Executive Summary

Brazil faces a dual challenge to protect its abundant natural resources and, at the same time, support an expanding agricultural sector and its accompanying opportunities for economic growth. Previous CPI/PUC-Rio work shows that it is possible to meet both of these challenges through efficient land use (Assunção et al, 2013).

One crucial aspect of efficient land use is agricultural risk management, which includes protecting farmers from adverse shocks, such as unfavorable weather and pests, and from price risk caused by volatility in output prices. The latter is currently a major concern for Brazilian farmers and policymakers — not only because unmanaged price risk can result in low income for farmers, and thereby affect productivity, but moreover because it can restrict farmers’ ability to raise credit, which can affect agricultural growth more broadly. When price risk is properly mitigated, farmers are under less pressure to retain a safety net and can, instead, use more of their financial resources for consumption or investment.

Historically, nations have addressed price risk through a variety of public and private sector mechanisms including insurance, price floors, and direct government buyouts when prices fall below a certain level. A large share of the price risk mitigation offered in Brazil is executed in the form of government buyouts. When prices reach a minimum, the government purchases output directly from farmers and determines its destination.

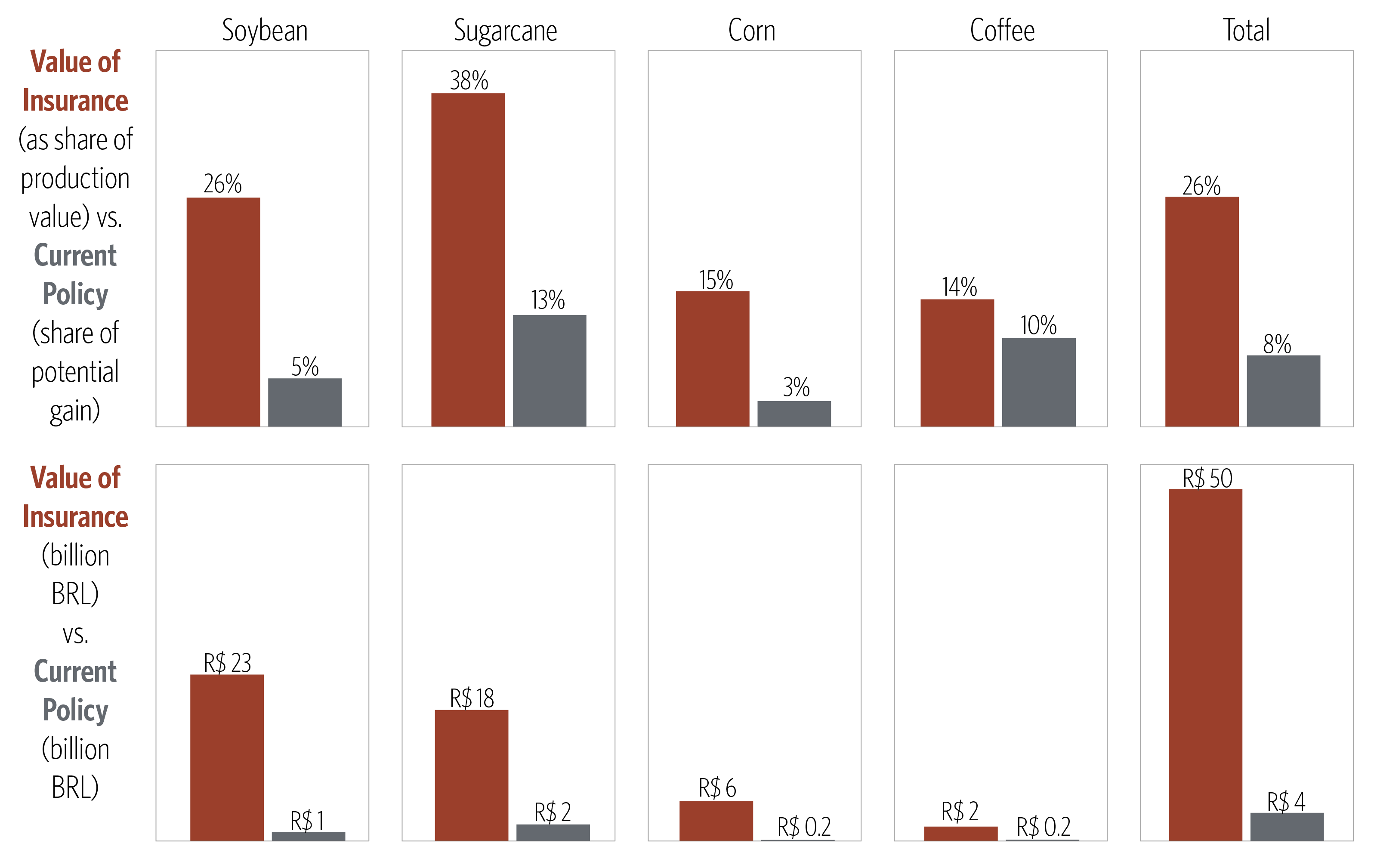

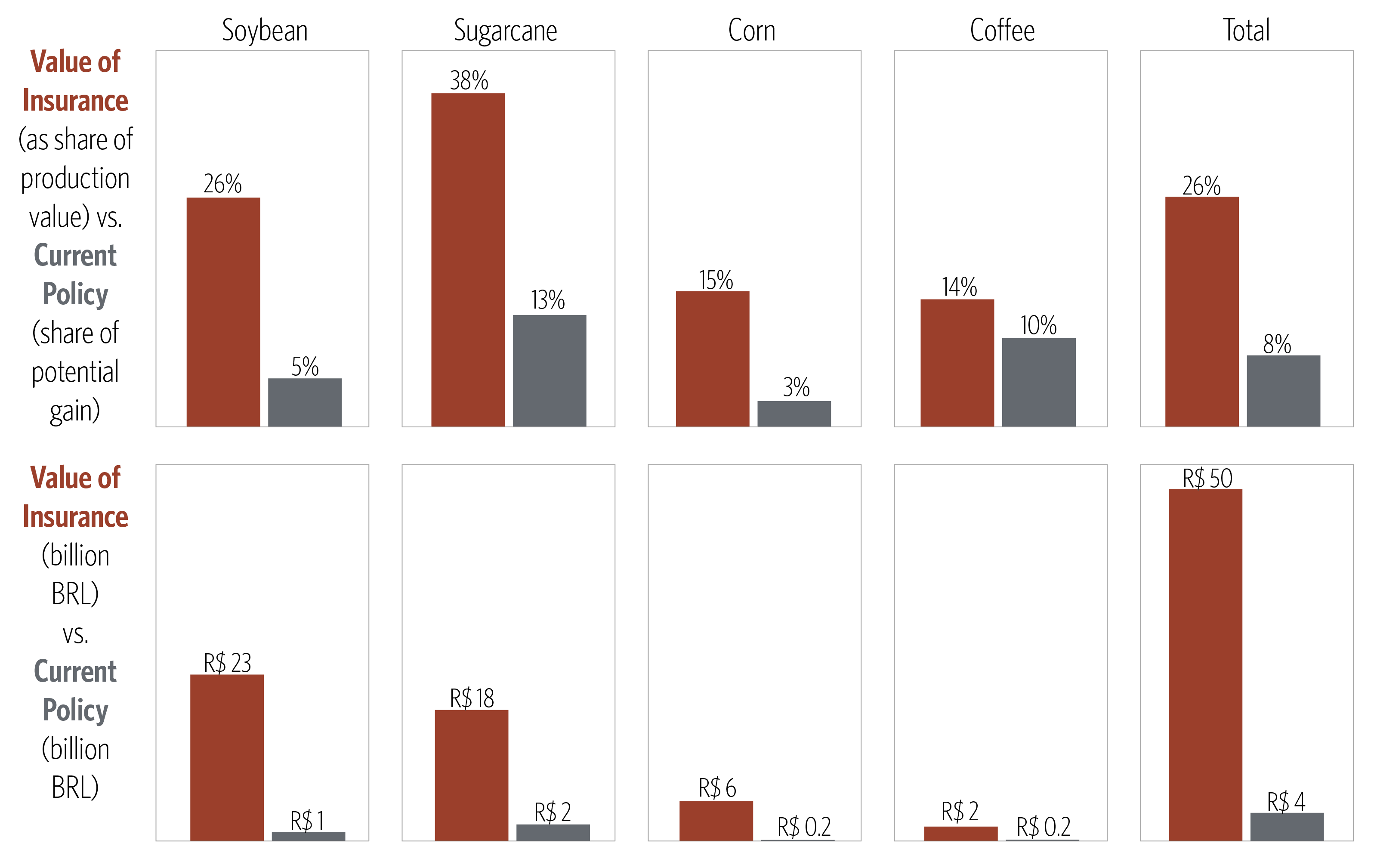

This study assesses these risk mitigation policies and finds that they are not meeting the large needs of the market. Current policy yields approximately BRL 4 billion in gains for farmers, which is equivalent to 8% of total production value. In contrast, we find that farmers would be willing to pay about BRL 50 billion (26% of total production value) to avoid price risk across the four crops that are commercially most relevant in Brazil — soybean, sugarcane, corn, and coffee.

Results further suggest that current policies are not cost-effective. In 2013, the federal budget for price risk mitigation totaled BRL 5.4 billion, with over two fifths of it being destined for government buyouts and storage expenses. Our model indicates, however, that current policy only yields BRL 4 billion in gains. Finally, we find that small farmers, who are more vulnerable to output price risk, stand to benefit most from measures that would improve on current price risk mitigation policy, such as insurance.

Interpretation of Results

What could explain the inefficiency of Brazil’s current policy? One reason may be that some of the policies that are still in place were designed in the 1960s, when Brazil’s agricultural sector was very different from how it is today. These policies were designed primarily to avoid extreme risk that could lead to poverty and hunger, and not to deal with the core problem of price volatility. Today, there are alternatives to address rural poverty and hunger. Yet, despite not being capable of entirely mitigating price risk volatility, the old policies remain.

So what could policymakers in Brazil do to improve price risk mitigation in today’s context?

The best candidate for implementing price risk mitigation is, in fact, not policy, but private capital markets. In theory, farmers may go to the private market to acquire sell options for output or buy options for inputs, all of which can happen without public resources. However, Brazil’s markets for mitigating agricultural output price risk are at an early stage of development. There is therefore a role that policy needs to play until markets develop further.

We can learn from how other regions have used policy to mitigate price risk in the face of imperfect capital markets.

Since the 1980s, the use of direct buyouts has decreased steadily in developed countries, as has government financial support to guarantee minimum prices. In the United States, the 1985 Farm Bill cut public funds for buyouts. A similar move happened in Europe in 1993. Such policy changes were introduced as a response to criticisms concerning high public expenditures, frequent overproduction, dumping in world markets, and rotting stocks. This trend has continued, and now price risk mitigation in much of the world is based mostly on direct payments to farmers, which avoids inefficiency.

Policy Implications

Our findings suggest that Brazilian price risk mitigation policy should move in the same direction as the United States and the European Union.

First, the government should neither buy farmers’ output, nor decide its final destination, since these activities create inefficiency in the markets. Further, direct buyouts, especially when the government purchases the whole output, impose a huge burden on public expenditures.

Instead, the government should incentivize the use of market-based instruments such as sell options, which are specifically targeted at price risk. A sell option would allow farmers to purchase insurance, guaranteeing them a minimum sale price at a later date. Policymakers could subsidize sell options in the private market, replicating a program like the one already in use in the state of São Paulo since 2011. As our results show, spurring these types of programs could free up significant economic potential in Brazil’s agricultural sector.

Related Materials

Since the 1980s, the use of direct buyouts has decreased steadily in developed countries, as has government financial support to guarantee minimum prices. In the United States, the 1985 Farm Bill cut public funds for buyouts. A similar move happened in Europe in 1993. Such policy changes were introduced as a response to criticisms concerning high public expenditures, frequent overproduction, dumping in world markets, and rotting stocks. This trend has continued, and now price risk mitigation in much of the world is based mostly on direct payments to farmers, which avoids inefficiency.