Cities are at the forefront of the climate crisis. Climate risks are escalating, and climate hazards are becoming more frequent and costly. Cities account for more than 80% of the global GDP and more than half of the world’s population. The impacts of climate change are often felt disproportionally in urban communities due to high population density, a concentration of key infrastructure in cities, and their role as economic hubs among other factors. Yet, investment in urban climate finance adaptation is far from what is needed.

National governments can play a key role in enabling and scaling financing for urban adaptation. This document presents key actions for national policymakers around the world to increase the amount of available finance for cities to respond to climate risks.

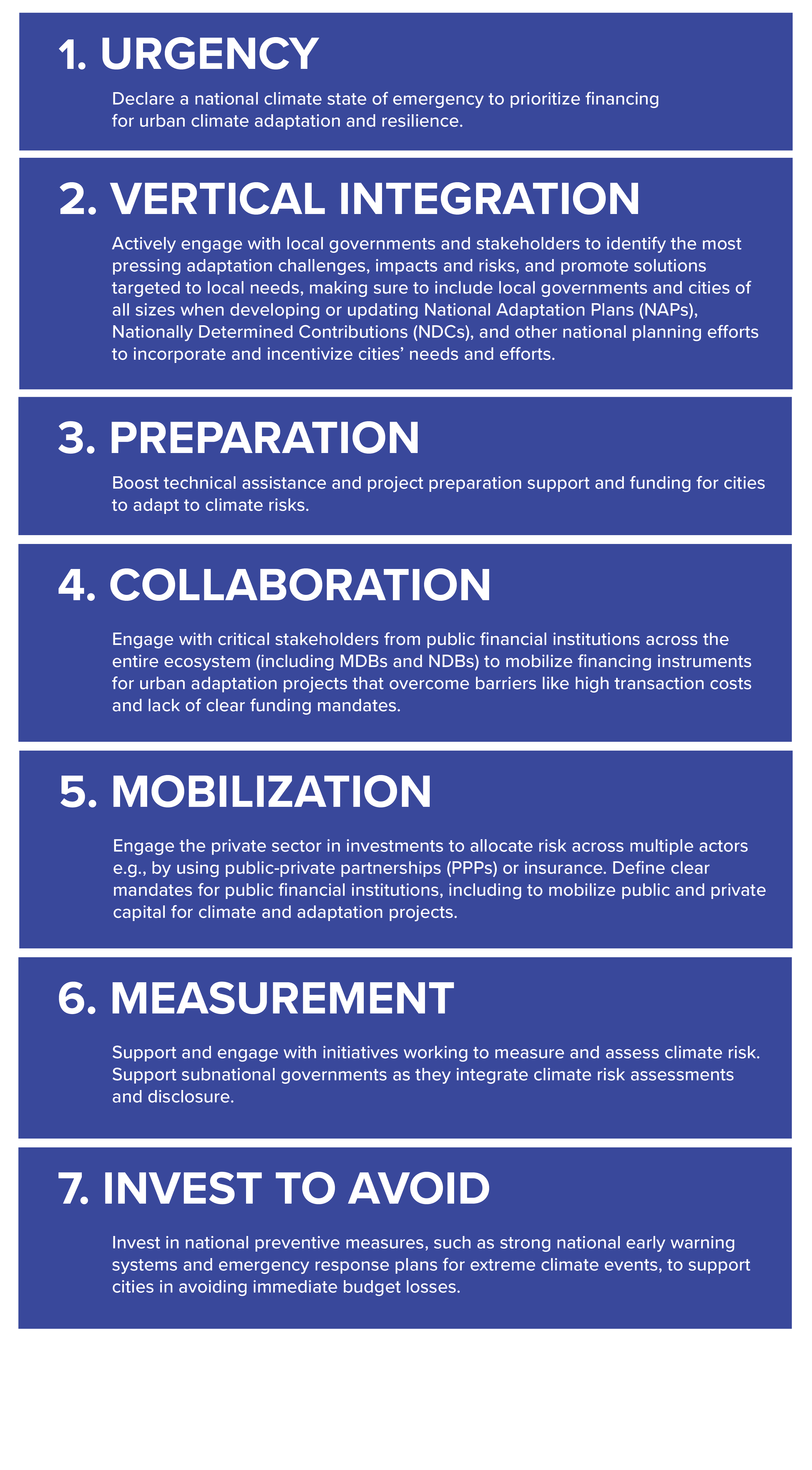

Figure 1: 7 key actions national policymakers can take to increase urban climate adaptation finance

Along with these actions, we invite national policymakers to join the Cities Climate Finance Leadership Alliance as members to understand cities’ financing needs and commit to scaling financing for urban climate adaptation and resilience. Please reach out to alliancesecretariat@cpiglobal.org to get involved.