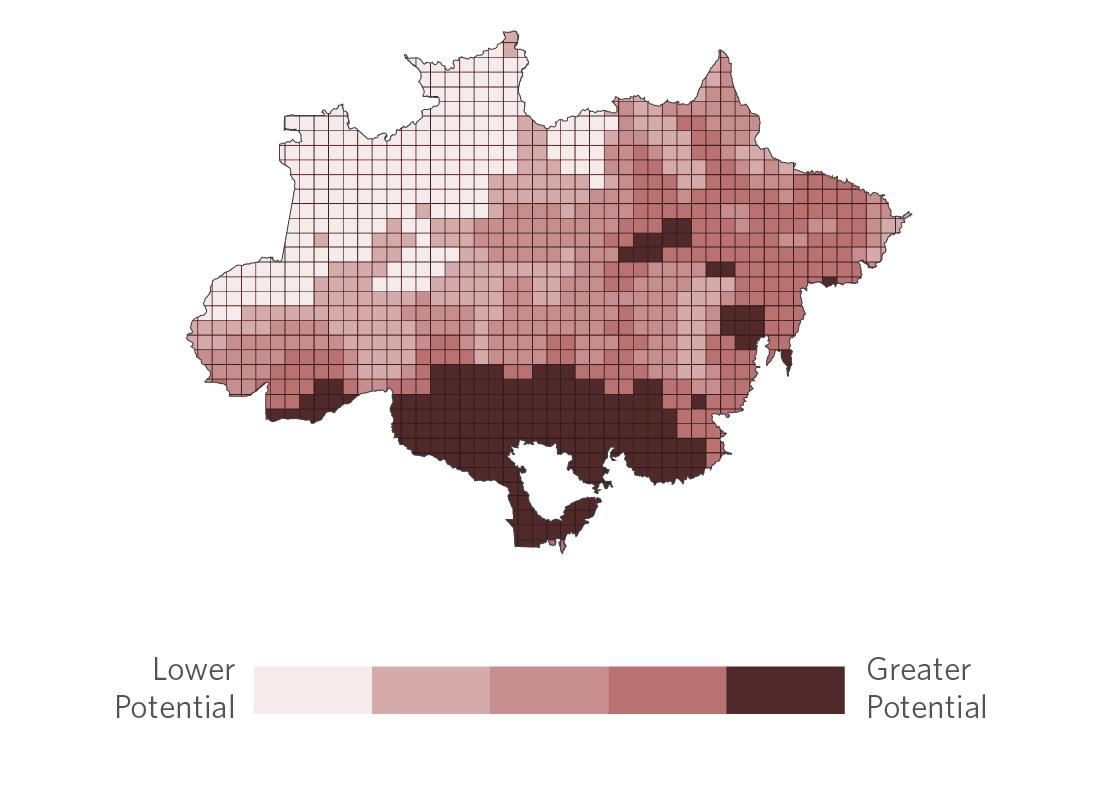

The first such challenge is the fact that the region is highly heterogenous due to its size and complexity, be it in terms of cattle potential or carbon absorption/emission capacity. To account for such heterogeneity, this analysis divides the Amazon biome into 1,055 cells measuring approximately 67.5 km x 67.5 km. Figure 4 shows the potential for carbon absorption and storage (Figure 4a) and cattle productivity (Figure 4b). Carbon information considers the most recent maps of above-ground biomass estimates for primary forests as identified in MAPBIOMAS.[6][7] Cattle productivity is derived from municipal cattle revenue information collected in the 2017 Agricultural Census, the most recent survey available.

The second methodological challenge is the essential role of temporal dynamics. The time horizon for agricultural income generation is different from that of carbon capture. While areas devoted to cattle ranching can offer a permanent income flow, which fluctuates solely with the price of cattle, the income generated by regenerating areas will depend on the carbon capture process, which varies as the forest grows. As such, when evaluating the best allocation for each area in the Amazon under a carbon price scenario, it is important to consider expectations about future cattle prices along with the dynamics of carbon capture. A discount rate of 2% is considered in the baseline simulations.

Figure 4. Carbon and Cattle Potential by area in the Amazon

Source: CPI/PUC-Rio and Amazônia 2030

Third, uncertainty must be addressed. Uncertainty about the price of cattle is captured by the distribution of (deflated) prices observed in the period from 1995 to 2017. This considers a price distribution associated with a Markov process. In addition to the price uncertainty inherent to the state of the economy at each given moment, the uncertainty about the parameters that represent the potential for carbon capture and meat production is also considered. In both cases, these measurements are subject to inaccuracies, and the results need to be robust against this kind of uncertainty.

The paper develops a dynamic spatial model to examine the complex trade-offs in time and space between land use for cattle ranching and forest restoration and conservation. As previously mentioned, the usual economic methods cannot account for the host of issues involved in a model of this nature. To characterize the results, researchers had to expand on techniques from a method known as “Modified Predictive Control” – originally developed for large-scale engineering problems. Furthermore, Monte Carlo methods with Markov Chains were adapted to derive new forms of uncertainty quantification adapted to the policy problems under study.

RESULTS

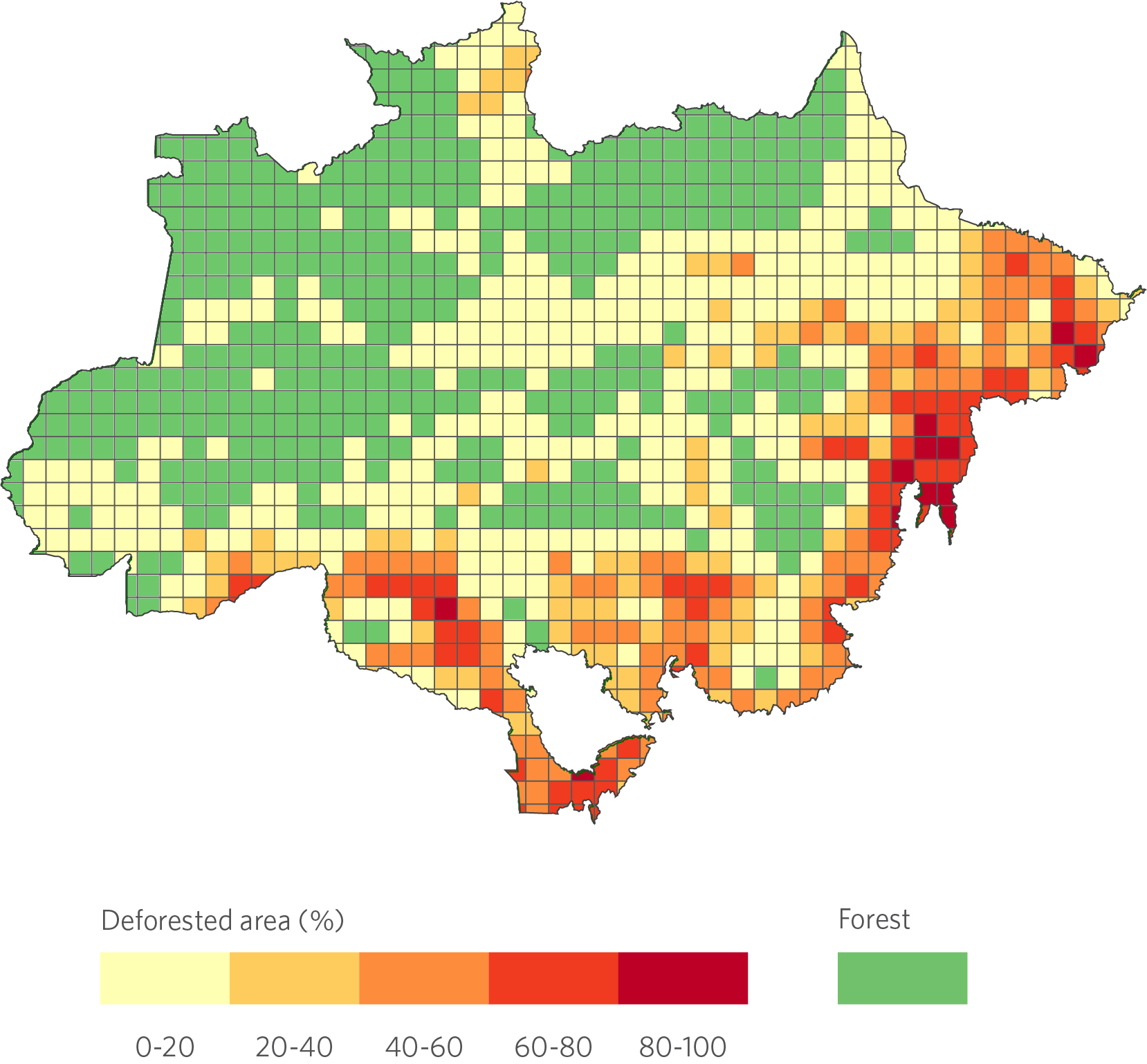

The model takes as the initial condition the land use area defined by the Agricultural Census in 2017, which is the first year of the most recent analysis. Figure 5 shows that there is a relationship between the areas deforested until 2017 and the cattle ranching potential shown in Figure 4. This, however, is not a perfect relationship – some areas featured low productivity but were nonetheless deforested. On the other hand, areas with great potential for carbon absorption have also been deforested. For each carbon price scenario, the model predicts the fate of each area in the Amazon.

Figure 5. Land Use in the Amazon in 2017

Source: CPI/PUC-Rio and Amazônia 2030

The fate of each area in the Amazon is determined by the interaction between physical suitability for carbon absorption and cattle ranching, the initial land use status and the price of carbon. If the price of carbon in a given scenario is too low, cattle activities will tend to continue to expand, causing a reduction in forest area and an increase in carbon emissions. However, as the price of carbon rises, the relative profitability of cattle ranching drops and it starts to make more economic sense to abandon cattle in certain areas and allow the forest to be restored naturally.

There are two things happening at the same time here. First, an adjustment in the number of areas which, depending on the carbon price, may either increase deforestation (in the case of low carbon prices) or reduce cattle ranching and promote forest restoration (in the case of high carbon prices). Second, there is also a change in the spatial distribution of activities, which brings land use into closer alignment with the economic potential of the Amazon. This happens because the role of the forest as a carbon sink was not taken into account when the region was first occupied. This change in perception vis-à-vis the value of the carbon cycle and its relationship with the forest is quite recent.

THE VALUE OF THE FOREST TO BRAZILIAN SOCIETY ACCORDING TO THE MODEL

The first application of the model is based on accrued deforestation until 2008, the year when the Amazon Fund was created. Until then, the country decided about occupation or conservation of the Amazon independently, without the possibility of carbon-based payments. The drive to explore the region for cattle ranching, motivated by the revenue enabled by this activity, was counterbalanced by forest conservation policies and the fight against deforestation. From the model’s perspective, the interaction between these two forces can be represented by an implicit carbon valuation.

The question behind this first exercise is: if Brazil were looking at the value of the forest only from the perspective of carbon, what carbon price would be compatible with the deforestation levels witnessed up until 2008? In other words: which carbon price point can explain the occupation and conservation policies in place in the Amazon until 2008?

The amount revealed by the model is US$ 5.76 per ton of CO2. In other words: according to the model, if the carbon price had been higher than that, there would have been less deforestation in Brazil than the actual levels observed until 2008. If the carbon price had been lower, Brazil would have deforested more than the actual levels leading up to 2008. The amount of US$ 5.76 per ton of CO2 can be interpreted as the average amount of forest valuation in Brazil throughout its history and until 2008, considering the fluctuation of public policies enacted until then.

Figure 6 shows a forecast of what should be expected from the Amazon if the value of the forest were equivalent to US$ 5.76 per ton of CO2. It is a dramatic scenario where deforestation rises to 30% and reaches the tipping point (at 20-25%, as estimated by scientists) in a little over a decade.

Figure 6. The Evolution of Cattle Ranching in the absence of International Transfers

Source: CPI/PUC-Rio and Amazônia 2030

CARBON PAYMENTS AND THE FATE OF THE AMAZON

Based on previous estimates showing that society has valued each ton of CO2 at the equivalent of US$ 5.76, a scenario with payment of U$$ 20 per ton of CO2 captured by the region was considered. The idea is to calculate the net carbon capture of the Amazon (carbon absorption through forest restoration minus emissions from deforestation) for each year and to pay for the volume that was actually captured. The forest will be remunerated US$ 20 per ton of CO2 from foreign transfers, plus US$ 5.76 per ton of CO2 as revealed for Brazilian society.

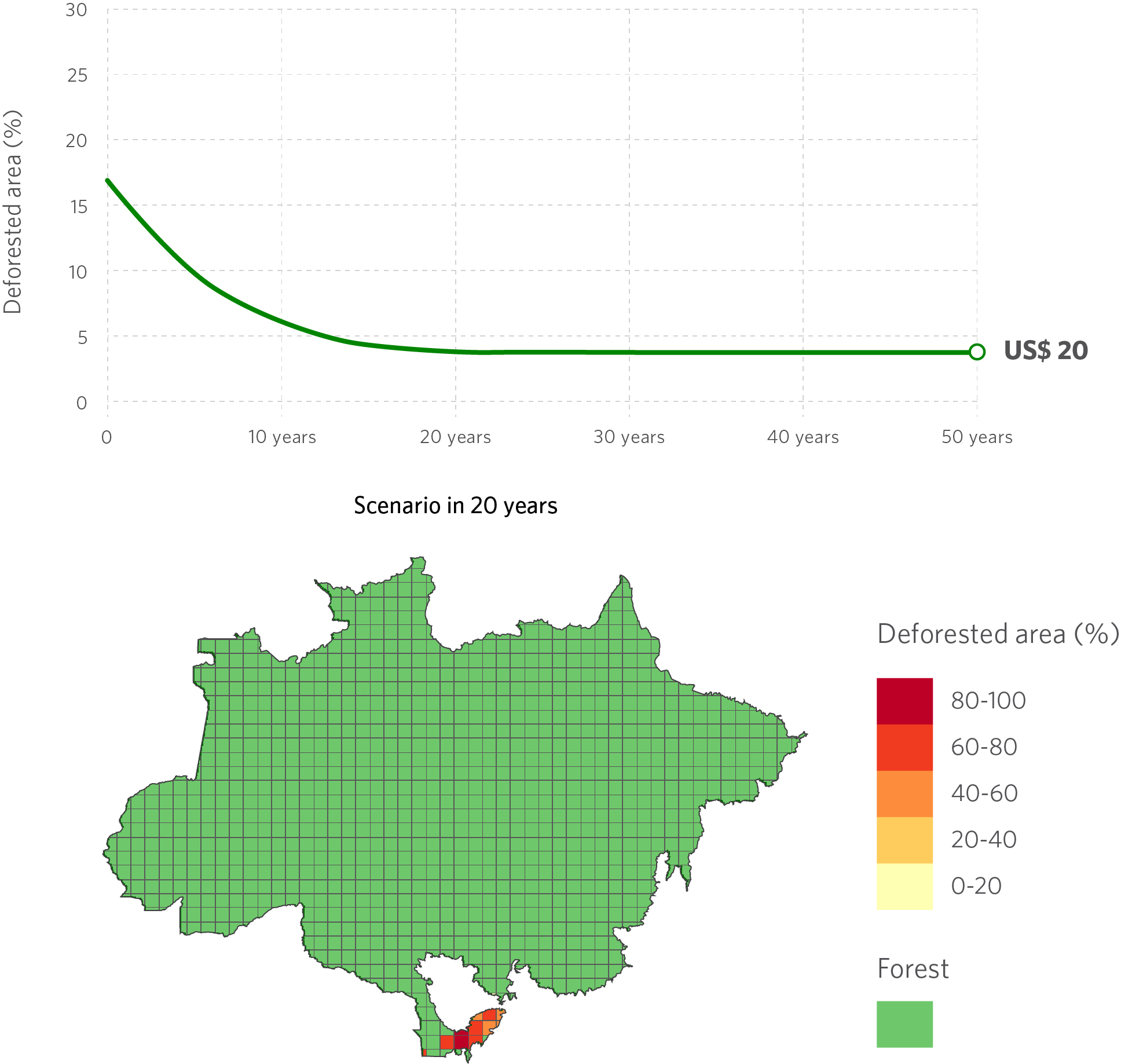

Figure 7 shows that payments can change the fate of the forest. With a price of US$ 20 per ton of CO2 the region would benefit as well from forest restoration largely replacing cattle ranching. This price represents a scenario in which forest restoration becomes the most profitable activity in the Amazon – except in very specific cattle ranching regions.

Figure 7. Evolution of the Area devoted to Cattle according to Carbon Price

Source: CPI/PUC-Rio and Amazônia 2030

![]() Interactive graphic – Compare scenarios by sliding the slider left and right

Interactive graphic – Compare scenarios by sliding the slider left and right

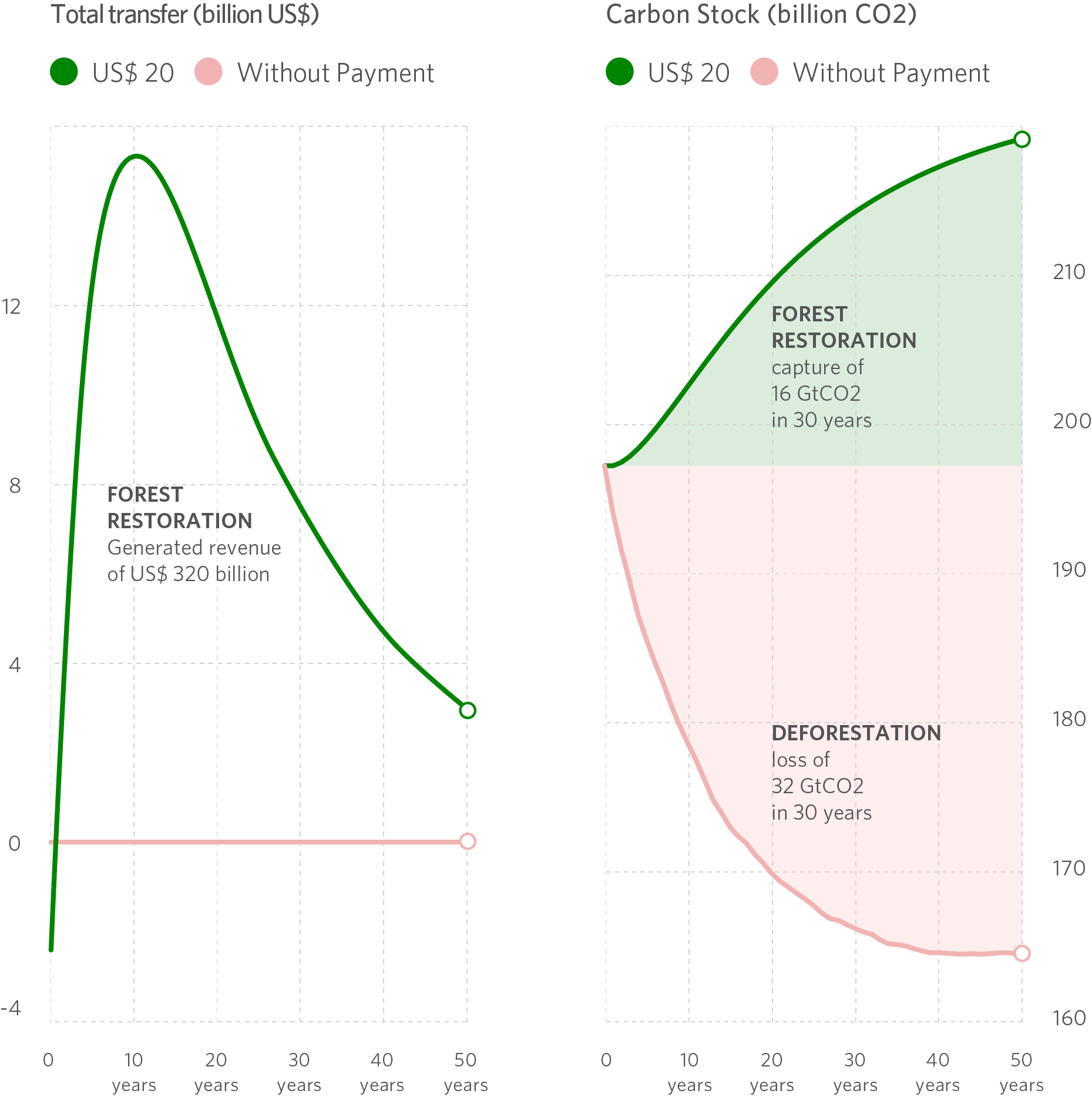

Figure 8 shows the financial flows for each scenario. At US$ 20 per ton of CO2, the Amazon would capture around 16 Gt CO2 in 30 years and generate US$ 320 billion in revenue. Despite a limited window of opportunity in the model of three decades, restoration pays better than cattle ranching in this scenario.

Expected Net Transfers by Carbon Price

Source: CPI/PUC-Rio and Amazônia 2030

Figure 8 also shows the trajectories of the carbon stored in the Amazon. In a scenario with no foreign payments for carbon, the continuity of emissions associated with deforestation leads to a loss of carbon stock in the forest in the amount of 32 Gt CO2 in 30 years. In the US$ 20 per ton of CO2 scenario, on the other hand, the carbon stock would increase by 16 Gt CO2 in 30 years as a result of forest restoration. This would amplify the effect of the carbon mechanism because of the incentive it provides to eliminate deforestation, which means that the total difference between this scenario and the one without international transfers would amount to 48 Gt CO2 in 30 years.

WHAT DOES US$ 20 PER TON OF CO2 MEAN?

The proposed mechanism focuses on removing carbon from the atmosphere by means of natural forest restoration, which directly contributes to the climate mitigation agenda. Due to its focus on capture and its jurisdictional approach, this carbon operation produces effects comparable to those embedded in regulated carbon markets that pursue similar objectives. This arrangement is quite different from mechanisms such as the Amazon Fund or the LEAF Coalition, for example, which focus on the carbon associated with reducing deforestation and, therefore, on reducing associated greenhouse gas emissions.

In this sense, the US$ 20 per ton of captured CO2 price point from the simulation points to the great forest restoration potential of tropical countries as a significant component in the portfolio of solutions for the climate crisis. There is significant room for negotiation between the price of US$ 20 and the price range of around US$ 90 in the European cap-and-trade market. The potential to capture up to 16 Gt CO2 in 30 years in the Amazon biome alone indicates that nature-based solutions can, indeed, help balance the carbon budget while keeping pace with the energy transition. Other tropical countries probably enjoy the same potential at viable costs.

CONCLUSION

The analysis shows that carbon prices above US$ 20 per ton of CO2 can play a vital role in preserving the Amazon, preventing deforestation, and stimulating forest restoration at scale, and capturing 16 Gt CO2 over the next three decades. Under this scenario, the Amazon would go from a net source of emissions to a significant remover of CO2, with a large portion of the areas previously devoted to cattle ranching being repurposed towards natural forest recovery. The total effect in relation to the baseline scenario is 48 Gt CO2, which also considers a 32 Gt CO2 reduction in emissions from avoided deforestation. Revenue from the sale of carbon credits, which would amount to US$ 320 billion over 30 years, would far exceed losses in cattle ranching. It should be noted that these results resist uncertainty in both prices and modeled parameters. But the US$20 per ton of CO2 is only a reference, given the European carbon market is trading around US$ 90 per ton of CO2 in the first semester of 2023.

In this process, the carbon mechanism redirects the Amazon to its forest vocation. Today, the vast majority of the region’s population lives in urban centers. Agricultural employment is falling and the bioeconomy has gained momentum with the development of multiple forest-compatible products with significant growth potential.[8] In other words, large-scale forest restoration and associated resources can bring about a profound transformation in the region and reintegrate people with nature under a scenario of socioeconomic prosperity.

The work has benefited from comments and suggestions from Beto Veríssimo, Camila Calado, Giovanna Miranda, Natalie Hoover El Rashidy, Salo Coslovsky and other participants from Amazon 2030 Project’s virtual meetings, whom we also thank.

[1] Based on: Assunção, Juliano J., Lars P. Hansen, Todd Munson and José Scheinkman. “Carbon Prices and Forest Preservation Over Space and Time in the Brazilian Amazon”. SSRN. 2023. bit.ly/3EzpyxR.

[2] Santos, Daniel, Manuele L. dos Santos and Beto Veríssimo. Fatos da Amazônia: meio ambiente e uso do solo. Amazônia 2030, 2022. bit.ly/3sOXGmK.

[3] Gandour, Clarissa. Políticas Públicas para Proteção da Floresta Amazônica: O que Funciona e Como Melhorar. Amazônia 2030, 2021. bit.ly/4669M9g.

[4] Pinto, Andréia, Paulo Amaral, Rodney Salomão, Luís Oliveira Jr., Carlos Alexandre da Cunha et al. Restauração Florestal em Larga Escala na Amazônia: O Potencial da Vegetação Secundária. Amazônia 2030, 2021. bit.ly/3Ze2Ft0.

[5] The inclusion of other crops, such as soy, would not significantly affect the results about the implications of carbon price scenarios and would make the model exceedingly complex. This approach considers what is observed in the Amazon today.

[6] Santoro, Maurizio e Oliver Cartus. ESA Biomass Climate Change Initiative (Biomasscci): Global datasets of forest above-ground biomass for the years 2010, 2017and 2018, v3. 2021. Access date: May 10, 2023.

[7] Souza, Carlos M., Julia Z. Shimbo, Marcos R. Rosa, Leandro L. Parente, Ane A. Alencar et al. “Reconstructing Three Decades of Land Use and Land Cover Changes in Brazilian Biomes with Landsat Archive and Earth Engine”. Remote Sensing 12, nº 17, 2735. bit.ly/466mpkL.

[8] Coslovsky, Salo. Oportunidades para Exportação de Produtos Compatíveis com a Floresta na Amazônia Brasileira. Amazônia 2030, 2021. bit.ly/48qp9LV.